- Foreign exchange market. Asian session: Fed statement weighed on the dollar

Noticias del mercado

Foreign exchange market. Asian session: Fed statement weighed on the dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

04:30 Switzerland SNB Financial Stability Report

06:00 Switzerland Trade Balance May 2.85 3.43

The U.S. dollar weakened against almost all major currencies after the Federal Open Market Committee left the key interest rate unchanged at 0.25%. Policymakers hinted that rates can stay below levels that are considered normal for quite a while even if inflation and employment approach their target levels. The Fed's median near-term interest-rate outlook was unchanged at 0.625%, but its median forecasts for year-end 2016 and 2017 declined by 0.25% to 1.625% and 2.875% respectively.

Despite concerns over Greece, the euro gained as the dollar weakened. Euro zone finance ministers will meet today.

The pound rose all the way to $1.5846 yesterday amid the weaker dollar and strong earnings data. It closed $1.5831 and is currently staying around this level.

The U.K. Office of National Statistics reported yesterday that the unemployment rate was 5.5% in April. The rate was in line with expectations. Meanwhile average earnings except bonuses rose by 2.7% 3m/y in April vs 2.5% expected and 2.3% previous. At the same time average earnings rose by 2.7% 3m/y vs 2.1% expected and 2.3% previous.

The Australian dollar rose slightly yesterday. The AUD has started Thursday with declines.

The New Zealand dollar yesterday managed to close above its open level. Today, it has declined amid weak GDP data.

Statistics New Zealand reported that the country's Q1 GDP rose by 0.2% q/q, while an increase of 0.6% was expected after the 0.8% rise reported previously. On an annualized basis, it rose by 2.6% vs 3.1% expected and 3.5% previous.

The Japanese yen closed around its open level yesterday and it is getting stronger against the dollar today.

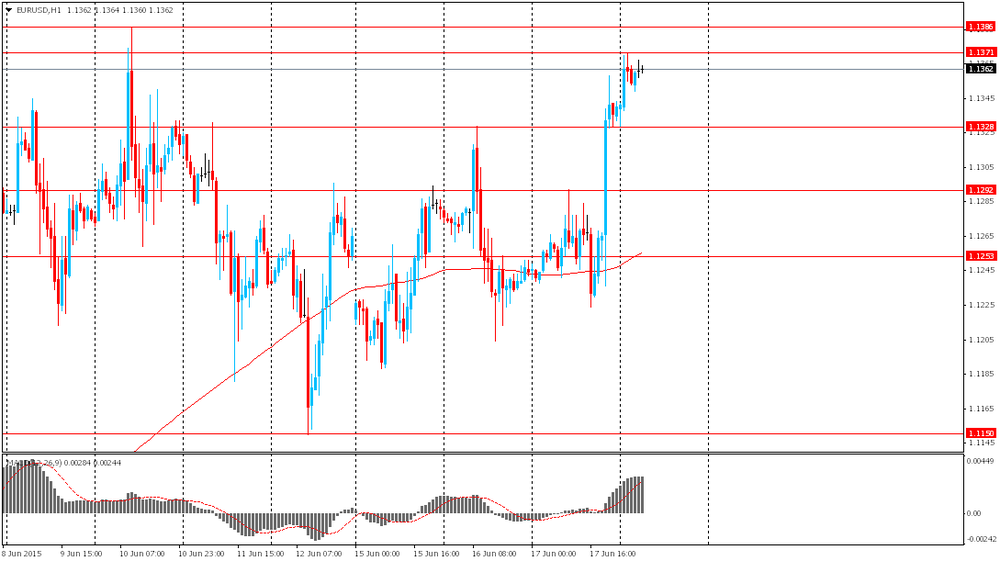

EUR/USD: the euro is extending gains.

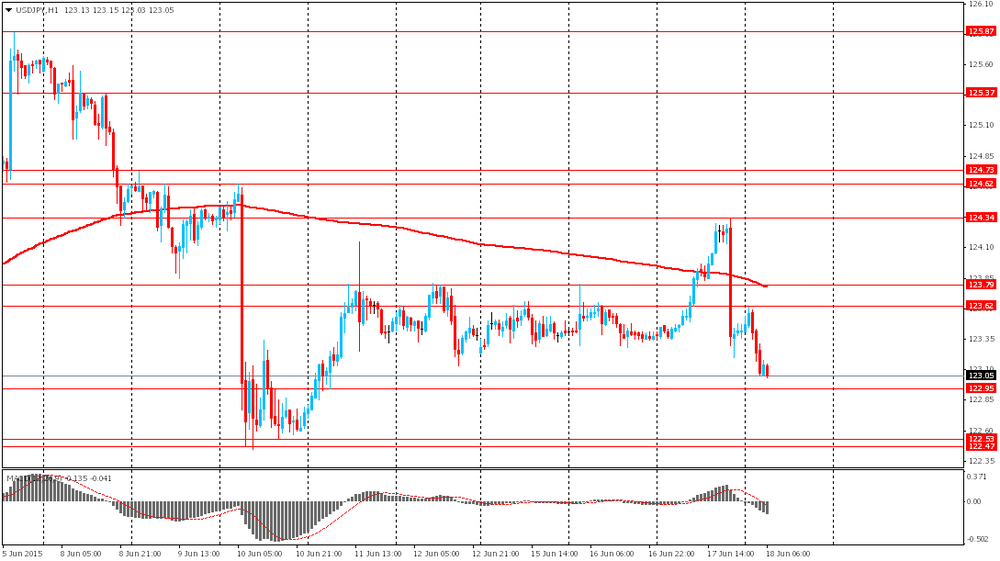

USD/JPY: the pair is heading down.

GBP/USD: the pound is taking breath after yesterday's rally.

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May 1.2% 0.0%

08:30 United Kingdom Retail Sales (YoY) May 4.7% 4.8%

09:00 Eurozone Eurogroup Meetings

09:15 Eurozone Targeted LTRO 97.8

12:30 U.S. Continuing Jobless Claims June 2265 2200

12:30 U.S. Initial Jobless Claims June 279 275

12:30 U.S. Current account, bln Quarter I -113.5 -117

12:30 U.S. CPI, m/m May 0.1% 0.5%

12:30 U.S. CPI, Y/Y May -0.2% 0.0%

12:30 U.S. CPI excluding food and energy, m/m May 0.3% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May 1.8% 1.8%

14:00 U.S. Leading Indicators May 0.7% 0.4%

14:00 U.S. Philadelphia Fed Manufacturing Survey