- European session: the dollar rose

Noticias del mercado

European session: the dollar rose

07:15 Switzerland Producer & Import Prices, m/m June -0.3% +0.3% +0.1%

07:15 Switzerland Producer & Import Prices, y/y June -0.2% +0.3% +0.2%

The U.S. dollar strengthened against the major currencies in anticipation of the report on retail sales. According to the forecasts of economists, retail sales in the U.S. in June, is likely to have grown by 0.7% m / m, after rising 0.6% in May, buoyed by good sales of cars and decent weather. Experts believe that sales excluding autos rose 0.4%, while sales excluding motor vehicles and gasoline - by 0.3%.

Australian dollar strengthened early in the session against most of its 16 major counterparts after the publication of data showing that China's economic slowdown in the 2nd quarter was not as steep as some had feared. According to these data, China's GDP in the 2nd quarter grew by 7.5% compared with the same period last year, after rising 7.7% in the 1st quarter. China is the largest trading partner of Australia, which is becoming impressive volumes of iron ore and coal for its infrastructure projects. As a result, the Australian dollar is highly dependent on the state of China's economy. According to analysts, after the Chinese Finance Ministry on Friday said that "GDP at 6.5% will not make the problem", the markets were expecting weak data, regardless of the subsequent retraction / clarification.

The Reserve Bank of Australia on Tuesday to publish the minutes of its meeting on July 2. Investors believe that the probability of the next lower key interest rate in August was 60%, as the government is likely to intensify efforts to revive activity in the economy in sectors not related to the mining industry. Now the key interest rate RBA is at 2.75%. Published last week, the data indicated a low level of business confidence and rising unemployment to a peak of four years. This year, interest rates were dropped to record lows, as Australia is struggling with the effects of falling commodity prices and slowing economic growth in China.

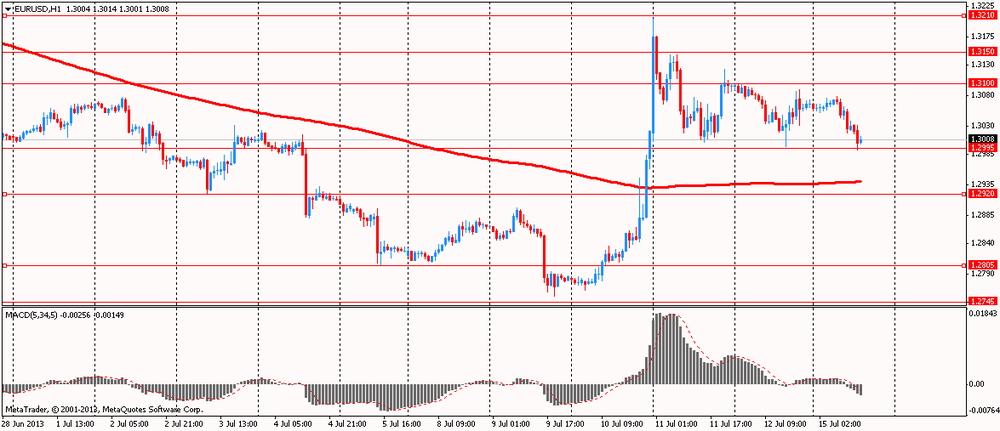

EUR / USD: during the European session, the pair fell to $ 1.2992

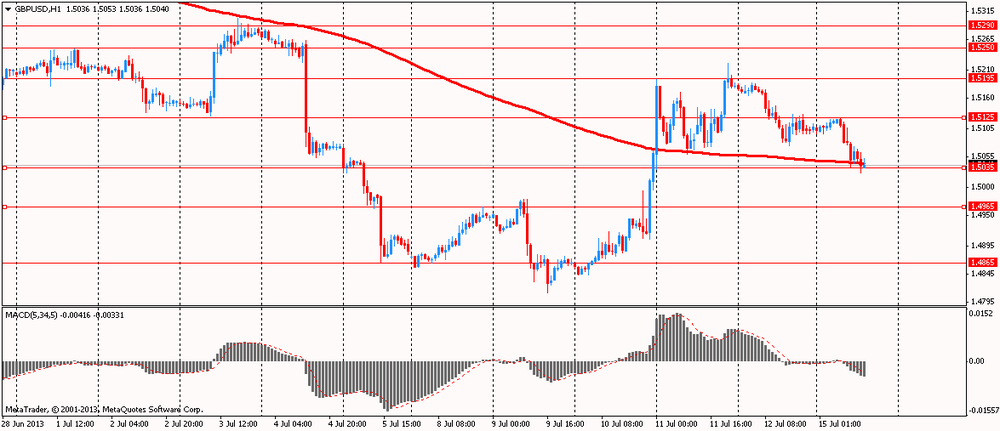

GBP / USD: during the European session, the pair fell to $ 1.5026

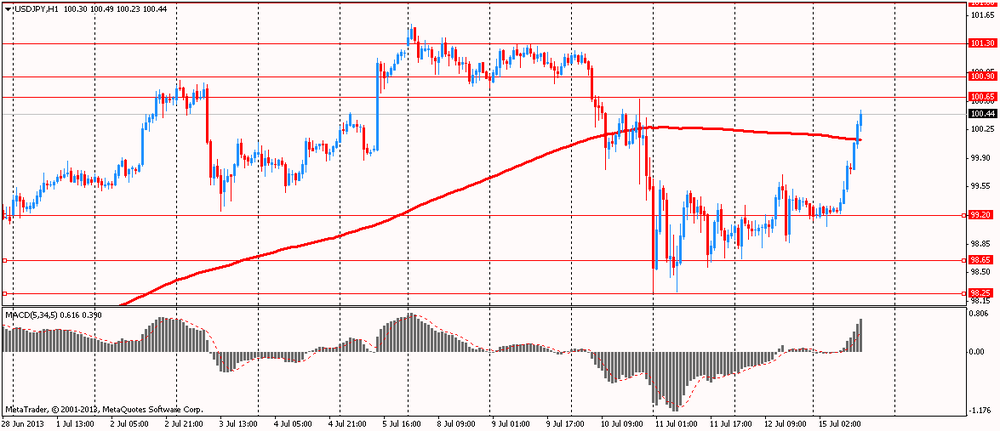

USD / JPY: during the European session, the pair rose to Y100.49

U.S. at 12:30 GMT will publish the change in retail sales, the change in retail sales excluding auto sales, changes in the volume of retail trade sales, excluding cars and fuel for June, Empire Manufacturing manufacturing index for July at 14:00 GMT - the change in volume Business Inventories for May. End the day at 22:45 GMT New Zealand data on the consumer price index for the 2nd quarter.