- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the positive ZEW economic sentiment data

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the positive ZEW economic sentiment data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

09:30 United Kingdom Retail Price Index, m/m January +0.2% -0.8%

09:30 United Kingdom Retail prices, Y/Y January +1.6% +1.2% +1.1%

09:30 United Kingdom RPI-X, Y/Y January +1.7% +1.2%

09:30 United Kingdom Producer Price Index - Input (YoY) January -11.6% Revised From -0.3% -14.2%

09:30 United Kingdom Producer Price Index - Input (MoM) January -3.3% Revised From -2.4% -2.1% -3.7%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.5% Revised From -0.3% -0.2% -0.5%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.1% Revised From -0.8% -1.8%

09:30 United Kingdom HICP, m/m January 0.0% -0.9%

09:30 United Kingdom HICP, Y/Y January +0.5% +0.3% +0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January +1.3% +1.3% +1.4%

10:00 Eurozone ZEW Economic Sentiment February 45.2 51.3 52.7

10:00 Eurozone ECOFIN Meetings

10:00 Germany ZEW Survey - Economic Sentiment February 48.4 56.2 53.0

The U.S. dollar traded mixed to lower against the most major currencies ahead the U.S. economic data. The NY Fed Empire State manufacturing index is expected to decline to 9.1 in February from 10.0 in January.

The NAHB housing market index is expected to climb to 58 in February from 57 in January.

The euro traded higher against the U.S. dollar after the positive ZEW economic sentiment data. Germany's ZEW economic sentiment index increased to 53.0 in February from 48.4 in January, but missing expectations for a rise to 56.2. That was the highest reading since February 2014.

The increase was driven by quantitative easing by the European Central Bank and the better-than-expected economic data from the Eurozone.

Eurozone's ZEW economic sentiment index rose to 52.7 in February from 45.5 in January, beating expectations for a gain to 51.3.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound traded mixed against the U.S. dollar after the consumer price inflation data from the U.K. The U.K. consumer price index declined to 0.3% in January from 0.5% in December, in line with expectations. That was the lowest level since 1989.

The drop was driven by lower fuel and food prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% in January from 1.3% the month before.

The Retail Prices Index declined to 1.1% in January from 1.6% in December.

The Swiss franc rose against the U.S. dollar ahead the speech by the Swiss National Bank President Jordan.

The Canadian dollar increased against the U.S. dollar ahead of foreign securities purchases from Canada. Foreign securities purchases in Canada are expected to rise by C$5.35 billion in December, after a C$4.29 increase in November.

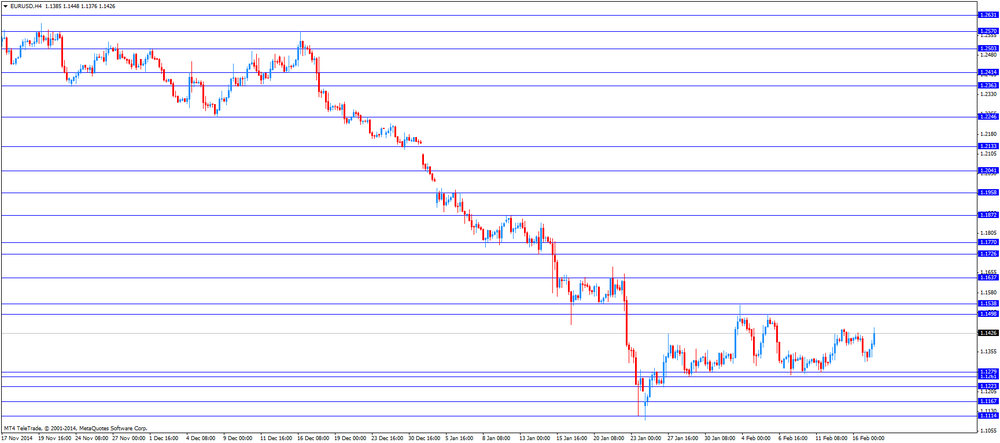

EUR/USD: the currency pair rose to 1.1448

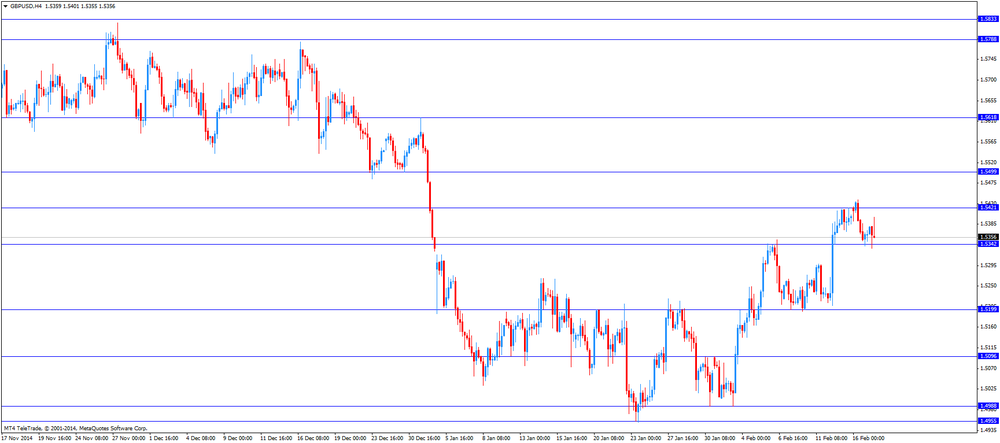

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y118.93

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases December 4.29 5.35

13:30 U.S. NY Fed Empire State manufacturing index February 10.0 9.1

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. NAHB Housing Market Index February 57 58

17:00 Switzerland SNB Chairman Jordan Speaks