- Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the economic data from the U.K.

Noticias del mercado

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia RBA Assist Gov Kent Speaks

01:30 Australia RBA Meeting's Minutes

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Retail Price Index, m/m August -0.1% +0.5% +0.4%

08:30 United Kingdom Retail prices, Y/Y August +2.5% +2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y August +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) August -1.6% -0.2% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) August -7.3% -6.6% -7.2%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.1% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) August +0.9% +0.9% +0.9%

08:30 United Kingdom HICP, m/m August -0.3% +0.4% +0.4%

08:30 United Kingdom HICP, Y/Y August +1.6% +1.5% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y August +1.8% +1.8% +1.9%

09:00 Eurozone ZEW Economic Sentiment September 23.7 21.3 14.2

09:00 Germany ZEW Survey - Economic Sentiment September 8.6 5.2 6.9

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. producer price index (PPI) is expected to rise 0.1% in August, after a 0.1% gain in July.

The U.S. PPI excluding food and energy is expected to increase 0.1% in August, after a 0.2% increase in July.

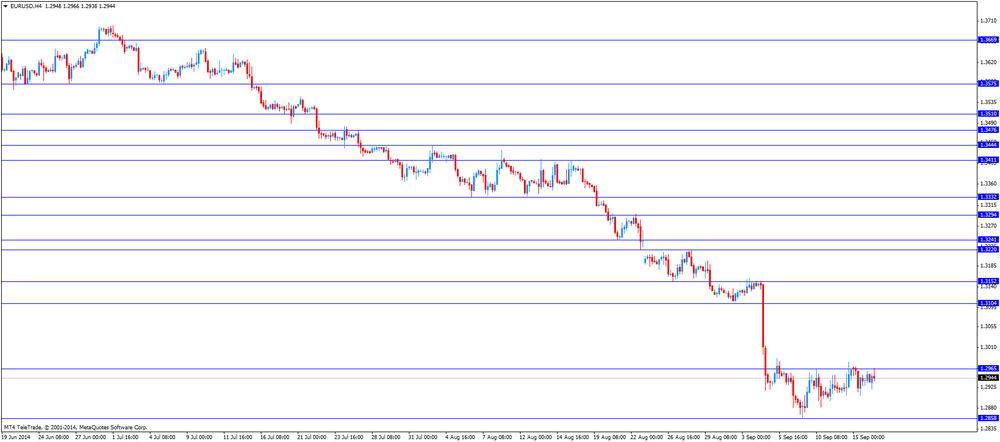

The euro traded lower against the U.S. dollar. The ZEW economic sentiment index for Germany declined to 6.9 in September from 8.6 in August, beating expectations for a drop to 5.2.

Eurozone's ZEW economic sentiment index dropped to 14.2 in September from 23.7 in August, missing forecast of a decrease to 21.3.

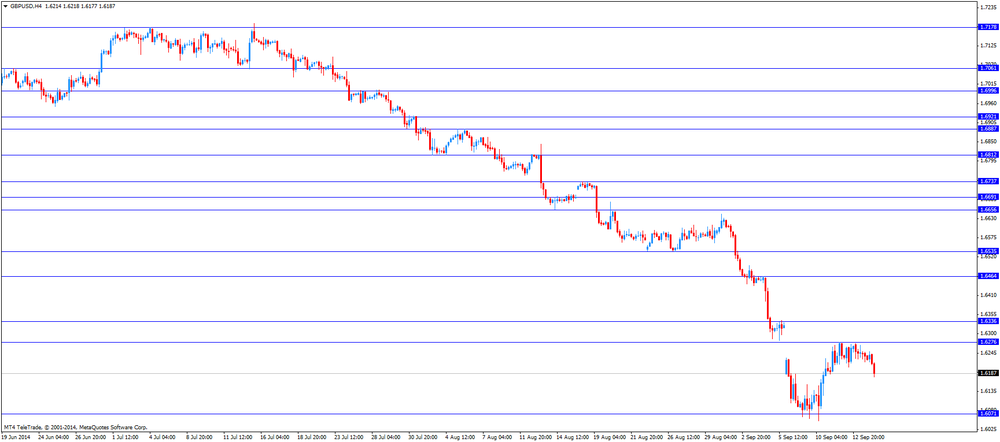

The British pound traded mixed against the U.S. dollar after the economic data from the U.K. The U.K. consumer price index (CPI) increased 0.4% in August, in line with expectations, after a 0.3% decrease in July.

On a yearly basis, the U.K. CPI fell to 1.5% in August from 1.6% in July, in line with expectations.

The U.K. core CPI excluding food, energy, alcohol and tobacco increased to 1.9% in August from 1.8% in July, beating forecasts of a 1.8% rise.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian manufacturing shipments. The Canadian manufacturing shipments are expected to rise 1.1% in July, after a 0.6% gain in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6160

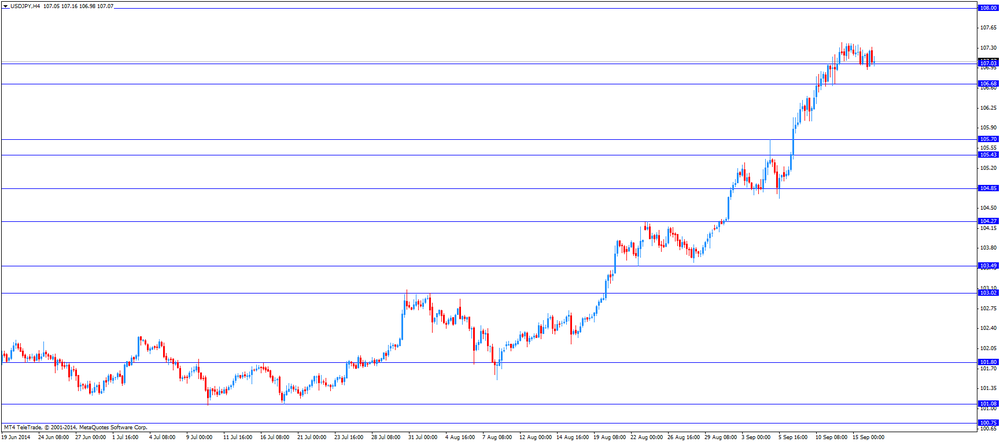

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) July +0.6% +1.1%

12:30 U.S. PPI, m/m August +0.1% +0.1%

12:30 U.S. PPI, y/y August +1.7% +1.8%

12:30 U.S. PPI excluding food and energy, m/m August +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.6% +1.7%

13:00 U.S. Net Long-term TIC Flows July -18.7 24.3

13:00 U.S. Total Net TIC Flows July -153.5

16:45 Canada BOC Gov Stephen Poloz Speaks

22:45 New Zealand Current Account Quarter II 1.41 -1.04