- Foreign exchange market. Asian session: U.S. dollar muted ahead of Fed benchmark rate decision

Noticias del mercado

Foreign exchange market. Asian session: U.S. dollar muted ahead of Fed benchmark rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May 0.1% -0.1%

The U.S. dollar has had a flat start today with most major currencies as investors await the result of the Federal Open Market Committee meeting. The liftoff is not expected to take place today so traders will listen carefully to comments made after the meeting. Fed Chair Janet Yellen will speak after the announcement of the rate decision. Particular attention will be paid to the median forecast for the funds rate over the current year.

The euro has slightly fallen amid ongoing uncertainty about Greece. Market participants are waiting for news on Greece when the euro zone finance ministers meet on Thursday. Today traders will pay attention to Eurozone inflation data 09:00 GMT and Fed interest rate decision 18:00 GMT.

The pound has given up a little bit of its gains. However today news background is strong and lack of motion in the morning might mean that the currency is waiting for a storm. Yesterday data showed that the Harmonized index of consumer prices confirmed expectations and rose by 0.2% m/m and 0.1% y/y in May.

The Australian dollar fell to 0.7720. Westpac Leading Index for May came in at -0.12%. Westpac said that the country is likely to see even lower rates.

The New Zealand dollar slightly shifted down to 0.6968.

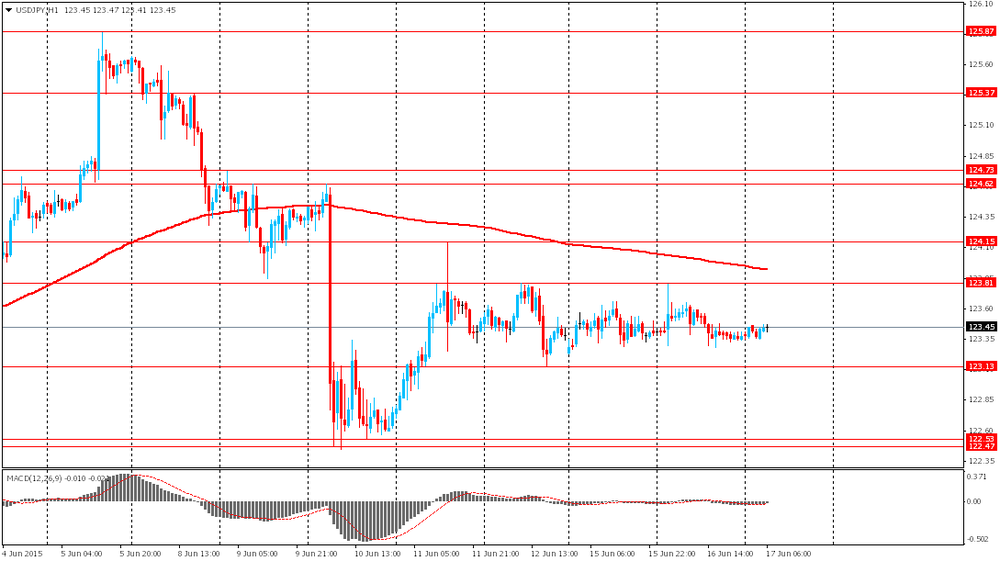

The Japanese yen has declined slightly against the U.S. dollar. The Finance Ministry reported Wednesday that the deficit in May was 216 billion yen ($1.7 billion), compared with 917.2 billion yen a year earlier. At the same time, it expanded compared to the 55.8 billion yen deficit recorded in April.

EUR/USD: the dollar is muted ahead of Fed interest rate decision

USD/JPY: the U.S. dollar slightly gained against the yen.

GBP/USD: the pound is steady waiting for news.

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% 2.5%

08:30 United Kingdom Average Earnings, 3m/y April 1.9% 2.1%

08:30 United Kingdom ILO Unemployment Rate April 5.5% 5.5%

08:30 United Kingdom Claimant count May -12.6 -12.3

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI May 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y May 0.0% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May 0.6% 0.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June -0.1

12:30 Canada Wholesale Sales, m/m April 0.8% 0.3%

14:30 U.S. Crude Oil Inventories June -6.812 -1.8

17:45 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP y/y Quarter I 3.5% 3.1%

22:45 New Zealand GDP q/q Quarter I 0.8% 0.6%

23:05 United Kingdom BOE Quarterly Bulletin