- Foreign exchange market. European session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

Noticias del mercado

Foreign exchange market. European session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 New Zealand Credit Card Spending February +6.2% +5.8%

02:10 Australia RBA's Governor Glenn Stevens Speech

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2% +0.1%

07:00 Germany Producer Price Index (YoY) February -2.2% -2.1%

09:00 Eurozone Current account, adjusted, bln January 22.5 Revised From 17.8 21.3 29.4

09:00 Eurozone Current account, unadjusted, bln January 35.2 Revised From 29.2 8.2

09:30 United Kingdom PSNB, bln February -8.9 Revised From -9.7 7.7 6.2

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -1.8% Revised From -2.0% -0.3% -1.7%

12:30 Canada Retail Sales YoY January +4.0% +1.2%

12:30 Canada Retail Sales ex Autos, m/m January -2.0% Revised From -2.3% +0.1% -1.8%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7% +0.9%

12:30 Canada Consumer price index, y/y February +1.0% +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5% +0.6%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2% +2.1%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic data from the U.S.

The euro traded higher against the U.S. dollar as Greece and the European Union has agreed to implement a new reform plan.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded higher against the U.S. dollar after the better-than-expected public sector net borrowing data from the U.K. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February.

The consumer price index was driven by price increases in seven of the index's eight major components.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

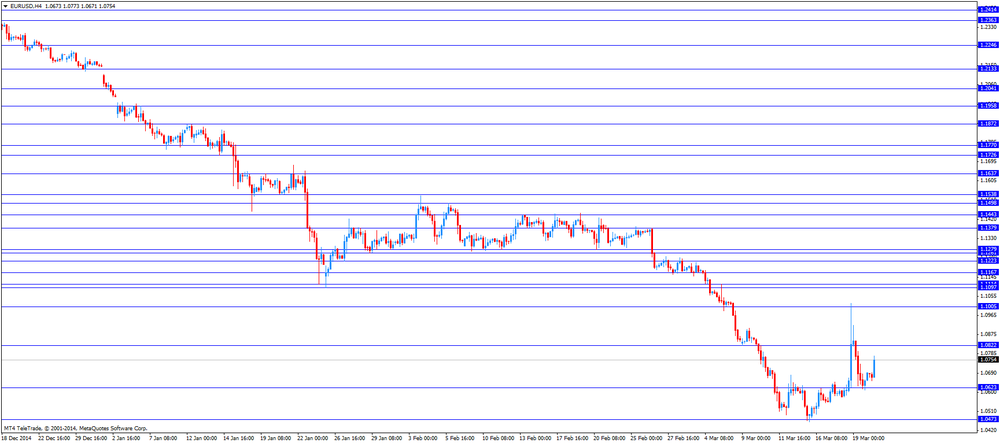

EUR/USD: the currency pair rose to $1.0773

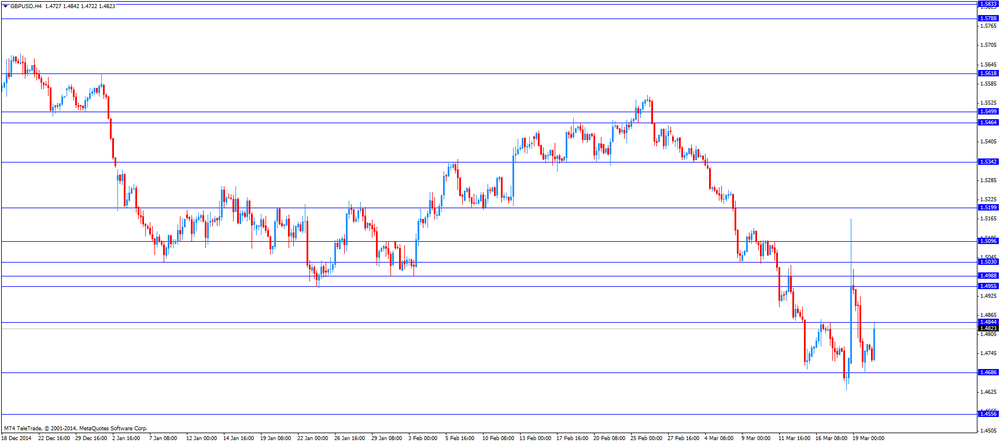

GBP/USD: the currency pair increased to $1.4842

USD/JPY: the currency pair climbed to Y121.19

The most important news that are expected (GMT0):

14:20 U.S. FOMC Member Dennis Lockhart Speaks