- European session: the pound rose on strong PMI and the decision of the Bank of England

Noticias del mercado

European session: the pound rose on strong PMI and the decision of the Bank of England

07:50 France Manufacturing PMI (Finally) July 49.8 49.8 49.7

07:55 Germany Manufacturing PMI (Finally) July 50.3 50.3 50.7

08:00 Eurozone Manufacturing PMI (Finally) July 50.1 50.1 50.3

08:30 United Kingdom Purchasing Manager Index Manufacturing July 52.5 52.8 54.6

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.50%

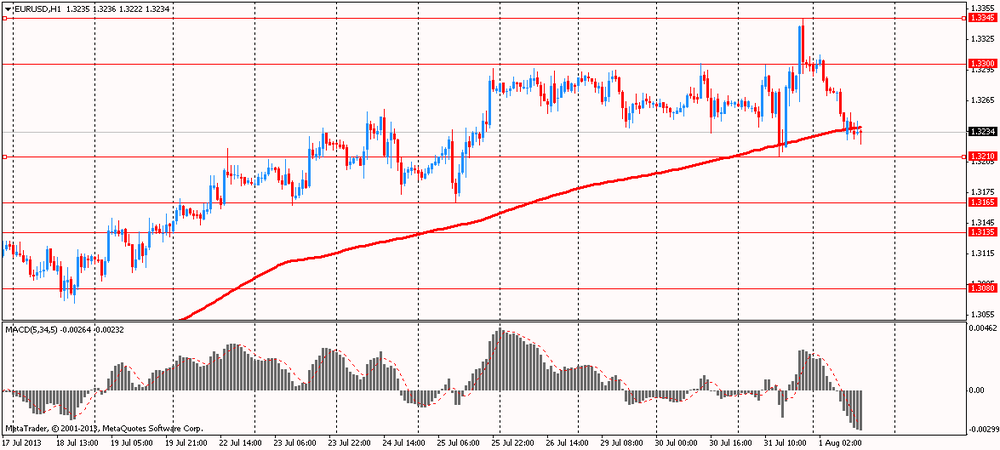

The euro fell against the U.S. dollar despite the data on the growth of activity in the manufacturing sector in Germany and the euro zone.

Purchasing Managers Index (PMI) for the manufacturing sector in the euro area July rose to 50.3 against 48.8 in June. Thus, for the first time since July 2011, he was above the threshold level 50 which separates growth in activity from its decline. The July value was revised upward from a preliminary estimate of 50.1. Growth in the manufacturing sector of Germany was the fastest one and a half years, and Italian manufacturers reported an increase in activity for the first time in two years.

Today announced its decision to the ECB, which left interest rates unchanged at 0.50%. Euro has not reacted to this decision. Later, a press conference of the ECB, Mario Draghi, on which investors are waiting for comments on the policy of the central bank and the state of the eurozone economy.

The British pound rose against the dollar after strong data on manufacturing PMI and the decision of the Bank of England.

Manufacturing activity in the UK in July showed the highest growth in over two years. Total new orders rose at the fastest pace since February 2011, receiving support from the national and international market and increasing employment third consecutive month. Purchasing Managers Index (PMI) for the manufacturing sector, which is calculated by Markit and the Chartered Institute of Purchasing & Supply, in July rose to 54.6, its highest level since March 2011, against 52.9 in June.

Today, the Bank of England decided, in line with expectations, leaving at current levels as the rate and the size of its asset purchase program (0.5% and £ 375 billion, respectively). Unlike last month, this time MPC refrained from accompanying statement. However, the Bank of England has confirmed its intention to streamline the communication process and to make their policies more transparent. "As previously announced, the Committee will respond to the request of the Minister of Finance to evaluate the benefits of using targets and" transparency policy "and this will be reflected in the report on inflation, which will be published on August 7.

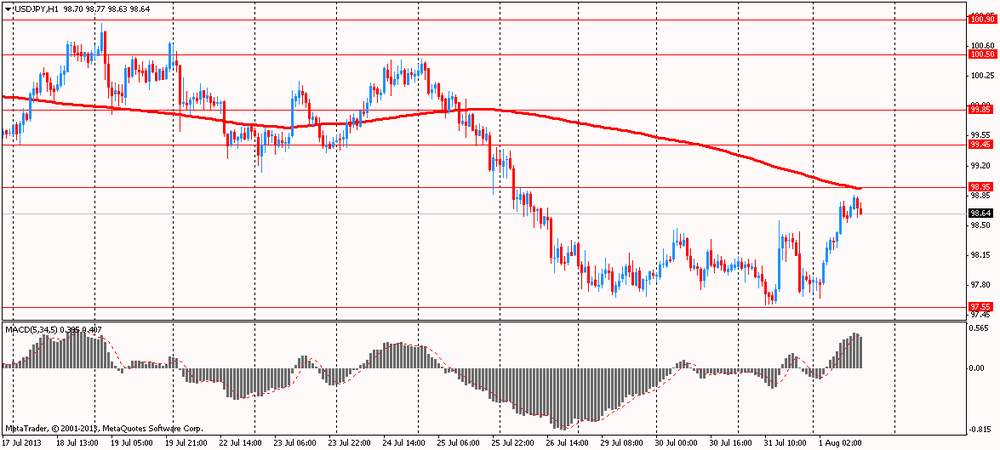

The Japanese yen fell against most major currencies against the background of large-scale increase of Asian stock markets after more positive than-expected data on the manufacturing sector in China and under the influence of rising expectations of continuing the policy of ultra-low interest rates in the U.S., even after the collapse of the program of bond purchases. The official manufacturing Purchasing Managers Index (PMI) of China rose in July to 50.3 against 50.1 in June, easing concerns about the possibility of a sharp slowdown second-largest economy in the world. In this projected figure at 49.8. The data came after the Federal Reserve on Wednesday left unchanged loose monetary policy against the background of weak economic growth and low inflation in the 1st half of the year.

EUR / USD: during the European session, the pair fell to $ 1.3222

GBP / USD: during the European session, the pair rose to $ 1.5242

USD / JPY: during the European session, the pair rose to Y98.86

At 12:30 GMT will begin monthly press conference of the ECB. At 14:00 GMT the U.S. ISM manufacturing index will be released in July. At 23:50 GMT Japan will release the change in the monetary base in July.