- Foreign exchange market. Asian session: the U.S. dollar traded higher against the most major currencies due to yesterday’s San Francisco Federal Reserve research report

Noticias del mercado

Foreign exchange market. Asian session: the U.S. dollar traded higher against the most major currencies due to yesterday’s San Francisco Federal Reserve research report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 11 8

01:30 Australia Home Loans July +0.1% +1.1% +0.3%

05:00 Japan Consumer Confidence August 41.5 42.3 41.2

06:00 Japan Prelim Machine Tool Orders, y/y August +37.7% +35.6%

06:45 France Trade Balance, bln July -5.6 Revised From -5.4 -5.0 -5.5

08:30 United Kingdom Industrial Production (MoM) July +0.3% +0.2% +0.5%

08:30 United Kingdom Industrial Production (YoY) July +1.2% +1.3% +1.7%

08:30 United Kingdom Manufacturing Production (MoM) July +0.3% +0.3% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) July +1.9% +2.2% +2.2%

08:30 United Kingdom Trade in goods July -9.4 -9.1 -10.2

The U.S. dollar traded higher against the most major currencies due to yesterday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. The Fed could raise its interest rate sooner than expected.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar fell against the U.S. dollar after the weaker-than-expected economic data from Australia. The National Australia Bank's business confidence index declined to 8 in August from 11 in July.

Home loans in Australia climbed 0.3% in July, missing expectations for a 1.1% rise, after a 0.1% increase. June's figure was revised down from a 0.2% gain.

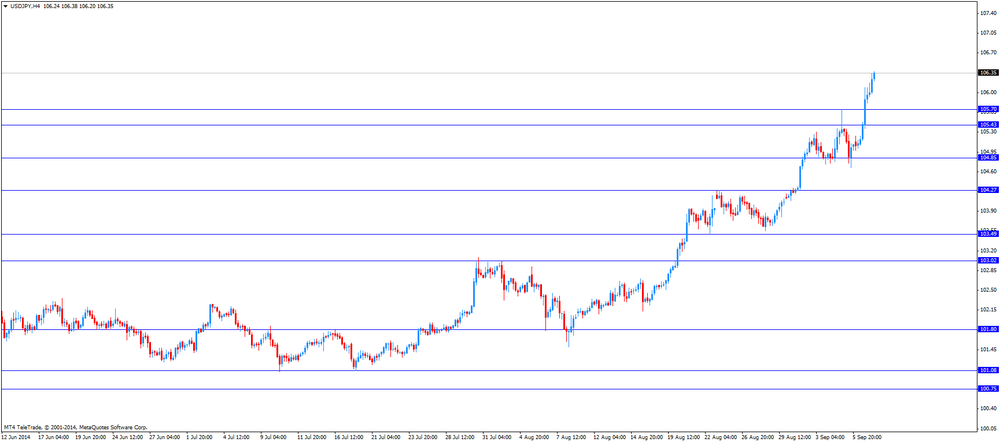

The Japanese yen dropped against the U.S. dollar after the mixed economic data from Japan and due to the stronger U.S. dollar. Japan's tertiary industry index remained flat in July, beating forecasts for a 0.3% decline. June's figure was revised up from a 0.1% decrease.

Japan's Cabinet Office released its consumer confidence index for Japan. The index fell to 41.2 in August from 41.5 in July, missing expectations for a rise to 42.3.

Preliminary machine tool orders in Japan rose 35.6% in august, after a 37.7% gain July.

The Bank of Japan (BoJ) released its minutes from the August meeting. The BoJ said the Japan's economy has continued its moderate recovery as a trend. Japan's central bank added that "it was important to accurately gauge the underlying trend in prices".

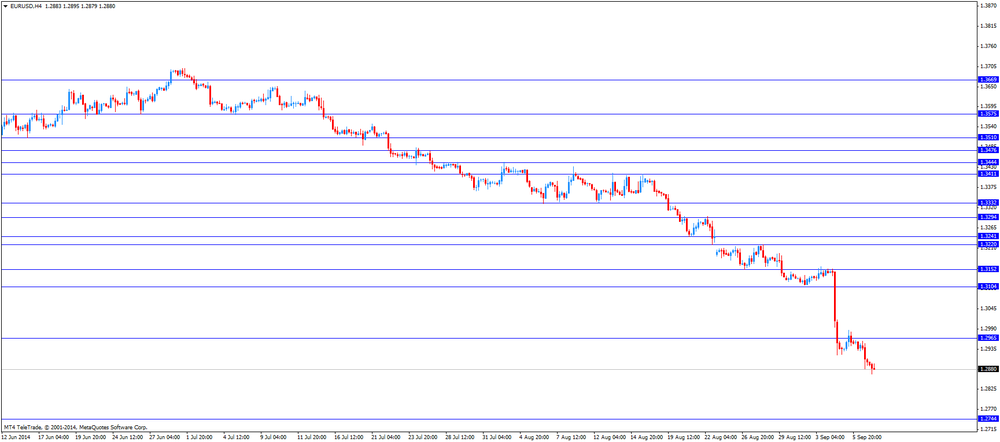

EUR/USD: the currency pair fell to $1.2866

GBP/USD: the currency pair decreased to $1.6063

USD/JPY: the currency pair rose Y106.34

The most important news that are expected (GMT0):

10:45 United Kingdom BOE Gov Mark Carney Speaks

12:15 Canada Housing Starts August 200 197

14:00 United Kingdom NIESR GDP Estimate August +0.6%

14:00 U.S. JOLTs Job Openings July 4.67 4.72

14:00 U.S. FOMC Member Tarullo Speaks

23:50 Japan Core Machinery Orders July +8.8% +4.1%

23:50 Japan Core Machinery Orders, y/y July -3.0% +0.6%