Market news

-

23:26

Stocks. Daily history for Oct 31’2017:

(index / closing price / change items /% change)

Nikkei -0.06 22011.61 +0.00%

TOPIX -4.88 1765.96 -0.28%

Hang Seng -90.65 28245.54 -0.32%

CSI 300 -3.00 4006.72 -0.07%

Euro Stoxx 50 +11.77 3673.95 +0.32%

FTSE 100 +5.27 7493.08 +0.07%

DAX +12.03 13229.57 +0.09%

CAC 40 +9.66 5503.29 +0.18%

DJIA +28.50 23377.24 +0.12%

S&P 500 +2.43 2575.26 +0.09%

NASDAQ +28.71 6727.67 +0.43%

S&P/TSX +22.81 16025.59 +0.14%

-

20:09

The main US stock indexes finished trading on the positive territory

Major US stock indices slightly increased due to a rise in the price of shares of Mondelez and Kellogg after the publication of quarterly reports.

Some support for the market was also provided by statistics on the United States. As it became known that the growth in house prices accelerated in August, which indicates that despite the slowdown in sales in recent months, the demand for housing remains strong. The national housing price index from S & P / Case-Shiller, covering the whole country, grew by 6.1% in the 12 months ending August, higher than the 5.9% increase compared to the same period last year in July .

However, the data published by the Managers Association in Chicago showed that in October the index of purchasing managers in Chicago improved to 66.2 points from 65.2 points in September. The latter value was the highest since March 2011. Experts expected that the index will drop to 61.0 points.

In addition, the Conference Board consumer confidence index improved significantly in October after recording a slight increase in September. The index now stands at 125.9 (1985 = 100), compared with 120.6 in September (revised from 119.8). The index of the current situation increased from 146.9 to 151.1, and the index of expectations increased from 103.0 last month to 109.1.

Components of the DOW index finished trading mixed (16 in positive territory, 14 in negative territory). The leader of growth was shares of Intel Corporation (INTC, + 2.77%). Outsider were shares of General Electric Company (GE, -1.27%).

Almost all sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 1.0%). Only the financial sector declined (-0.1%).

At closing:

DJIA + 0.12% 23,377.11 +28.37

Nasdaq + 0.43% 6,727.67 +28.71

S & P + 0.09% 2.575.26 + 2.43

-

19:00

DJIA +0.16% 23,385.69 +36.95 Nasdaq +0.48% 6,731.27 +32.31 S&P +0.15% 2,576.69 +3.86

-

17:01

European stocks closed: FTSE 100 +5.27 7493.08 +0.07% DAX +12.03 13229.57 +0.09% CAC 40 +9.66 5503.29 +0.18%

-

13:34

U.S. Stocks open: Dow +0.05%, Nasdaq +0.26%, S&P +0.11%

-

13:23

Before the bell: S&P futures +0.17%, NASDAQ futures +0.36%

U.S. stock-index futures rose slightly on Tuesday following a fresh set of earnings reports, while investors awaited the outcomes of the FOMC's October meeting, as well as a decision on the next Fed chair.

Global Stocks:

Nikkei 22,011.61 -0.06 0.00%

Hang Seng 28,245.54 -90.65 -0.32%

Shanghai 3,394.50 +4.17 +0.12%

S&P/ASX 5,909.02 -10.06 -0.17%

FTSE 7,492.11 +4.30 +0.06%

CAC 5,505.19 +11.56 +0.21%

DAX 13,229.57 +12.03 +0.09%

Crude $54.15 (0.00%)

Gold $1,272.40 (-0.41%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

47.5

0.08(0.17%)

1311

ALTRIA GROUP INC.

MO

64.5

0.45(0.70%)

6714

Amazon.com Inc., NASDAQ

AMZN

1,112.60

1.75(0.16%)

26748

Apple Inc.

AAPL

168.35

1.63(0.98%)

331657

AT&T Inc

T

33.62

0.08(0.24%)

10468

Barrick Gold Corporation, NYSE

ABX

14.66

-0.03(-0.20%)

6078

Caterpillar Inc

CAT

136.61

0.12(0.09%)

1621

Chevron Corp

CVX

116

1.61(1.41%)

467

Citigroup Inc., NYSE

C

73.8

0.02(0.03%)

1105

Deere & Company, NYSE

DE

134.62

2.32(1.75%)

765

Exxon Mobil Corp

XOM

83.8

0.26(0.31%)

200

Facebook, Inc.

FB

180.4

0.53(0.29%)

121111

Ford Motor Co.

F

12.15

0.05(0.41%)

66779

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.87

-0.07(-0.50%)

30267

General Electric Co

GE

20.37

-0.04(-0.20%)

46877

General Motors Company, NYSE

GM

43.25

-0.12(-0.28%)

3410

Google Inc.

GOOG

1,019.00

1.89(0.19%)

1091

HONEYWELL INTERNATIONAL INC.

HON

144.26

-0.38(-0.26%)

255

Intel Corp

INTC

45.2

0.83(1.87%)

863310

JPMorgan Chase and Co

JPM

101.65

0.24(0.24%)

817

Merck & Co Inc

MRK

54.83

0.12(0.22%)

6085

Microsoft Corp

MSFT

84.11

0.22(0.26%)

28950

Nike

NKE

54.45

-0.82(-1.48%)

51384

Pfizer Inc

PFE

35.07

-0.08(-0.23%)

130844

Procter & Gamble Co

PG

86.6

0.33(0.38%)

10875

Tesla Motors, Inc., NASDAQ

TSLA

321.15

1.07(0.33%)

18103

The Coca-Cola Co

KO

46.19

0.33(0.72%)

33252

Verizon Communications Inc

VZ

47.88

0.05(0.10%)

908

Visa

V

110.47

0.43(0.39%)

7597

Walt Disney Co

DIS

98.15

0.11(0.11%)

1657

Yandex N.V., NASDAQ

YNDX

32.89

-0.21(-0.63%)

700

-

12:44

Upgrades before the market open

Microsoft (MSFT) upgraded to Buy from Hold at Argus

Merck (MRK) upgraded to Hold from Underperform at Jefferies

-

12:30

Company News: MasterCard (MA) quarterly results beat analysts’ expectations

MasterCard (MA) reported Q3 FY 2017 earnings of $1.34 per share (versus $1.08 in Q3 FY 2016), beating analysts' consensus estimate of $1.23.

The company's quarterly revenues amounted to $3.400 bln (+18.1% y/y), beating analysts' consensus estimate of $3.281 bln.

MA rose to $150.50 (+1.04%) in pre-market trading.

-

11:54

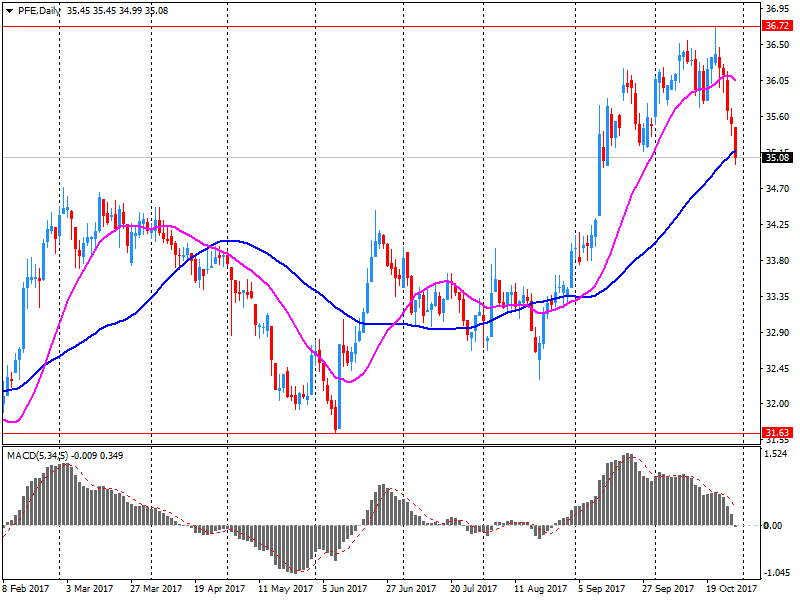

Company News: Pfizer (PFE) quarterly earnings beat analysts’ estimate

Pfizer (PFE) reported Q3 FY 2017 earnings of $0.67 per share (versus $0.61 in Q3 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $13.168 bln (+0.9% y/y), generally in-line with analysts' consensus estimate of $13.175 bln.

The company also raised guidance for FY2017 EPS to $2.58-2.62 from $2.54-2.60 versus analysts' consensus estimate of $2.56, as well as for FY2017 revenues to $52.4-53.1 bln from $52.0-54.0 bln versus analysts' consensus estimate of $52.76 bln.

PFE rose to $35.38 (+0.65%) in pre-market trading.

-

08:39

Major stock exchanges in Europe trading mainly in the green zone: FTSE 7501.25 +13.44 + 0.18%, CAC 5493.72 +0.09 0%

-

07:09

Eurostoxx 50 futures up 0.1 pct, CAC 40 futures flat, FTSE futures flat

-

06:32

Global Stocks

Asian stock markets were lacking direction early Tuesday, with Japan's benchmark index underperforming as investors were cautious amid a stronger yen and the central bank's latest monetary policy announcement. As was widely expected, the Bank of Japan announced during the trading day that it would stand pat on interest rates.

European stocks scored the highest close in five months Monday, with much of the action centered around Spanish equities after the central government in Madrid took control of the Catalonia region following its push for independence.

U.S. stocks closed lower Monday as a report that the House of Representatives is considering phasing in a cut to corporate taxes rather than enacting them immediately weighed on investors' confidence. Tax cuts are the centerpiece in President Donald Trump's business-friendly agenda and are viewed as critical to sustaining the stock market's record-setting rally.

-