- Oil rose

Noticias del mercado

Oil rose

West Texas

Intermediate crude rose for a second day after

Futures

increased as much as 1.1 percent in

Bloomberg

survey estimates of 92 economists for February payrolls ranged from gains of

100,000 to 220,000.

Unemployment

rose to 6.7 percent from 6.6 percent as more people entered the labor force and

couldn’t find work, the data released today in

U.S.

President Barack Obama signed an order authorizing financial sanctions against

The flow of

Russian crude through Ukraine to Europe in the southern branch of the Druzhba

oil pipeline is uninterrupted, Natalya Kutsik, a spokeswoman for Russia’s oil

pipeline operator OAO Transneft, said by text message. The link carried about

300,000 barrels a day last year, according to data from

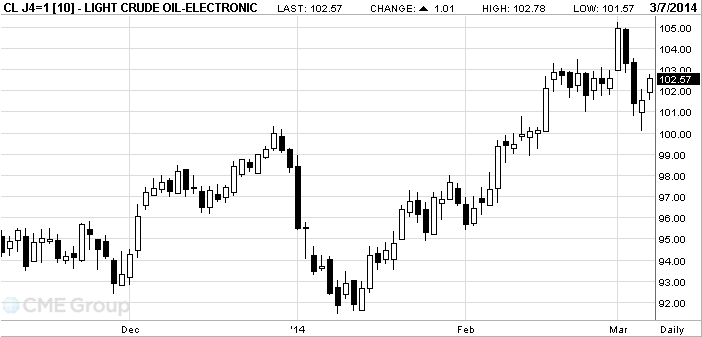

WTI for

April delivery increased 89 cents, or 0.9 percent, to $102.45 a barrel at 10:40

a.m. on the New York Mercantile Exchange. Prices are down 0.1 percent this

week. The volume of all futures traded was 2.4 percent above the 100-day

average.

Brent for

April settlement rose 36 cents, or 0.3 percent, to $108.46 a barrel on the

London-based ICE Futures Europe exchange. Trading volume was near the 100-day

average. The European benchmark was at a $6.01 premium to WTI, down from $6.54

at yesterday’s close.