- European session: the euro fell

Noticias del mercado

European session: the euro fell

07:00 Germany Current Account January 21.1 Revised From 23.5 13.0 16.2

07:00 Germany Trade Balance January 18.3 Revised From 18.5 19.3 17.2

07:30 Japan BOJ Press Conference

08:00 China New Loans February 1320

09:30 United Kingdom Industrial Production (MoM) January +0.5% Revised From +0.4% +0.3% +0.1%

09:30 United Kingdom Industrial Production (YoY) January +1.9% Revised From +1.8% +3.0% +2.9%

09:30 United Kingdom Manufacturing Production (MoM) January +0.4% Revised From +0.3% +0.3% +0.4%

09:30 United Kingdom Manufacturing Production (YoY) January +1.4% Revised From +1.5% +3.3% +3.3%

09:30 United Kingdom Inflation Report Hearings Quarter IV

10:00 Eurozone ECOFIN Meetings

Euro fell against the U.S. dollar on the background data on the trade balance of Germany. In January, German exports grew more than expected , after a decline in December showed Tuesday, official data agency Destatis.Eksport rose 2.2 percent on a monthly measurement in January , rebounding from the 0.9 percent drop in December. Exports are projected to grow had 1.5 percent . In addition , imports expanded by 4.1 percent after falling 1.4 percent a month earlier. Growth rate significantly higher than the increase of 1.4 per cent expected by economists.

Due to the marked increase in import trade surplus fell to a seasonally adjusted to 17.2 billion euro in January from 18.3 billion euros in the previous month . In annualized export growth slowed to 2.9 percent from 4.5 percent in December. Similarly , imports increased by 1.5 percent , which is slower than the growth of 2.4 percent in December.

On an unadjusted basis the current account surplus was 16.2 billion euros in January, compared with 10.6 billion euro surplus , which saw in the corresponding period last year.

The British pound was down against the U.S. dollar on a background of mixed data on industrial production . In the UK, industrial production growth slowed in January, more than expected , while growth in the manufacturing industry remained stable compared to December showed Tuesday, official data Office for National Statistics .

The volume of industrial production increased by 0.1 percent compared with December . Issue , according to forecasts, had to expand 0.3 percent after 0.5 percent growth in December. Manufacturing output rose by 0.4 percent, the same as in December and remained above the 0.3 percent growth forecast by economists.

The annual increase in industrial output accelerated to 2.9 percent from 1.9 percent. At the same time , growth in the manufacturing industry increased more than doubled to 3.3 percent from 1.4 percent.

Today in the British Parliament held a hearing at which the Bank of England and M. Carney MPC members P. Fisher , D. Miles and M. Weale commented on the February inflation report CB. Recall that last month the Bank has changed its policy of transparency, shifting the emphasis from the target threshold unemployment rate of 7% for a number of other factors that should also serve as guidelines in the decision to raise rates . In particular , we are talking about the spare capacity in the economy, productivity growth and wages.

Carney suggested today that the amount of spare capacity in the economy should be a little more than 1.5% of GDP , while Wil named a figure of less than 1 %. Carney noted that the state of the British economy is improving much faster than in the rest of the world . Over the past few months increased inflation expectations , he said , and suggested that in the next three years, the Bank may raise rates gradually to reach 3.5 %. Carney said that the Central Bank will start folding QE program only after several rate increases , while it does not require consultation with the Treasury on this issue.

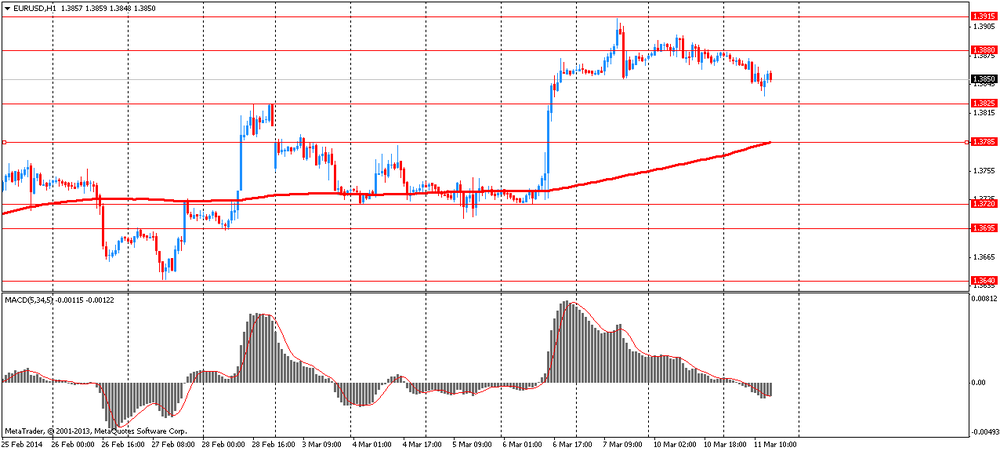

EUR / USD: during the European session, the pair fell to $ 1.3833

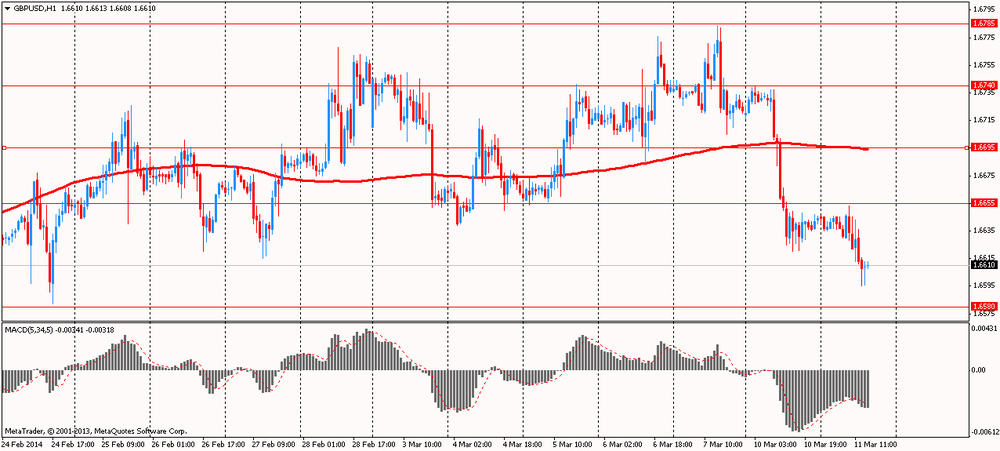

GBP / USD: during the European session, the pair fell to $ 1.6595

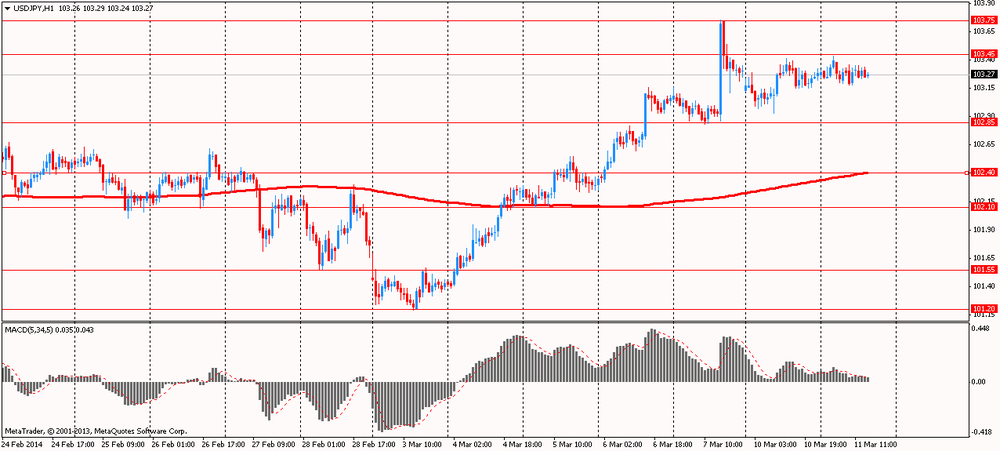

USD / JPY: during the European session, the pair traded in the range Y103.18 - Y103.36

At 14:00 GMT the United States will vacancy rates and labor turnover from the Bureau of Labor Statistics in January . At 15:00 GMT Britain will publish data on the change in GDP from NIESR February . At 20:30 GMT the United States will change in the volume of crude oil , according to the API. At 23:30 GMT Australia will release the consumer confidence index from Westpac in March . At 23:50 GMT Japan will BSI index of business conditions for large manufacturers , business conditions index (BSI) for large enterprises in all sectors for the 1st quarter , the index of activity in the services sector in January .