- Oil fell for a third day

Noticias del mercado

Oil fell for a third day

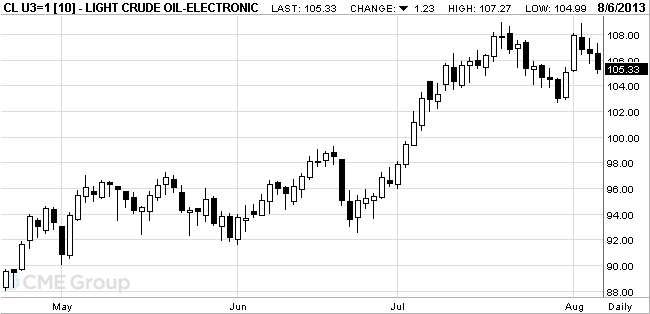

West Texas

Intermediate crude fell for a third day amid speculation that the Federal

Reserve may reduce stimulus and after Bank of America’s Francisco Blanch said

it will be difficult for WTI to rally much more.

Prices

dropped as much as 1.2 percent as investors awaited an address by Fed Bank of

Chicago President Charles Evans for indications of the central bank’s policy. Dallas

Fed President Richard Fisher said yesterday the bank is closer to slowing $85

billion in monthly bond buying. WTI could slide $8 to $10, Blanch, head of

commodities research at Bank of America in

WTI for

September delivery decreased $1.09, or 1 percent, to $105.47 a barrel at 10:23

a.m. on the New York Mercantile Exchange. Earlier, it gained as much as 0.7

percent. The volume of all futures traded was 7.2 percent below the 100-day

average.

Brent for

September settlement slid 94 cents, or 0.9 percent, to $107.76 a barrel on the

London-based ICE Futures Europe exchange. Volume was 6.1 percent above 100-day

average. The European benchmark grade was at a premium of $2.29 to WTI.

Crude

surged 8.8 percent in July, the biggest monthly gain since August 2012, as