- Foreign exchange market. Asian session: yesterday’s strong U.S. labour market data still weighed on markets

Noticias del mercado

Foreign exchange market. Asian session: yesterday’s strong U.S. labour market data still weighed on markets

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Australia RBA Assist Gov Edey Speaks

06:00 Germany Factory Orders s.a. (MoM) May +3.4% Revised From +3.1% -0.8% -1.7%

06:00 Germany Factory Orders n.s.a. (YoY) May +6.3% +5.5%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

The New Zealand dollar declined against the U.S dollar due to yesterday's strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports in Australia. Yesterday's strong U.S. labour market data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens still weighed on the Australian currency. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

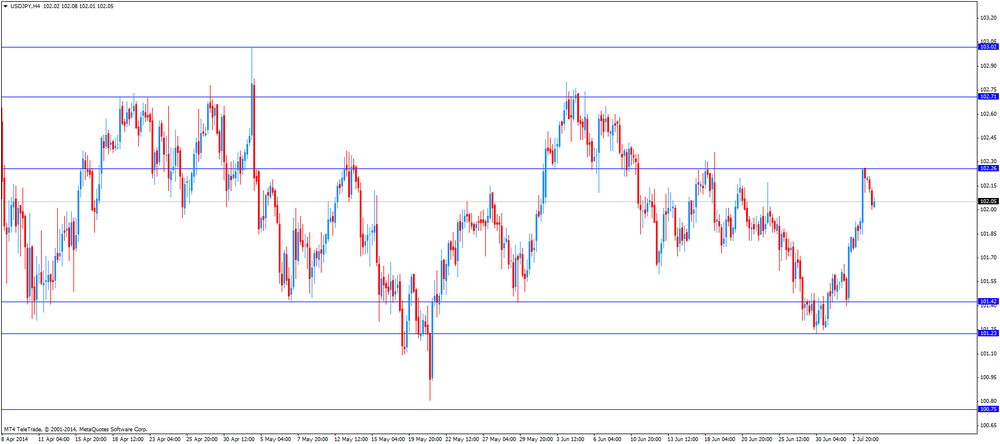

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan. Yesterday's strong U.S. labour market data still weighed on the yen.

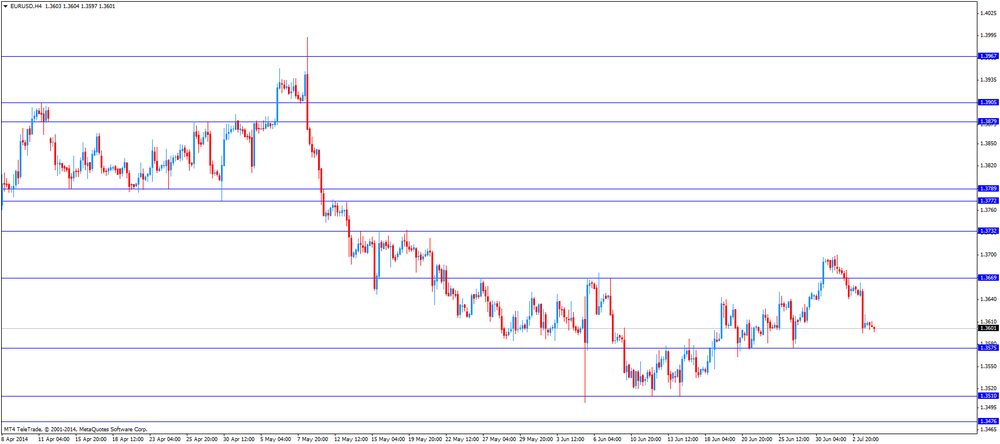

EUR/USD: the currency pair traded mixed

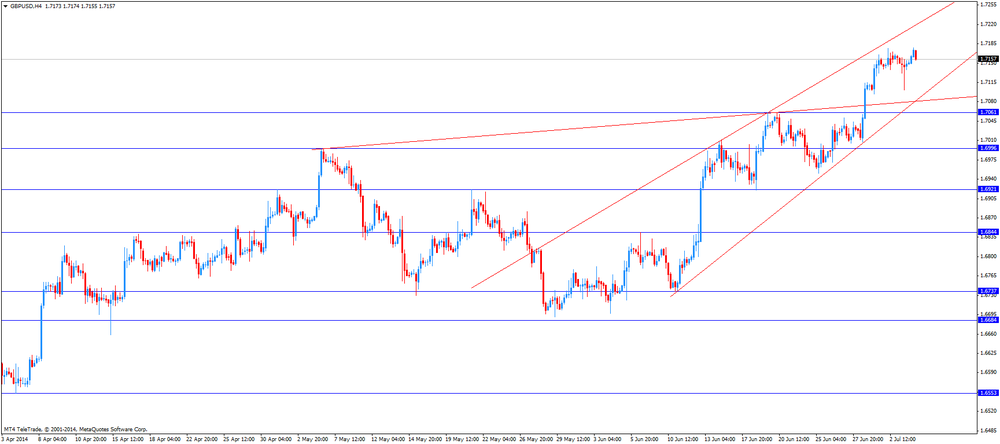

GBP/USD: the currency pair increased to $1.7175

USD/JPY: the currency pair declined to Y102.00