- Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision

Noticias del mercado

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance June -2.04 -2.00 -1.68

01:45 China HSBC Services PMI July 53.1 50

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

07:48 France Services PMI (Finally) July 48.2 50.4 50.4

07:53 Germany Services PMI (Finally) July 54.5 56.6 56.7

07:58 Eurozone Services PMI (Finally) July 52.8 54.4 54.2

08:30 United Kingdom Purchasing Manager Index Services July 57.7 58.1 59.1

The U.S. dollar traded mixed against the most major currencies. Friday's release of U.S. labour market data still weighed on the U.S. currency. The U.S. economy added 209,000 jobs in July, missing expectations for a growth of 230,000 jobs. The unemployment rate in the U.S. increased to 6.2% in July from 6.1% in June.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia's interest rate decision. The RBA kept its interest rate unchanged at 2.50%. This decision was expected by analysts.

The RBA said its accommodative monetary policy should provide support to demand and help growth to strengthen over time. Australia's central bank added that inflation is expected to be within the 2-3 per cent over the next two years.

The Reserve Bank of Australia governor Glenn Stevens said that there had been some improvement in the labour market.

Australia's trade deficit decreased to A$1.68 billion in June from A$2.04 billion in May. May's figure was revised down from a deficit of A$1.91 billion. Analysts had expected the trade deficit to decline to A$2.00 billion.

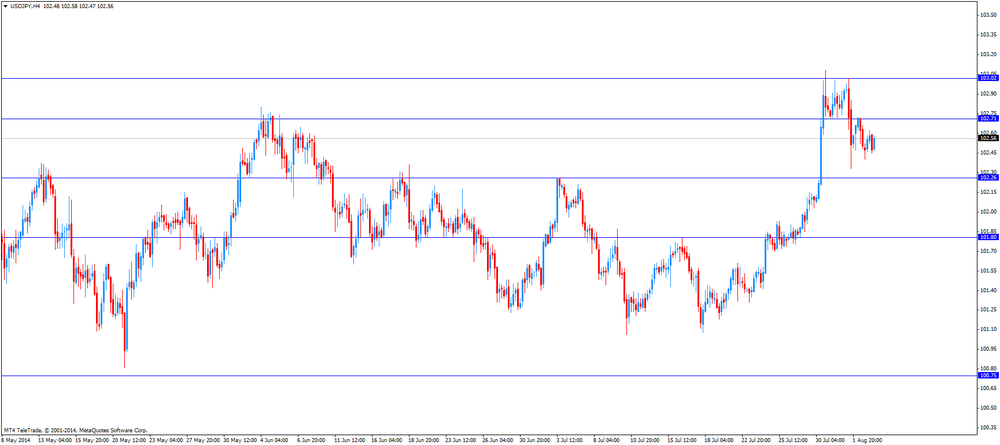

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan.

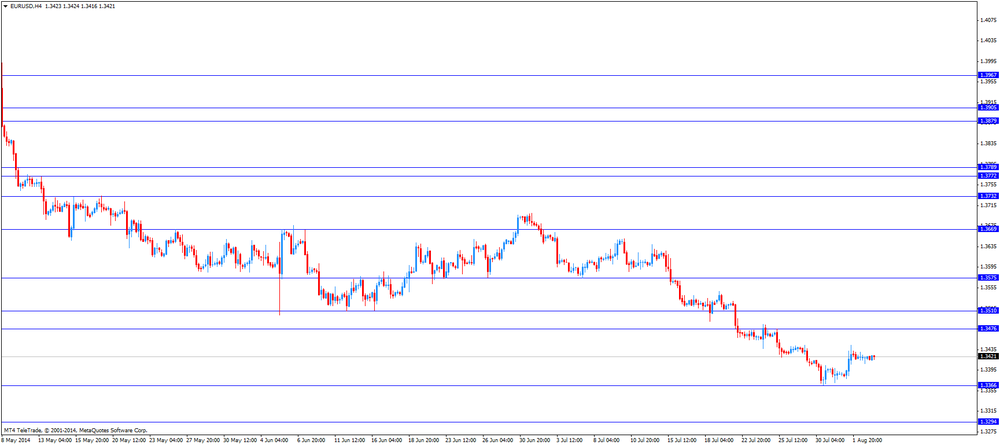

EUR/USD: the currency pair traded mixed

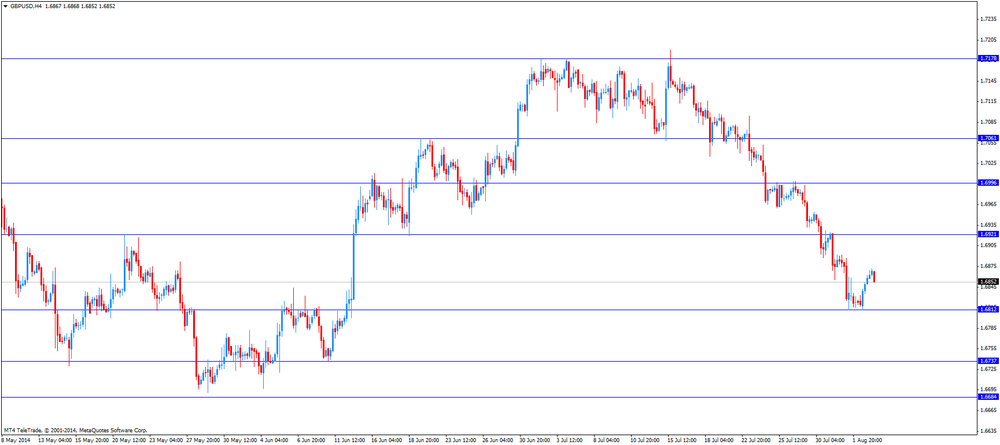

GBP/USD: the currency pair increased to $1.6870

USD/JPY: the currency pair declined to Y102.47

AUD/USD: the currency pair was up to $0.9339

The most important news that are expected (GMT0):

09:00 Eurozone Retail Sales (MoM) June 0.0% +0.4%

09:00 Eurozone Retail Sales (YoY) June +0.7% +1.2%

14:00 U.S. ISM Non-Manufacturing July 56.0 56.6

14:00 U.S. Factory Orders June -0.5% +0.6%

22:45 New Zealand Unemployment Rate Quarter II 6.0% 5.8%

22:45 New Zealand Employment Change, q/q Quarter II +0.9% +0.7%