- Oil prices increase on a weaker U.S. dollar and due to profit taking

Noticias del mercado

Oil prices increase on a weaker U.S. dollar and due to profit taking

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

Concerns over the global oil oversupply still weigh on oil prices as OPEC continue to raise its oil output, and Iran may raise its oil output after reaching a nuclear deal.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

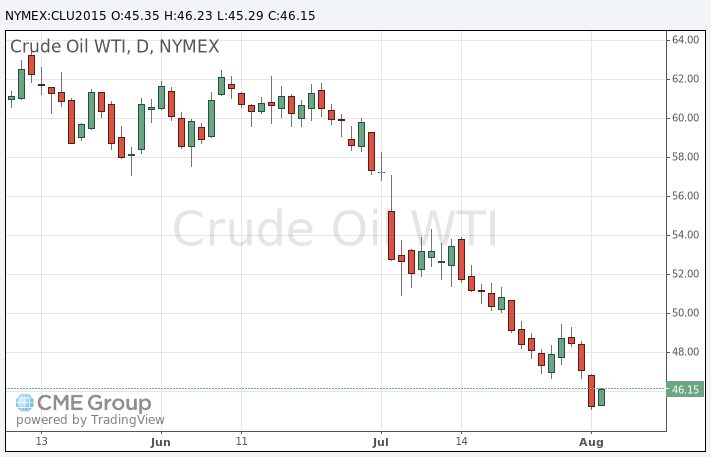

WTI crude oil for September delivery increased to $46.23 a barrel on the New York Mercantile Exchange.

Brent crude oil for September rose to $50.25 a barrel on ICE Futures Europe.