- Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current March 50.1 50.9 52.2

05:00 Japan Eco Watchers Survey: Outlook March 53.2 53.4

06:00 Germany Factory Orders s.a. (MoM) February -2.6% Revised From -3.9% 1.5% -0.9%

06:00 Germany Factory Orders n.s.a. (YoY) February -0.3% Revised From -0.1% -1.3%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln February -3.7 -3.8 €-3.44B

07:15 Switzerland Consumer Price Index (MoM) March -0.3% 0.1% 0.3%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% -1.0% -0.9%

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February 0.9% Revised From 1.1% -0.1% -0.2%

09:00 Eurozone Retail Sales (YoY) February 3.2% Revised From 3.7% 3.0%

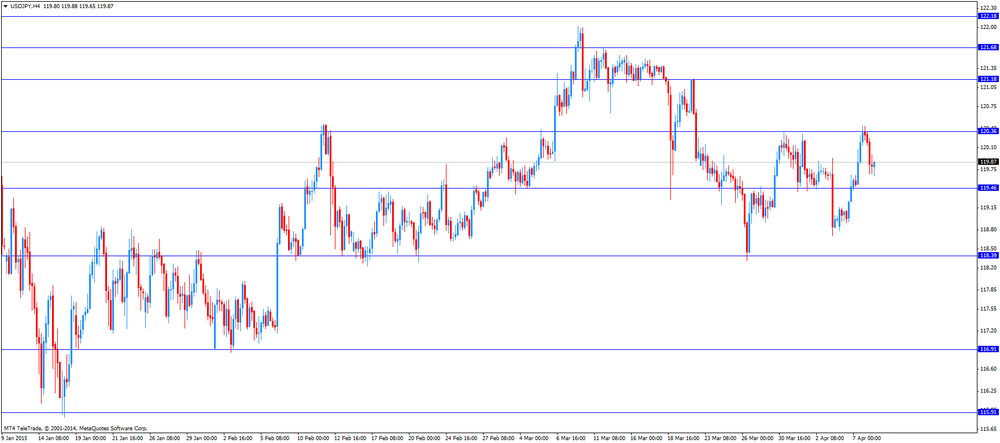

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's March monetary policy meeting minutes later in the day. Investors hope to get insight how the Fed plans to tighten its monetary policy. The central bank may start to hike its interest rate in June. It is unclear how the Fed want to raise its interest rate.

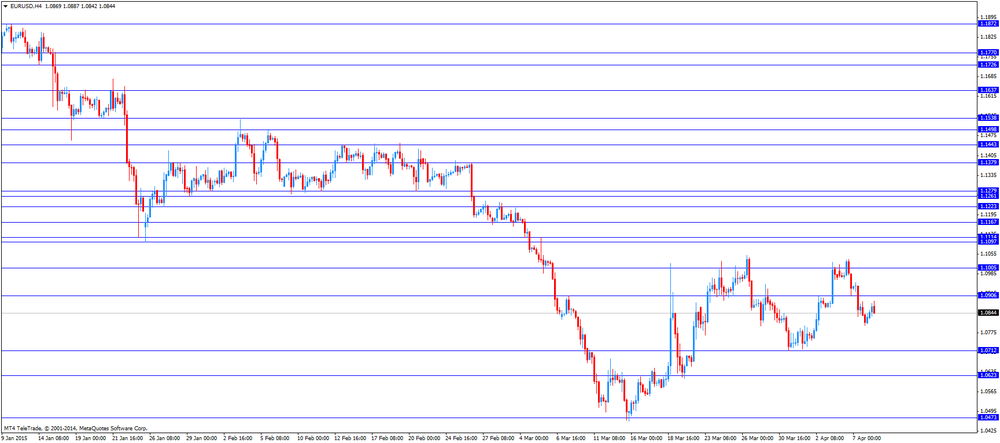

The euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone. Retail sales in the Eurozone fell 0.2% in February, missing expectations for a 0.1% decrease, after a 0.9% gain in January. January's figure was revised down from a 1.1% rise.

The decline was driven by lower gasoline sales and lower sales of food and drinks.

On a yearly basis, retail sales in the Eurozone rose 3.0% in February, after a 3.2% increase in January. January's figure was revised down from a 3.7% gain.

German seasonal adjusted factory orders decreased 0.9% in February, missing expectations for a 1.5% increase, after a 2.6% drop in January. January's figure was revised up from a 3.9% decline.

Concerns over Greece's debt problems continue to weigh on the euro. Greek Prime Minister Alexis Tsipras will meet Russian President Vladimir Putin in Moscow today.

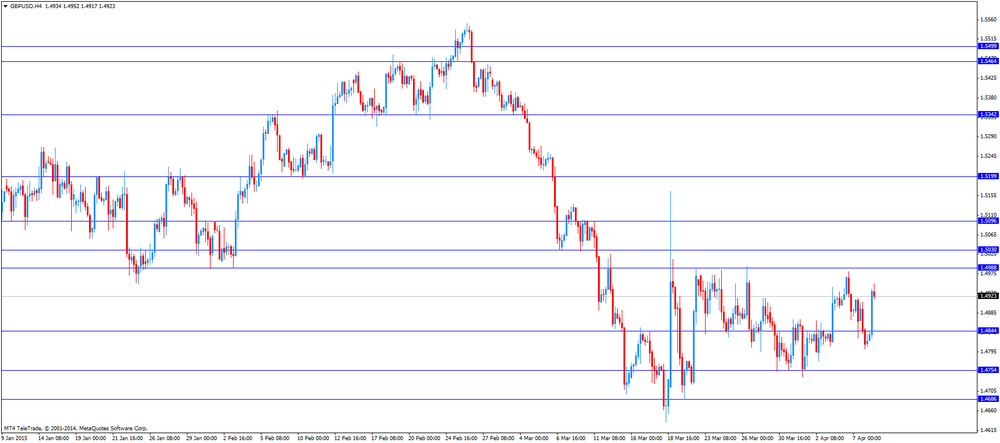

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected consumer price inflation from Switzerland. Switzerland's consumer price index rose 0.3% in March, exceeding expectations for a 0.1% rise, after a 0.3% decline in February.

The rise was driven by higher prices for clothing, petroleum products and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.9% in March from -0.8% in February, beating expectations for a drop to -1.0%. It was the lowest level since June 2012.

EUR/USD: the currency pair rose to $1.0887

GBP/USD: the currency pair increased to $1.4952

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. FOMC Member Dudley Speak

18:00 U.S. FOMC meeting minutes