- Oil prices decrease on concerns over the global oil oversupply

Noticias del mercado

Oil prices decrease on concerns over the global oil oversupply

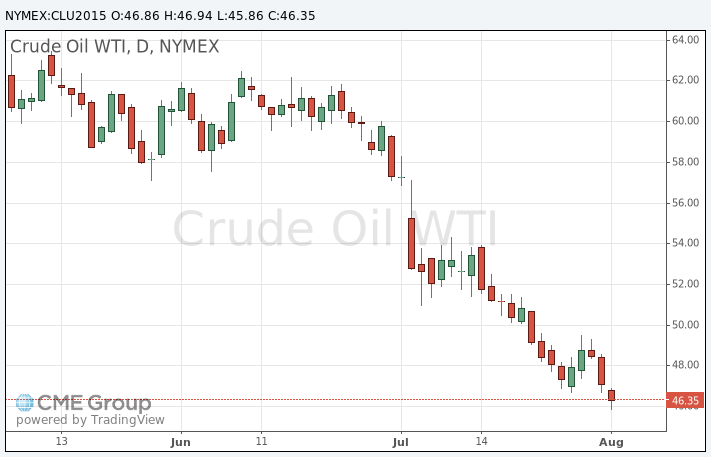

Oil prices decreased on concerns over the global oil oversupply. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 5 rigs to 664 last week. It was the second consecutive weekly increase.

Combined oil and gas rigs fell by 2 to 874.

The weaker-than-expected Chinese manufacturing data also weighed on oil prices. The Chinese manufacturing PMI declined to 50.0 in July from 50.2 in June. Analysts had expected the index to remain unchanged.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The index reflected the weakness in new orders and new export orders, employment and prices for materials.

"Both domestic and external manufacturing remain weak," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

WTI crude oil for September delivery decreased to $45.86 a barrel on the New York Mercantile Exchange.

Brent crude oil for September fell to $50.46 a barrel on ICE Futures Europe.