- Foreign exchange market. Asian session: the euro remains under pressure despite debt payments from Greece

Noticias del mercado

Foreign exchange market. Asian session: the euro remains under pressure despite debt payments from Greece

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:45 New Zealand Visitor Arrivals June 9.5% 9.2%

01:50 Japan Monetary Policy Meeting Minutes

03:30 Australia RBA Meeting's Minutes

The euro remained under pressure despite positive news from Athens. Sources reported that the European Central Bank and the International Monetary Fund had confirmed that they received payments from Greece. Yesterday Greece transferred €4.2 and over €2 billion to the ECB and the IMF respectively. Greece has also returned a loan of €500 million to its own central bank. Greece's banks reopened boosting risk appetite.

The New Zealand dollar rose against the U.S. dollar after New Zealand Prime Minister said that the New Zealand dollar's 25% decline to $0.6500 in the last twelve months was faster than expected. However growth of the NZD/USD pair is limited by low prices of dairy products and expectations of a 25 basis points rate cut by the RBNZ this week.

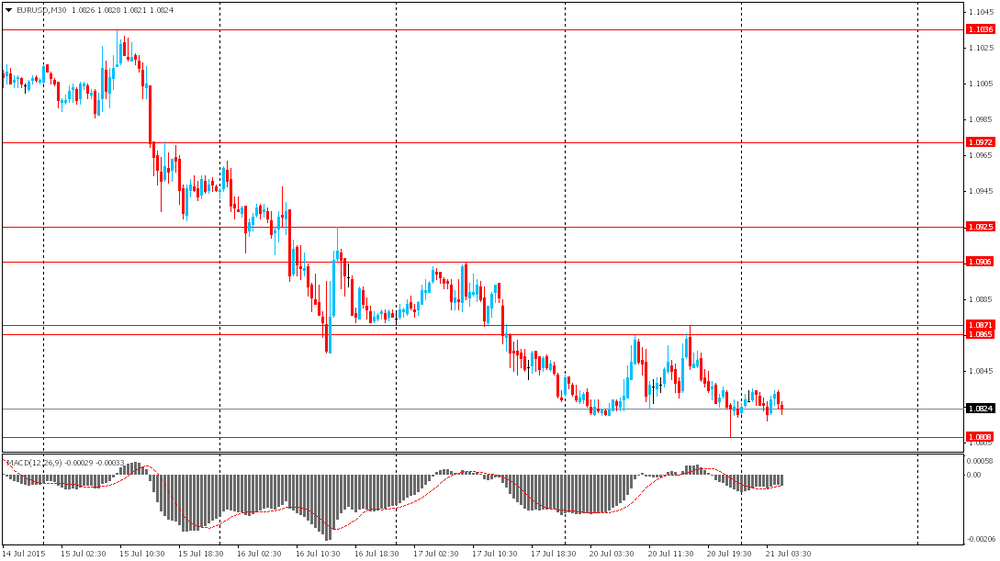

EUR/USD: the pair traded around $1.0815-35 in Asian trade

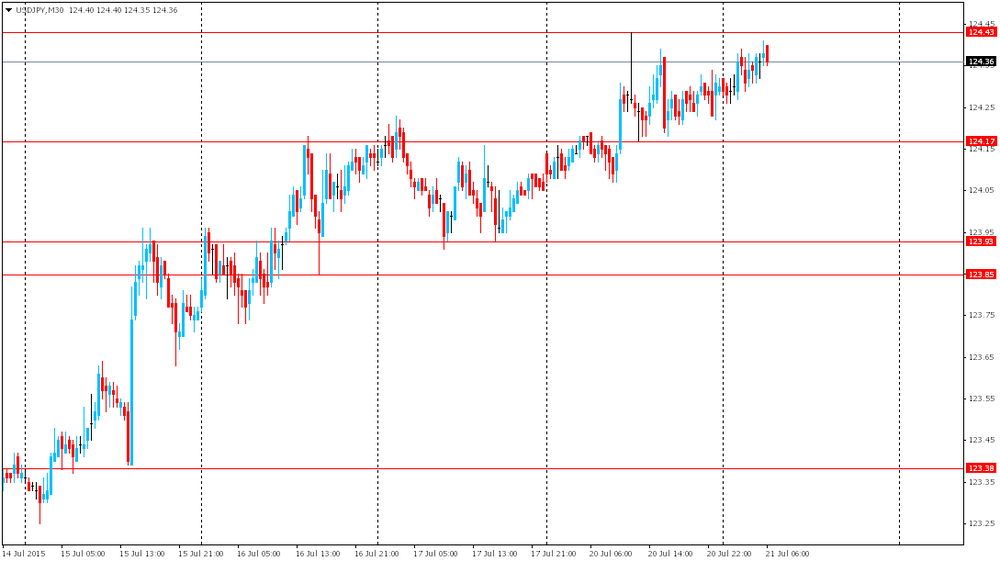

USD/JPY: the pair rose to Y124.40

GBP/USD: the pair traded around $1.5555-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland Trade Balance June 3.43

10:30 United Kingdom PSNB, bln June -9.35 -8.6

22:30 U.S. API Crude Oil Inventories July -0.95