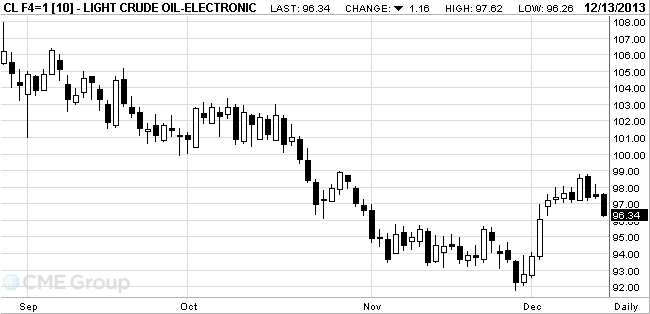

- Oil fell

Noticias del mercado

Oil fell

West Texas

Intermediate crude dropped to the lowest level in more than a week as falling

demand boosted fuel inventories amid concern that the Federal Reserve will curb

stimulus.

Prices slid

as much as 1.1 percent. Stockpiles of gasoline and distillate fuels, including

diesel and heating oil, jumped the most last week since Jan. 4, the Energy

Information Administration reported on Dec. 11. The Fed will start slowing its

monthly bond purchases at its Dec. 17-18 meeting, according to 34 percent of

economists surveyed Dec. 6 by Bloomberg, an increase from 17 percent in on Nov.

8.

“Demand is

weak and if we don’t see it become stronger, the market will come under pressure,”

said Gene McGillian, an analyst and broker at Tradition Energy in

WTI for

January delivery declined 84 cents, or 0.9 percent, to $96.66 a barrel at 10:07

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

3.2 percent below the 100-day average. Futures are down 1 percent this week.

Prices increased $6.98 between Nov. 27 and Dec. 11, based on intraday prices.

Brent for

January settlement, which expires on Dec. 16, dropped 29 cents, or 0.3 percent,

to $108.38 a barrel on the London-based ICE Futures Europe exchange. The

more-active February contract traded 38 cents lower at $108. The European

benchmark crude was at a $11.72 premium to WTI, compared with $11.06 yesterday.