- WSE: Session Results

Noticias del mercado

WSE: Session Results

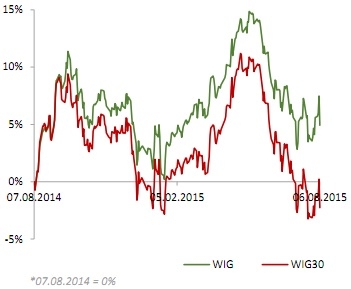

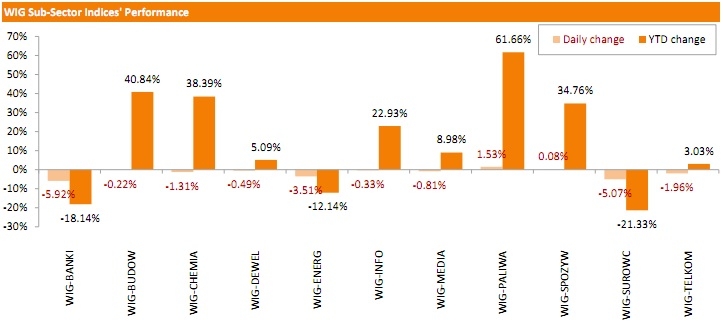

Polish equity market recorded a notable decline on Thursday. The broad market measure, the WIG Index, lost 2.38%. Sector-wise, banks fared the worst, slumping 5.92% on an amended draft law on Swiss franc mortgage conversion, suggesting that the lenders will have to pay 90% of the conversion cost. The best-performing group was oil and gas sector, gaining 1.53%.

The large-cap stocks' measure, the WIG30 Index, fell by 2.47%, dragged down by extremely weak performance of banking sector stocks, namely MBANK (WSE: MBK), PKO BP (WSE: PKO), BZ WBK (WSE: BZW), HANDLOWY (WSE: BHW) and PEKAO (WSE: PEO), which produced losses between 4.03% and 7.79%. In addition, significant declines were posted by PGE (WSE: PGE) and KGHM (WSE: KGH), which tumbled by 5.98% and 5.45% respectively. On the other side of the ledger, oil and gas name PKN ORLEN (WSE: PKN) recorded the strongest daily performance, soaring by 3.75%. It was followed by KERNEL (WSE: KER) and ASSECO POLAND (WSE: ACP), adding 0.90% and 0.50% respectively.