- European session: the euro sta,ilized

Noticias del mercado

European session: the euro sta,ilized

06:00 United Kingdom Nationwide house price index August +0.8% +0.6% +0.6%

06:00 United Kingdom Nationwide house price index, y/y August +3.9% +3.3% +3.5%

06:00 Germany Retail sales, real adjusted July -1.5% +0.5% -1.4%

06:00 Germany Retail sales, real unadjusted, y/y July -2.8% +1.7% +2.3%

07:00 Switzerland KOF Leading Indicator August 1.23 1.34 1.36

08:30 United Kingdom Net Lending to Individuals, bln July 1.5 1.7 1.3

08:30 United Kingdom Mortgage Approvals July 57.7 59.0 60.6

09:00 Eurozone Business climate indicator July -0.53 -0.36 -0.2

09:00 Eurozone Economic sentiment index August 92.5 93.8 95.2

09:00 Eurozone Industrial confidence August -10.6 -9.6 -8.0

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +1.6% +1.4% +1.3%

09:00 Eurozone Unemployment Rate July 12.1% +12.1% +12.1%

The Euro is trading without a trend against the U.S. dollar after the release of mixed statistics : business sentiment in the euro zone improved, German retail sales disappoint , while the number of unemployed in the euro zone fell a second straight month , while the unemployment rate remained at the same level.

Eurozone economic confidence improved fourth consecutive month in August , data released by the European Commission. Economic sentiment index rose to 95.2 from 92.5 in July. The value was higher than the consensus forecast of 93.8 .

The strong increase was due to the pronounced increase confidence among consumers and managers in industry, services and retail trade.

Thanks to a more positive assessment of the current level of general managers of orders and production expectations , the index of business optimism in the industry rose to -7.9 in August from 10.6 in the previous month .

In addition, confidence among service providers improved to -5.3 from -7.8 . The improvement was due to a sharp increase in estimates of managers past business situation and the important improvements on past demand and expectations of the proposal.

German retail sales for July disappoint : the fall was the second consecutive month. Thus, the shopkeepers at best get mixed results for the year. According to published data, the volume of retail sales fell in July by 1.4 % compared with the previous month , after the June sales were down 0.8 %. The data are adjusted for inflation and seasonal factors .

Eurozone unemployment rate remained at 12.1 percent in July , being in line with expectations , Eurostat data showed . The unemployment rate remained at this level for the fourth consecutive month. According to Eurostat for the euro area in July registered 19,231,000 unemployed. Compared with June, the unemployment rate fell to 15,000 , but rose to 1.008 million , compared with July last year.

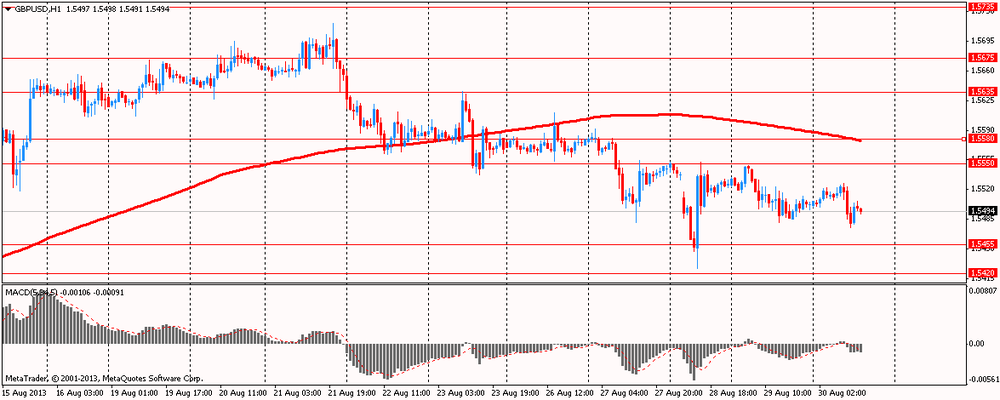

The British Pound was lower against the U.S. dollar. Statistics published today reflected the increase in the index of housing prices and the growth of approved applications for mortgage loans.

House prices in August rose 11 th consecutive month amid growing demand due to government interference and low supply . This is according to the mortgage operator Nationwide Building Society, published today . The data showed that in August rates increased by 0.6 % compared to July and was 3.5% higher compared to the same period the previous year . House prices rose by 1.4 % during the period from June to August , compared with the period from March to May. This is the highest growth since mid- 2010 and is an acceleration compared with growth of 1.0 % in the three months from May to July .

The number of mortgage approvals in the UK in July rose to a maximum of more than five years to a level that confirms the fruitfulness of efforts to address the problems in lending . On Friday the Bank of England said . According to published reports, the number of mortgage approvals in July was 60 624 and was the highest since March 2008 . The volume of consumer loans, both secured and unsecured , net of redemptions in July rose by 1.3 billion British pounds ( U.S. $ 2 billion ) . The average interest rate on new housing loans in July fell to 3.17 %, reaching its lowest level since the beginning of the comparable observations in 2004 .

EUR / USD: during the European session, the pair is trading in the range of $ 1.3221 - $ 1.3241

GBP / USD: during the European session, the pair fell to $ 1.5475

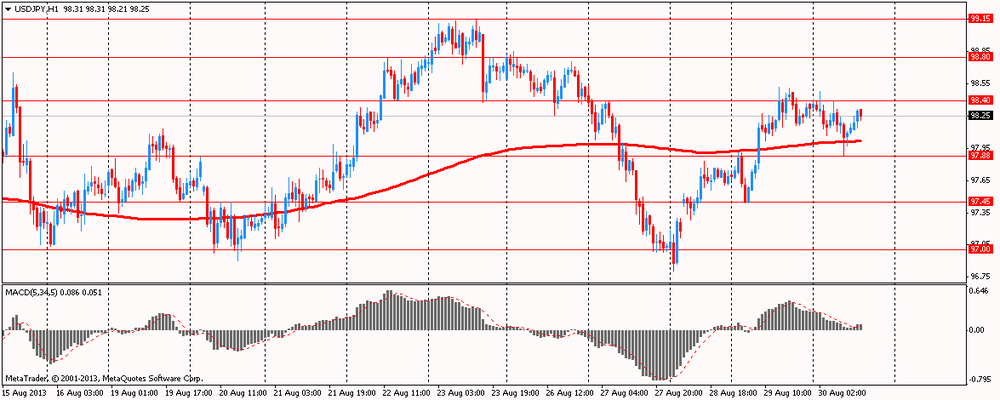

USD / JPY: during the European session, the pair fell to Y97.88

At 12:30 GMT Canada will release the Gross Domestic Product for June. In the U.S., will be released at 12:30 GMT the main index for personal consumption expenditures , changes in the level of spending, deflator of personal consumption expenditures for July will be released at 13:45 GMT Chicago PMI index for August.