- Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance

Noticias del mercado

Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance

Economic calendar (GMT0):

01:30 Australia Trade Balance May -0.12 -0.21 -1.91

06:00 United Kingdom Nationwide house price index June +0.7% +0.7% +1.0%

06:00 United Kingdom Nationwide house price index, y/y June +11.1% +11.8%

08:30 United Kingdom PMI Construction June 60.0 59.7 62.6

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected economic data. U.S. final manufacturing purchasing managers' index declined to 57.3 in June from 57.5 in April. Analysts had expected the index to remain unchanged.

ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

The New Zealand dollar declined against the U.S dollar after milk powder prices decreased at an auction. No economic reports were released in New Zealand.

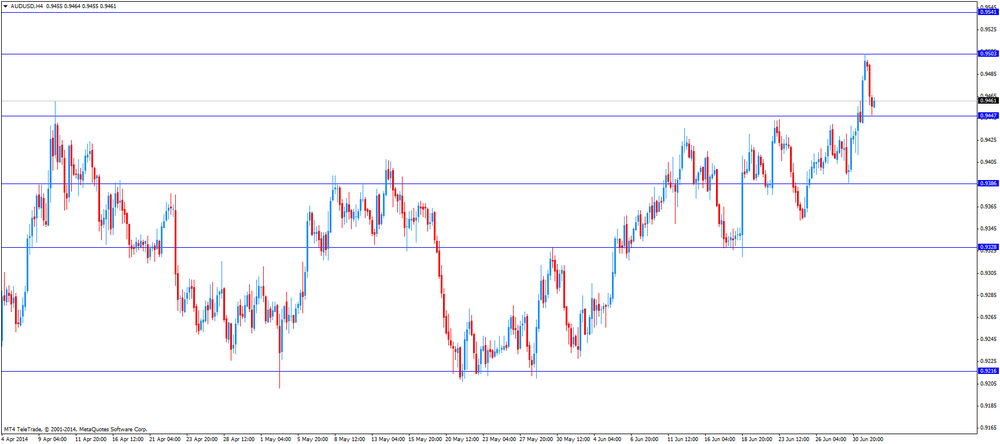

The Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance. Australia's trade deficit increased to A$1.91 billion in May, from A$0.78 billion in April. April's figure was revised down from a deficit of A$0.12 billion. Analysts had expected the trade deficit to sink to A$0.21 billion.

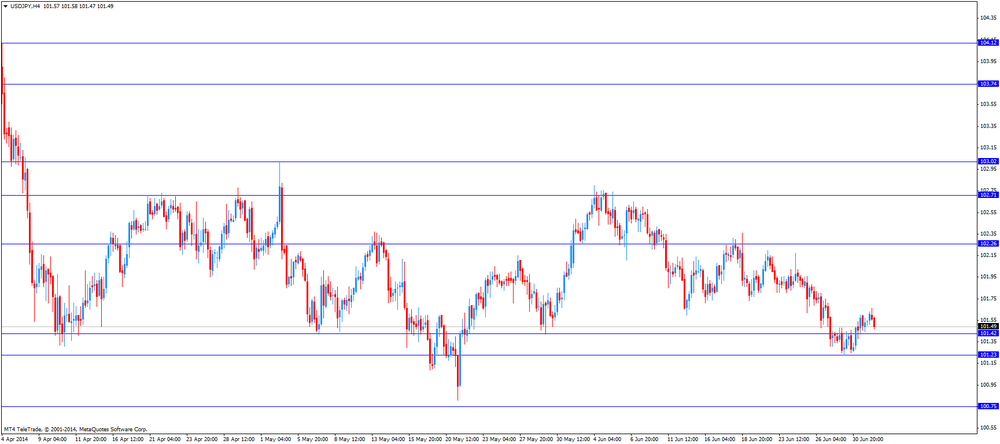

The Japanese yen traded mixed against the U.S. dollar due to the declining demand for safe-haven currency.

The monetary base in Japan climbed 42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

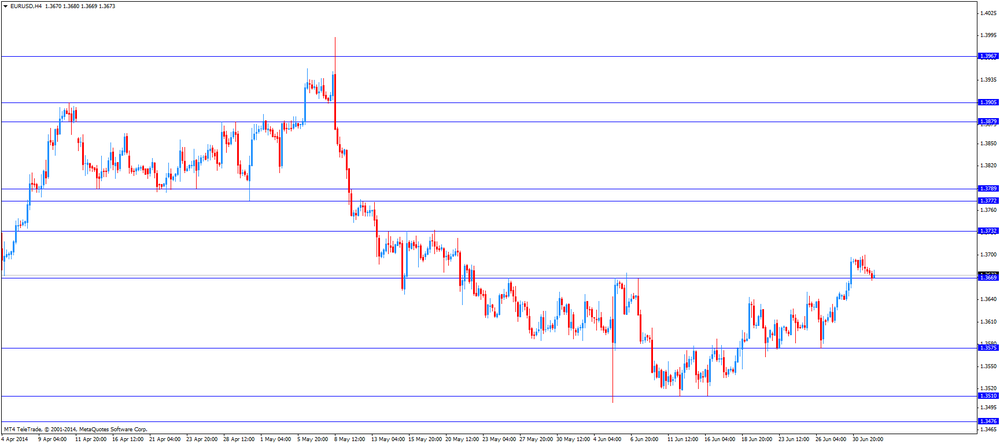

EUR/USD: the currency pair declined to $1.3670

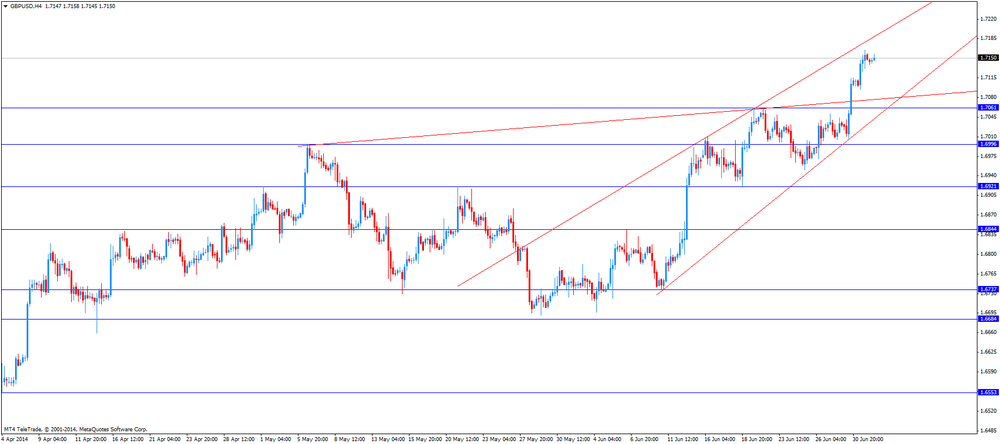

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y101.65

AUD/USD: the currency pair decreased to $0.9448

The most important news that are expected (GMT0):

09:00 Eurozone GDP (QoQ) (Finally) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter I +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

15:00 U.S. Fed Chairman Janet Yellen Speaks