- Oil rose

Noticias del mercado

Oil rose

Brent

crude rose from the lowest level in almost five months amid concern that talks

between the Libyan government and rebels won’t restore oil exports. West Texas

Intermediate’s discount to Brent widened.

The

European benchmark gained as much as 0.6 percent. The rebels’ Executive Office

for Barqa, representing the region of Cyrenaica, denied a report that the group

will cede one of the four ports that have been under its control since July to

the government in a few days. WTI traded below $100 as U.S. jobless claims rose

more than forecast last week.

“Libya

is right on Europe’s doorstep and it has more impact on Brent,” said Michael

Lynch, president of Strategic Energy & Economic Research in Winchester,

Massachusetts. “There are concerns about Libya’s ports and oil exports.”

Brent

for May settlement gained 23 cents to $105.02 a barrel at 10:46 a.m. New York

time on the London-based ICE Futures Europe exchange. Volume was 35 percent

above the 100-day average. Prices fell to $104.79 yesterday, the lowest

settlement since Nov. 7. The North Sea grade is used to price more than half

the world’s oil, including exports from Libya.

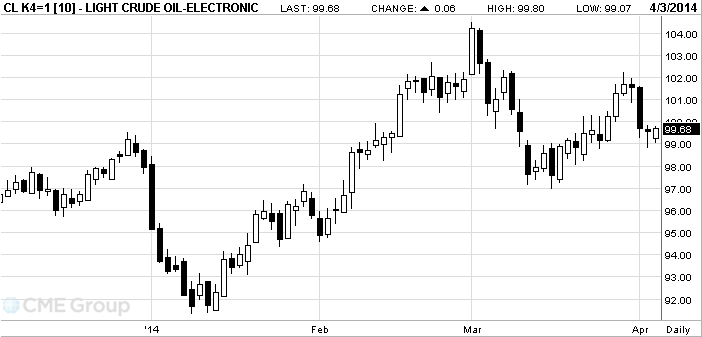

WTI for

May delivery declined 23 cents to $99.39 a barrel on the New York Mercantile

Exchange. The volume of all futures traded was 24 percent below the 100-day

average.

WTI was

at a discount of $5.63 to the European benchmark crude. The spread shrank to

$5.17 yesterday, the narrowest level since October.