- Foreign exchange market. Asian session: the New Zealand dollar climbed over 1% against the U.S dollar after the interest hike in New Zealand

Noticias del mercado

Foreign exchange market. Asian session: the New Zealand dollar climbed over 1% against the U.S dollar after the interest hike in New Zealand

Economic

calendar (GMT0):

01:00 Australia Consumer Inflation Expectation June 4.4% 4.0%

01:30 Australia Changing the number of employed May 10.3 10.3 -4.8

01:30 Australia Unemployment rate May 5.8% 5.9% 5.8%

06:45 France CPI, m/m May 0.0% +0.1% 0.0%

06:45 France CPI, y/y May +0.7% +0.8%

08:00 Eurozone ECB Monthly Report June

The U.S.

dollar traded mixed against the most major currencies. Market participants are

awaiting the release of the U.S. initial jobless claims and retail sales later

in the trading day.

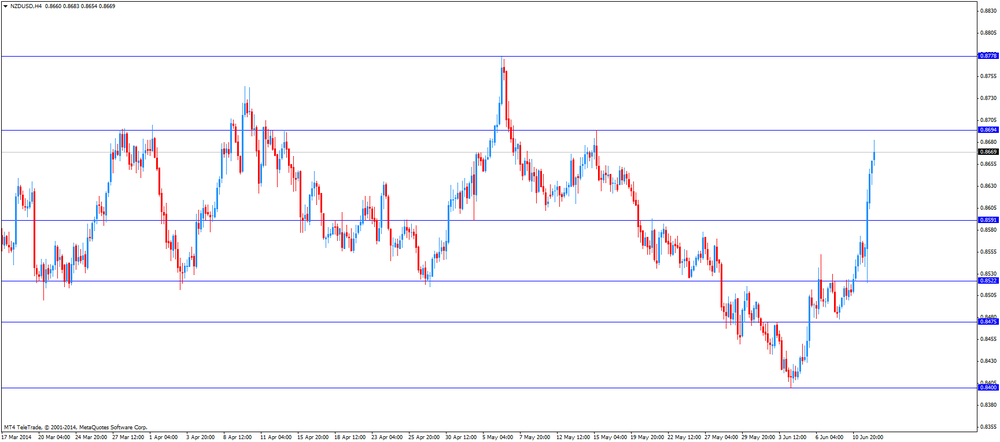

The New

Zealand dollar climbed toward 1-month highs against the U.S dollar after the

interest hike in New Zealand. The Reserve Bank of New Zealand (RBNZ) raised its

interest rate to 3.25% from 3.00%. New Zealand’s central bank commented that

borrowing costs could rise again this year.

The

Australian dollar traded mixed against the U.S. dollar after the mixed labour

market data from Australia. The number of employed people in Australia fell by

4,800 in May, missing expectations for a 10,300 rise, after 10,300 gain in

April. April's figure was revised down to a 10,300 increase from a 14,200 increase.

Australia's

unemployment rate remained unchanged at 5.8% in May. Analysts had expected an

increase to 5.9%.

The

Melbourne Institute released its inflation expectations for the next 12 months for

Australia. The inflation expectations dropped to 4.0% in May from 4.4% in April.

The

Japanese yen traded slightly lower against the U.S. dollar after the release of

the core machinery orders in Japan. Japan’s core machinery orders dropped 9.1%

in April, after a 19.1% gain in March. Analysts had forecasted a 10.8% decline.

On a yearly

basis, the core machinery orders in Japan climbed 17.6% in April, after a 16.1%

rise in March.

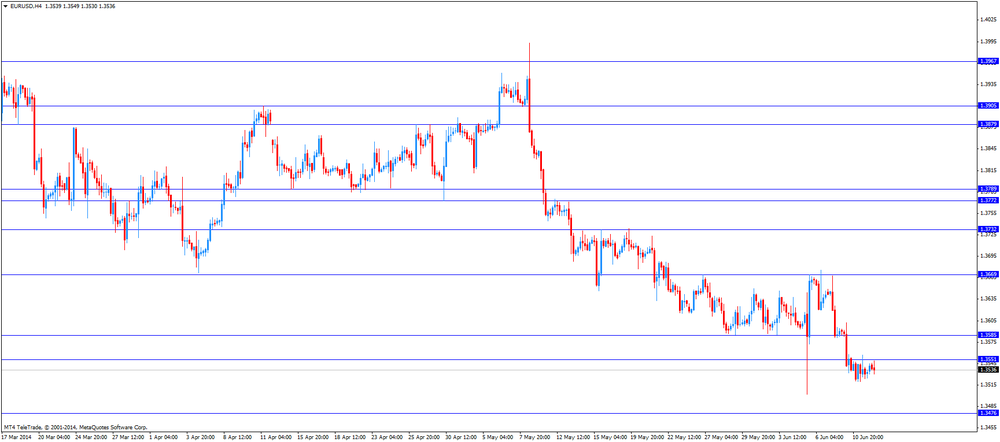

EUR/USD:

the currency pair climbed to $1.3545

GBP/USD:

the currency pair increased to $1.6800

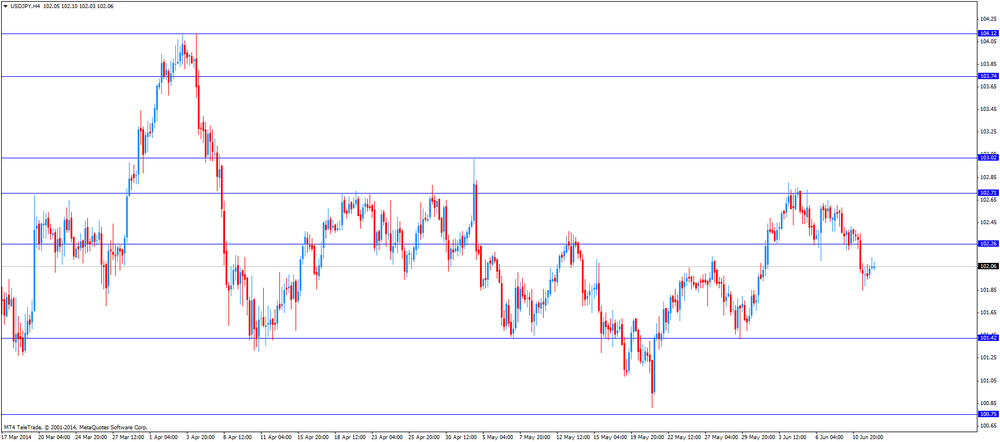

USD/JPY:

the currency pair was up to Y102.15

NZD/USD: the currency pair increased to $0.8659

The most

important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) April -0.3% +0.5%

09:00 Eurozone Industrial Production (YoY) April -0.1% +0.9%

12:30 Canada New Housing Price Index April +0.2% +0.3%

12:30 U.S. Retail sales May +0.1% +0.5%

12:30 U.S. Retail sales excluding auto May 0.0% +0.4%

12:30 U.S. Initial Jobless Claims June 312 306

12:30 U.S. Import Price Index May -0.4% +0.2%

14:00 U.S. Business inventories April +0.4% +0.4%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 55.2

22:45 New Zealand Food Prices Index, m/m May +0.6%

22:45 New Zealand Food Prices Index, y/y May +1.5%