- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks

Noticias del mercado

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 6.4% -6.9%

02:50 Australia RBA's Governor Glenn Stevens Speech

06:45 France Industrial Production, m/m April 0.0% Revised From -0.3% 0.4% -0.9%

06:45 France Industrial Production, y/y April 1.3% 1.1%

08:30 United Kingdom Industrial Production (MoM) April 0.6% Revised From 0.5% 0.1% 0.4%

08:30 United Kingdom Industrial Production (YoY) April 1.1% Revised From 0.7% 0.6% 1.2%

08:30 United Kingdom Manufacturing Production (MoM) April 0.4% 0.1% -0.4%

08:30 United Kingdom Manufacturing Production (YoY) April 1.2% Revised From 1.1% 0.4% 0.2%

11:00 U.S. MBA Mortgage Applications June -7.6% 8.4%

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports from the U.S. today.

The euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks. The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, the new proposal was insufficient.

Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel and French President François Hollande later in the day.

Higher yields of the European governments bonds supported the euro. German government bonds hit the 1% barrier due to a selloff in bonds markets. It was the highest levels since September 2014.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

The British pound traded higher against the U.S. dollar after the mixed economic data from the U.K. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

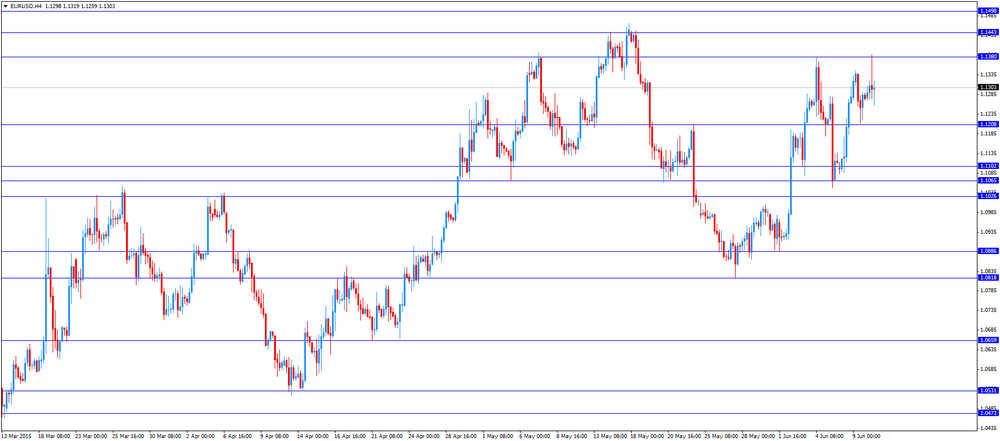

EUR/USD: the currency pair decreased to $1.1259

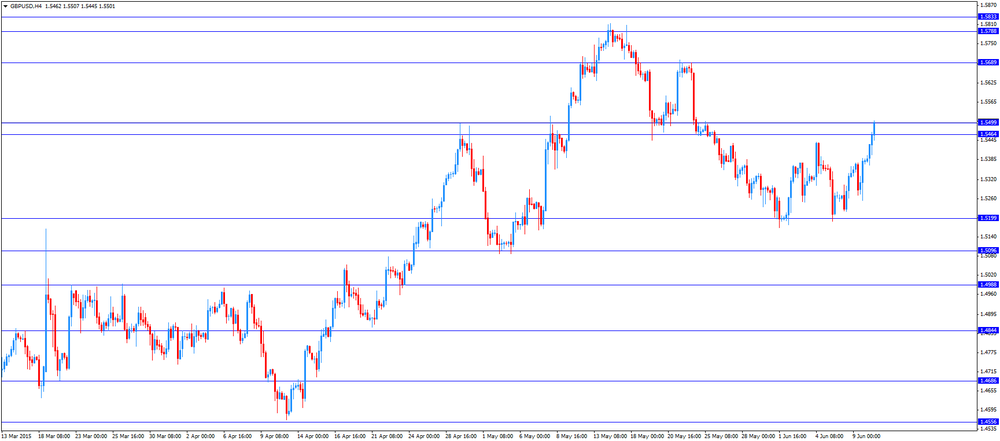

GBP/USD: the currency pair rose to $1.5507

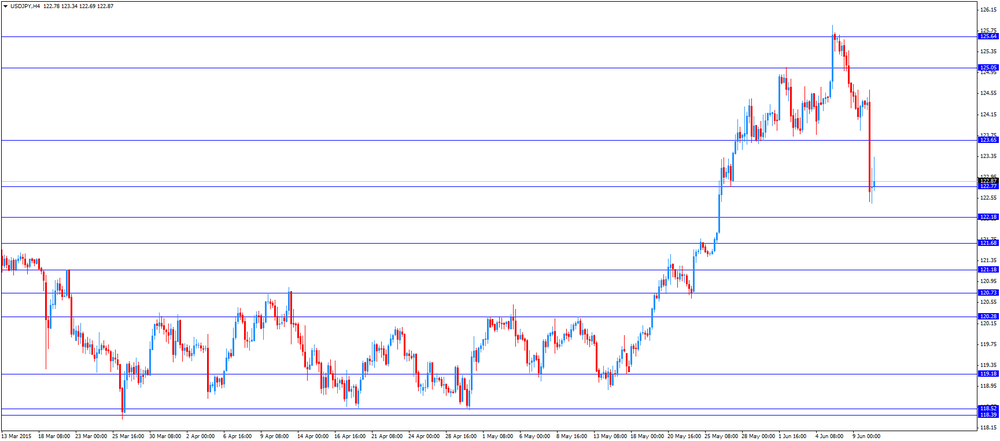

USD/JPY: the currency pair fell to Y122.45

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May 0.4%

18:00 U.S. Federal budget May 157 -98

20:00 United Kingdom BOE Gov Mark Carney Speaks

21:00 New Zealand RBNZ Interest Rate Decision 3.5% 3.5%

21:00 New Zealand RBNZ Rate Statement

21:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter II 2.4