- Oil erased losses

Noticias del mercado

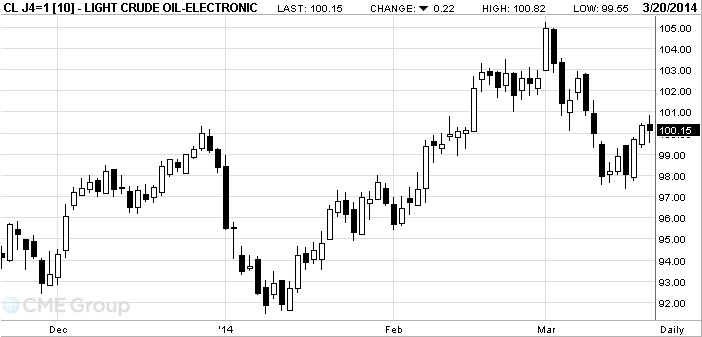

Oil erased losses

West Texas

Intermediate crude erased losses after measures of leading indicators raised

optimism that a stronger

Prices were

little changed after falling as much as 0.8 percent. The Conference Board’s

gauge of the outlook for the next three to six months climbed 0.5 percent last

month, the biggest gain since November. WTI followed gains in

“The market

is very data dependent,” said Phil Flynn, senior market analyst at the Price

Futures Group in

WTI futures

for April delivery, which expires today, climbed 12 cents to $100.49 a barrel

at 10:17 a.m. on the New York Mercantile Exchange. The more-active May contract

rose 22 cents to $99.39. The volume of all futures traded was about 18 percent

below the 100-day average for the time of day.

Brent for

May settlement increased 28 cents, or 0.3 percent, to $106.13 a barrel on the

London-based ICE Futures Europe exchange. The European benchmark was at a

premium of $6.74 to WTI for the same month on ICE. The spread narrowed for a

third day yesterday to close at $6.68, the smallest gap since March 7.