Market news

-

20:07

Major US stock indexes finished trading in positive territory

The main US stock indexes rose against the background of strong quarterly data from technological giants. The quarterly reports of Amazon (AMZN), Microsoft (MSFT), Intel (INTC) and Alphabet (GOOG) released earlier were quarterly better than forecasted by analysts.

In addition, the support of the market provided statistical data for the United States. As it became known, US GDP grew by 3% per annum in the third quarter, despite the damage from two hurricanes, according to the Ministry of Commerce. This is higher than the expectations of economists (+ 2.5%), and only slightly below the growth rate of 3.1% in the second quarter. The last time the economy had two consecutive quarters above 3% growth in 2014. The government said it can not say for sure how hurricanes Harvey and Irma reduced growth in the quarter from July to September. Since Puerto Rico is not a state, the impact of Hurricane Maria is not taken into account in GDP calculations.

However, the final results of the studies presented by Thomson-Reuters and the Michigan Institute showed that in October US consumers felt more optimistic about the economy than last month. According to the data, in October the consumer sentiment index rose to 100.7 points compared with the final reading for September 95.1 points and the preliminary value for October 101.1 points. It was predicted that the index will be 100.9 points.

Most components of the DOW index finished trading in the red (18 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 7.59%). Outsider were the shares of Merck & Co., Inc. (MRK, -6.28%).

Almost all sectors of the S & P index recorded an increase. The technological sector grew most (+ 2.1%). The sector of industrial goods decreased only (-0.1%).

At closing:

Dow + 0.14% 23.434.19 +33.33

Nasdaq + 2.20% 6,701.26 +144.49

S & P + 0.81% 2.581.07 +20.67

-

19:01

DJIA +0.14% 23,433.64 +32.78 Nasdaq +2.17% 6,698.81 +142.04 S&P +0.78% 2,580.29 +19.89

-

16:00

European stocks closed: FTSE 100 +18.53 7505.03 +0.25% DAX +84.26 13217.54 +0.64% CAC 40 +38.73 5494.13 +0.71%

-

13:34

U.S. Stocks open: Dow -0.03%, Nasdaq +1.12%, S&P +0.35%

-

13:29

Before the bell: S&P futures +0.19%, NASDAQ futures +0.84%

U.S. stock-index futures rose on Friday as strong earnings from technology giants and a better-than-expected quarterly GDP growth boosted investor sentiment.

Global Stocks:

Nikkei 21,739.78 +32.16 +0.15%

Nikkei 22,008.45 +268.67 +1.24%

Hang Seng 28,438.85 +236.47 +0.84%

Shanghai 3,416.42 +8.85 +0.26%

S&P/ASX 5,903.16 -13.14 -0.22%

FTSE 7,502.49 +15.99 +0.21%

CAC 5,497.97 +42.57 +0.78%

DAX 13,228.46 +95.18 +0.72%

Crude $52.40 (-0.46%)

Gold $1,265.40 (-0.33%)

-

13:09

Analyst coverage initiations before the market open

IBM (IBM) initiated with a Buy at Pivotal Research Group; target $180

-

13:07

Target price changes before the market open

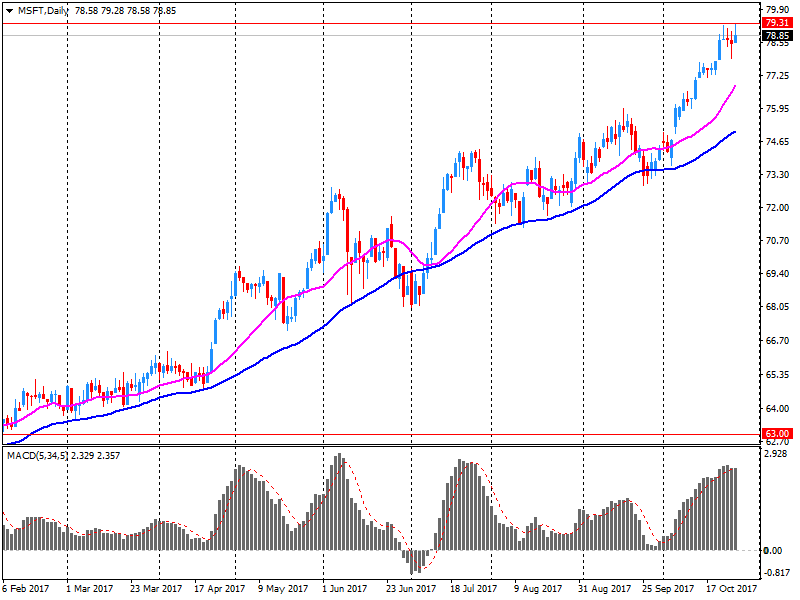

Microsoft (MSFT) target raised to $94 from $86 at BMO Capital Markets

Microsoft (MSFT) target raised to $88 from $85 at RBC Capital Mkts

Microsoft (MSFT) target raised to $90 from $85 at Stifel

Alphabet A (GOOGL) target raised to $1,125 from $1,050 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $1,200 from $1,050 at B Riley

Alphabet A (GOOGL) target raised to $1,180 from $1,050 at Oppenheimer

Alphabet A (GOOGL) target raised to $1,150 from $1,075 at Stifel

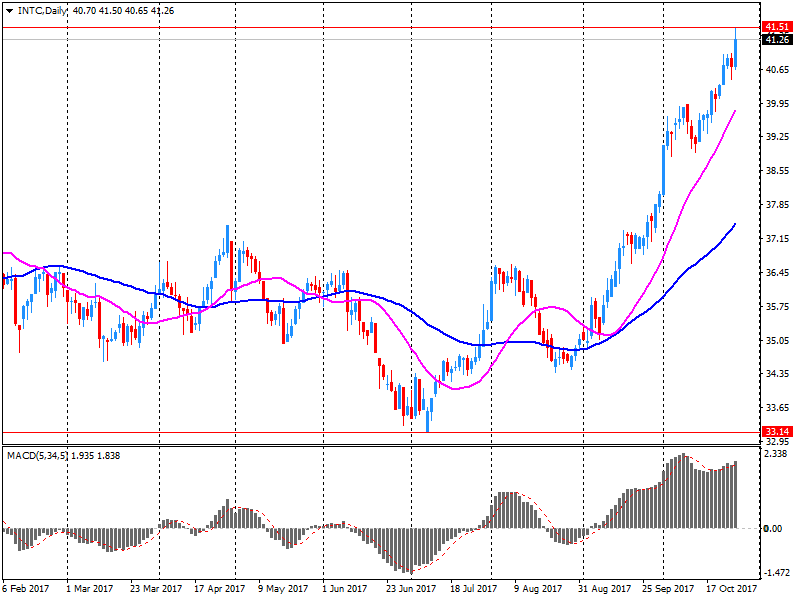

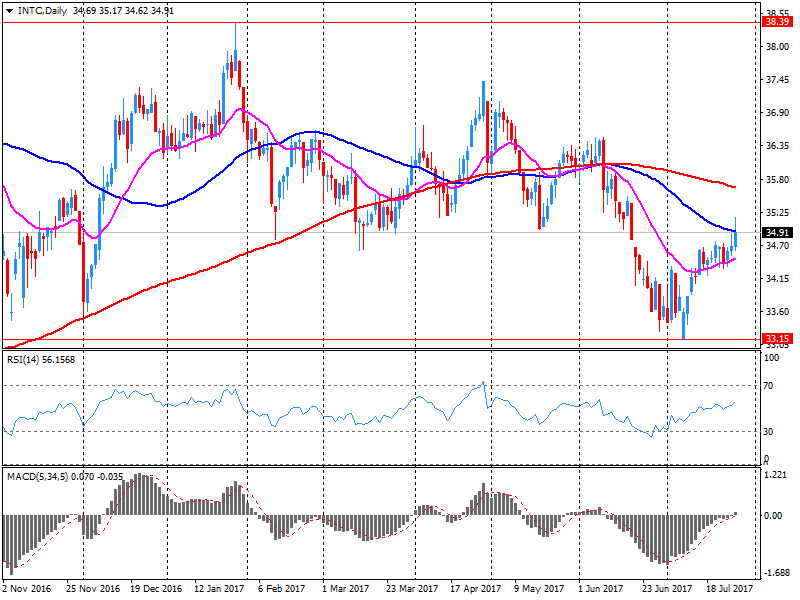

Intel (INTC) target raised to $47 from $45 at Mizuho Securities

Intel (INTC) target raised to $53 from $46 at B. Riley

Intel (INTC) target raised to $44 from $40 at RBC Capital Mkts

-

13:06

Downgrades before the market open

Tesla (TSLA) downgraded to In-line from Outperform at Evercore ISI

-

13:03

Upgrades before the market open

Facebook (FB) upgraded to Buy at Monness Crespi & Hardt; target $210

Amazon (AMZN) upgraded to Buy at Monness Crespi & Hardt; target $1250

Amazon (AMZN) upgraded to Outperform from Mkt Perform at Raymond James

Intel (INTC) upgraded to Buy from Neutral at BofA/Merrill

Twitter (TWTR) upgraded to Neutral from Sell at UBS

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

232.95

0.01(0.00%)

3844

ALCOA INC.

AA

48.5

-0.65(-1.32%)

5033

ALTRIA GROUP INC.

MO

66

0.21(0.32%)

1820

Amazon.com Inc., NASDAQ

AMZN

1,060.60

88.17(9.07%)

402838

American Express Co

AXP

95.55

-0.14(-0.15%)

1093

Apple Inc.

AAPL

159.65

2.24(1.42%)

383865

AT&T Inc

T

33.8

0.12(0.36%)

65091

Barrick Gold Corporation, NYSE

ABX

14.58

0.07(0.48%)

77994

Boeing Co

BA

258.85

-0.42(-0.16%)

2462

Caterpillar Inc

CAT

137.5

0.56(0.41%)

3503

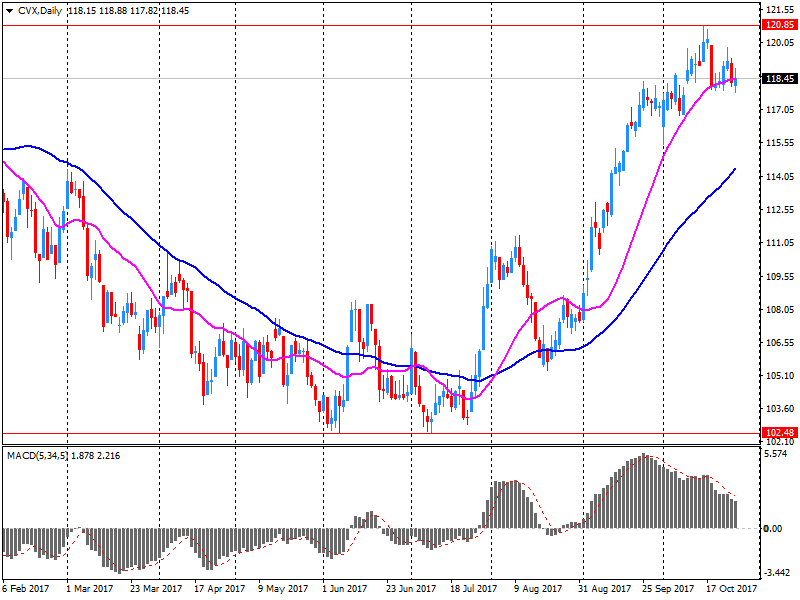

Chevron Corp

CVX

117

-1.44(-1.22%)

17820

Cisco Systems Inc

CSCO

34.25

-0.02(-0.06%)

27556

Citigroup Inc., NYSE

C

73.88

0.09(0.12%)

14297

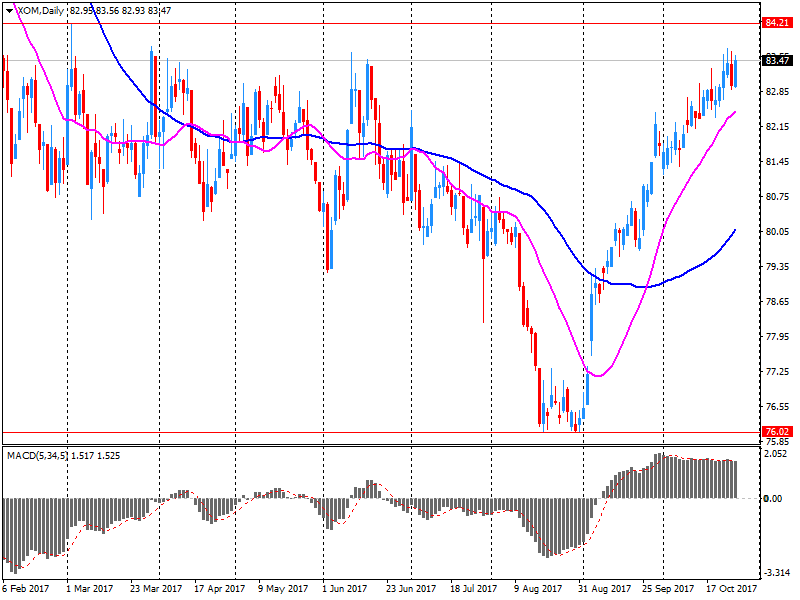

Exxon Mobil Corp

XOM

83.98

0.51(0.61%)

80873

Facebook, Inc.

FB

174.02

3.39(1.99%)

184638

Ford Motor Co.

F

12.25

-0.02(-0.16%)

21081

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.35

-0.34(-2.31%)

118824

General Electric Co

GE

21.38

0.06(0.28%)

127384

General Motors Company, NYSE

GM

45.27

0.02(0.04%)

500

Goldman Sachs

GS

241.5

-0.22(-0.09%)

2463

Google Inc.

GOOG

1,016.50

43.94(4.52%)

51455

Home Depot Inc

HD

167.3

-0.35(-0.21%)

1797

Intel Corp

INTC

43.32

1.97(4.76%)

1555872

International Business Machines Co...

IBM

154.14

0.54(0.35%)

6282

Johnson & Johnson

JNJ

141.3

-0.51(-0.36%)

2176

JPMorgan Chase and Co

JPM

101.9

0.16(0.16%)

20707

McDonald's Corp

MCD

164.02

0.01(0.01%)

2505

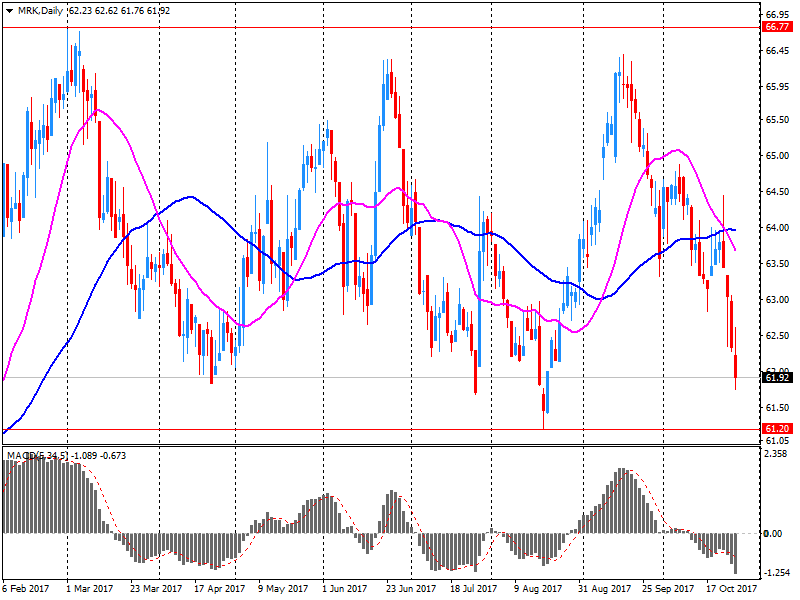

Merck & Co Inc

MRK

60.33

-1.66(-2.68%)

76180

Microsoft Corp

MSFT

84.6

5.84(7.41%)

1528725

Nike

NKE

55.85

-0.96(-1.69%)

16993

Pfizer Inc

PFE

35.64

-0.10(-0.28%)

25292

Starbucks Corporation, NASDAQ

SBUX

54.75

-0.16(-0.29%)

6250

Tesla Motors, Inc., NASDAQ

TSLA

320.67

-5.50(-1.69%)

131842

The Coca-Cola Co

KO

46.12

-0.11(-0.24%)

1751

Travelers Companies Inc

TRV

131.82

-0.12(-0.09%)

298

Twitter, Inc., NYSE

TWTR

20.16

-0.15(-0.74%)

288743

United Technologies Corp

UTX

119.75

-0.18(-0.15%)

440

UnitedHealth Group Inc

UNH

210.78

1.63(0.78%)

3050

Verizon Communications Inc

VZ

48.59

-0.30(-0.61%)

3019

Visa

V

109.91

0.11(0.10%)

8227

Wal-Mart Stores Inc

WMT

88.25

-0.37(-0.42%)

5379

Walt Disney Co

DIS

98.54

-0.02(-0.02%)

2467

Yandex N.V., NASDAQ

YNDX

32.61

-0.07(-0.21%)

1700

-

12:44

Company News: Chevron (CVX) quarterly results beat analysts’ expectations

Chevron (CVX) reported Q3 FY 2017 earnings of $1.03 per share (versus $0.68 in Q3 FY 2016), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $36.205 bln (+20.1% y/y), beating analysts' consensus estimate of $34.057 bln.

CVX fell to $117.00 (-1.22%) in pre-market trading.

-

12:41

-

12:29

Company News: Merck (MRK) quarterly earnings beat analysts’ estimates

Merck (MRK) reported Q3 FY 2017 earnings of $1.11 per share (versus $1.07 in Q3 FY 2016), beating analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $10.325 bln (-2.0% y/y), missing analysts' consensus estimate of $10.545 bln.

MRK fell to $60.92 (-1.73%) in pre-market trading.

-

12:19

Company News: Microsoft (MSFT) quarterly results beat analysts’ expectations

Microsoft (MSFT) reported Q1 FY 2018 earnings of $0.84 per share (versus $0.76 in Q1 FY 2017), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $24.500 bln (+11.7% y/y), beating analysts' consensus estimate of $23.566 bln.

MSFT rose to $83.50 (+6.02%) in pre-market trading.

-

12:10

Company News: Intel (INTC) quarterly results beat analysts’ forecasts

Intel (INTC) reported Q3 FY 2017 earnings of $0.94 per share (versus $0.80 in Q3 FY 2016), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $16.149 bln (+2.4% y/y), beating analysts' consensus estimate of $15.725 bln.

INTC rose to $42.65 (+3.14%) in pre-market trading.

-

12:04

Company News: Amazon (AMZN) quarterly results beat analysts’ estimates

Amazon (AMZN) reported Q3 FY 2017 earnings of $0.52 per share (versus $0.52 in Q3 FY 2016), beating analysts' consensus estimate of -$0.01.

The company's quarterly revenues amounted to $43.744 bln (+33.7% y/y), beating analysts' consensus estimate of $42.260 bln.

AMZN rose to $1,049.00 (+7.87%) in pre-market trading.

-

12:00

Company News: Alphabet (GOOG) quarterly results beat analysts’ expectations

Alphabet (GOOG) reported Q3 FY 2017 earnings of $9.57 per share (versus $9.06 in Q3 FY 2016), beating analysts' consensus estimate of $8.40.

The company's quarterly revenues amounted to $27.772 bln (+23.7% y/y), beating analysts' consensus estimate of $27.169 bln.

GOOG rose to $1,007.00 (+3.54%) in pre-market trading.

-

07:45

Major European stock exchanges trading in the green zone: FTSE 7501.15 +14.65 + 0.20%, DAX 13209.52 +76.24 + 0.58%, CAC 5478.34 +22.94 + 0.42%

-

06:32

Eurostoxx 50 futures up 0.19 pct, DAX futures up 0.25 pct, FTSE futures up 0.04 pct, CAC 40 futures up 0.29 pct

-

05:40

Global Stocks

Spanish stocks finished off session highs Thursday after the leader of the Catalan region failed to call anticipated snap elections. Catalan President Carles Puigdemont said he wouldn't call early elections because there was no guarantee the central government in Madrid would halt its move toward stripping Catalonia of autonomous rule, local reports said.

U.S. stocks ended mostly higher on Thursday as a fusillade of better-than-expected corporate results helped to reinvigorate Wall Street buying appetite a day after the S&P 500 and the Dow posted their biggest drops in more than seven weeks.

Asia-Pacific equities rose broadly on Friday, buoyed by strength in U.S. corporate earnings and the prospect of continuing stimulus in Europe. Ahead of the start of Asian trading, three of the world's biggest companies - Google parent Alphabet Inc., Amazon.com Inc. and Microsoft Corp. - reported booming quarterly growth, sending shares of the three tech giants surging in after-hours trade.

-