- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the economic data from Germany

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:50 Japan Monetary Policy Meeting Minutes

03:00 China Trade Balance, bln April 3.08 39.45 34.13

03:30 Australia RBA Monetary Policy Statement

07:45 Switzerland Unemployment Rate (non s.a.) April 3.4% 3.3% 3.3%

08:00 France Bank holiday

08:00 Germany Current Account March 16.6 27.9

08:00 Germany Industrial Production s.a. (MoM) March 0.0% Revised From 1.4% 0.4% -0.5%

08:00 Germany Industrial Production (YoY) March -0.3% 0.1%

08:00 Germany Trade Balance March 19.2 19.7 23.0

09:00 United Kingdom Halifax house price index 3m Y/Y April 8.1% 7.8% 8.5%

09:00 United Kingdom Halifax house price index April 0.6% Revised From 0.4% 0.4% 1.6%

09:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1% -0.2%

09:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.9% -1.1%

10:30 United Kingdom Total Trade Balance March -3.318 Revised From -2.859 -2.95 -2.817

10:30 United Kingdom Trade in goods March -10.8 Revised From -10.3 -10.1

14:15 Canada Housing Starts April 189.5 Revised From 189.7 182 181.8

The U.S. dollar traded higher against the most major currencies ahead of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to decline to 5.4% in April from 5.5% in March. The U.S. economy is expected to add 224,000 jobs in April, after adding 126,000 jobs in March.

The euro traded higher against the U.S. dollar after the economic data from Germany. German industrial production dropped 0.5% in March, missing expectations for a 0.4% rise, after a flat reading in February. February's figure was revised down from a 1.4% increase.

Germany's seasonally adjusted trade surplus narrowed to €19.3 billion in March from €20.0 billion in February. February's figure was revised up from a surplus of €19.7 billion.

The Greek debt crisis still weighs on the euro.

The British pound traded lower against the U.S. dollar despite the better-than-expected economic data from the U.K. The U.K. trade deficit in goods narrowed to £10.1 billion in March from £10.8 billion in February. February's figure was revised down from a deficit of £10.3 billion.

The trade deficit fell as exports rose, while imports declined. Exports of goods climbed by 1.4% in March, while imports declined by 1.0%.

The U.K. Halifax house price index climbed 1.6% in April, exceeding expectations for a 0.4% gain, after a 0.6% rise in March. March's figure was revised up from a 0.4% increase.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to rise to 6.9% in April from 6.8% in March.

Canada's economy is expected to shed 5,000 jobs in April.

The Swiss dollar traded lower against the U.S. dollar after the weaker-than-expected consumer price inflation from Switzerland. Switzerland's consumer price index fell 0.2% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

The rise was driven by a stronger Swiss franc.

On a yearly basis, Switzerland's consumer price index declined to -1.1% in April from -0.9% in March.

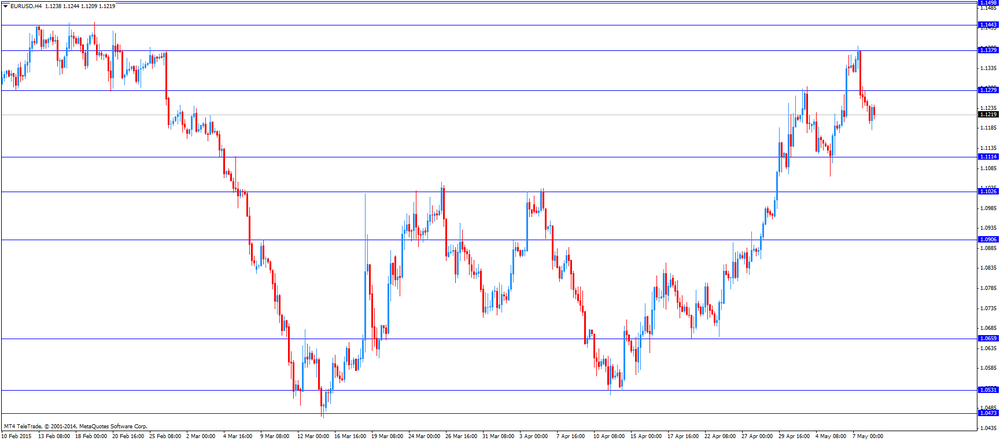

EUR/USD: the currency pair increased to $1.1245

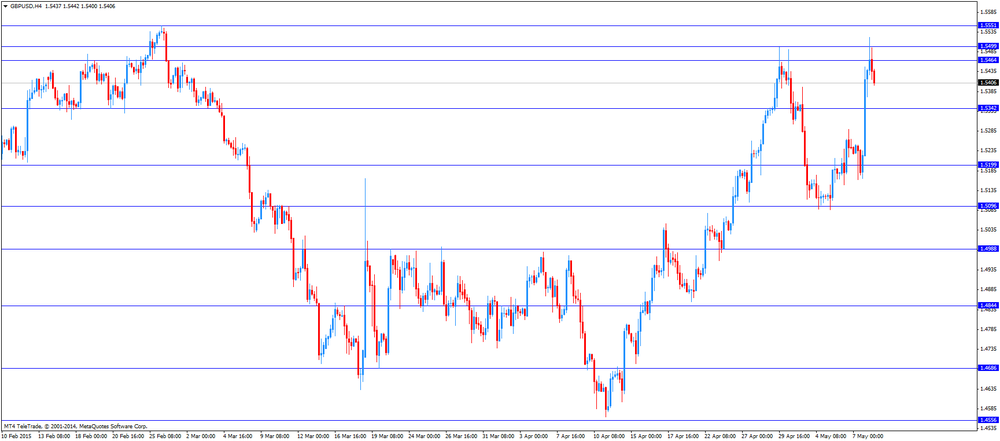

GBP/USD: the currency pair fell to $1.5400

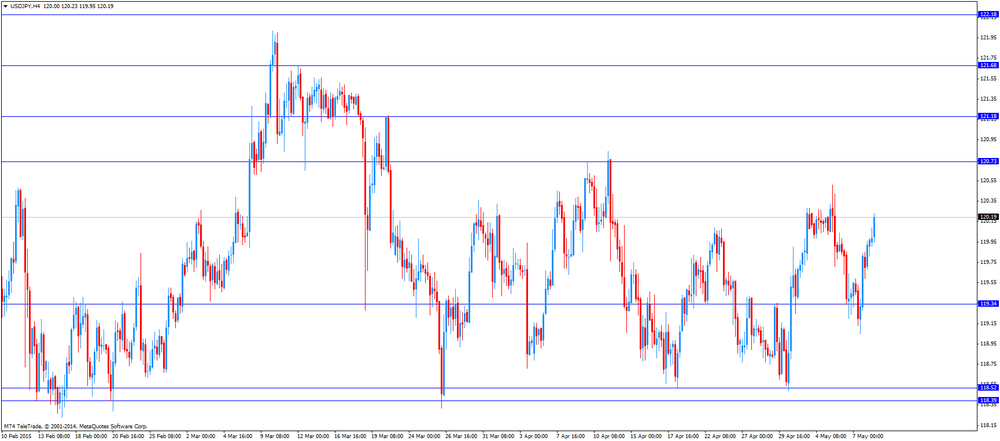

USD/JPY: the currency pair rose to Y120.23

The most important news that are expected (GMT0):

14:30 Canada Employment April 28.7 -5

14:30 Canada Unemployment rate April 6.8% 6.9%

14:30 U.S. Average hourly earnings April 0.3% 0.2%

14:30 U.S. Nonfarm Payrolls April 126 224

14:30 U.S. Unemployment Rate April 5.5% 5.4%