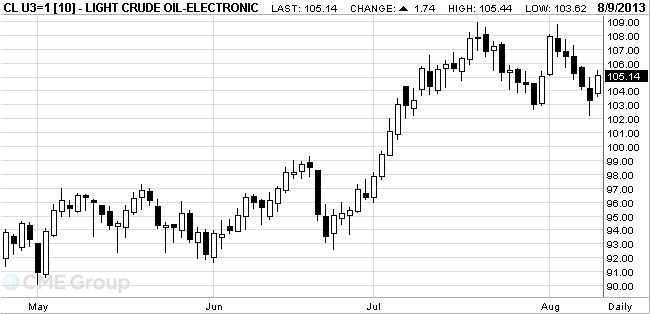

- Oil rose for the first time in six days

Noticias del mercado

Oil rose for the first time in six days

West Texas

Intermediate crude rose for the first time in six days, trimming a weekly drop

as industrial production advanced more than forecast in

Futures

gained as much as 1.4 percent in

WTI for

September delivery advanced as much as $1.42 to $104.82 a barrel in electronic

trading on the New York Mercantile Exchange and was at $104 as of 1:46 p.m.

Brent for

September settlement rose 0.4 percent to $107.09 a barrel on the London-based

ICE Futures Europe exchange. The European benchmark was at a premium of $3.09

to WTI, down from $3.28 yesterday.