- Foreign exchange market. Asian session: the sterling climbed

Noticias del mercado

Foreign exchange market. Asian session: the sterling climbed

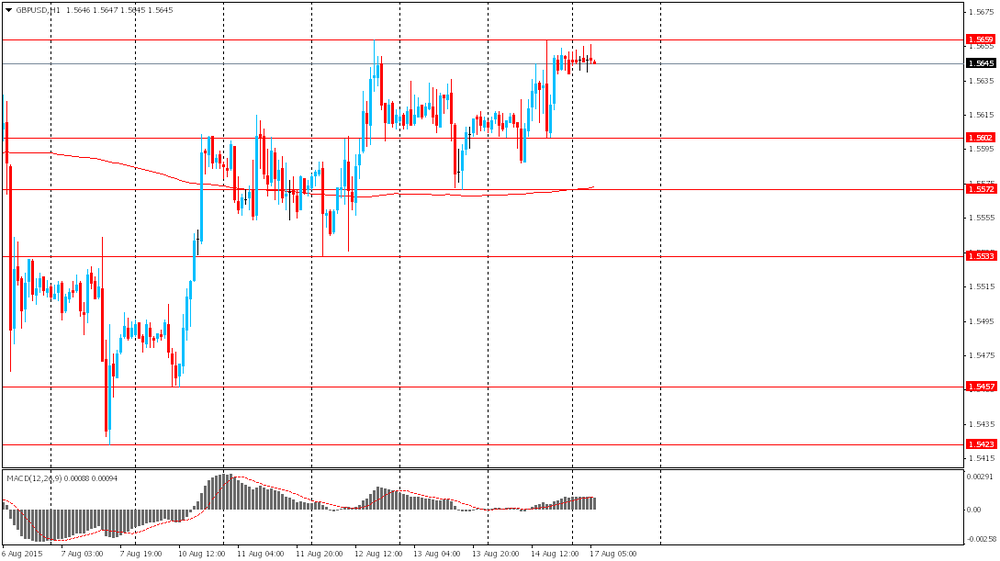

The pound rose against the U.S. dollar as weak consumer confidence data offset a favorable producer price report. Market volatility, which was caused by actions by the People's Bank of China, faded and investors focused on searching for clues on probability of a Fed rate hike in September. Market participants will also eye a report on UK consumer inflation. The corresponding index is expected to stay unchanged on a y/y basis in July amid falling oil prices and a stronger pound.

The euro weakened against the greenback despite positive news on Greece. On Friday finance ministers of the single currency area agreed to help Greece with €86 billion in the coming three years. The first tranche of €26 billion may be provided on August 19.

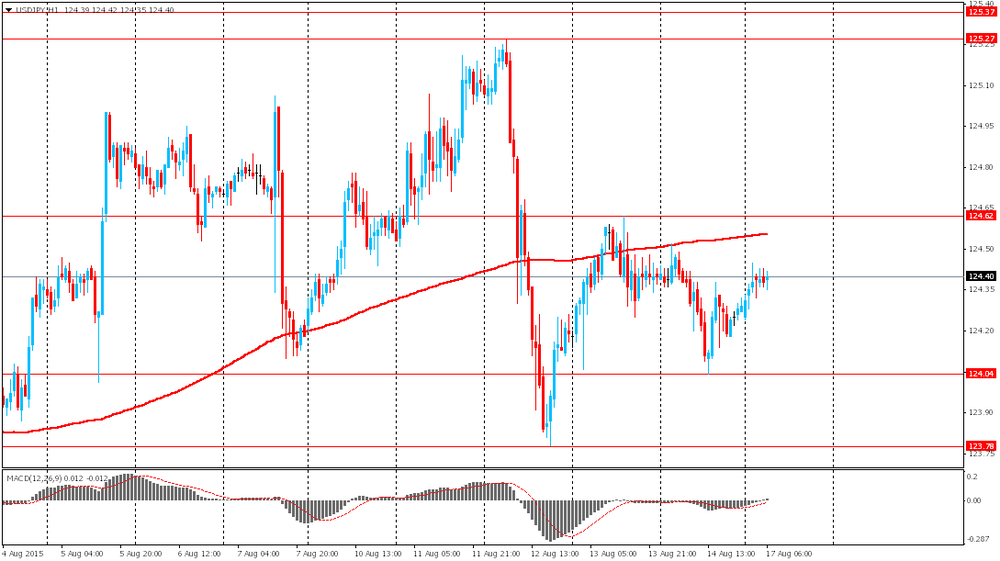

The yen fell slightly. Partly this decline was caused by the country's Q2 GDP report. Japanese economy contracted by 0.4% in the second quarter compared to a 1% gain reported previously. Nevertheless the reading was better than a decline of 0.5% expected by economists. On an annualized basis Japanese economy fell by 1.6% vs -1.9% expected.

A 0.8% decline in consumer spending contributed to this contraction.

EUR/USD: the pair declined to $1.1080 in Asian trade

USD/JPY: the pair rose to Y124.45

GBP/USD: the pair traded within $1.5640-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Retail Sales Y/Y June -1.8%

07:15 Switzerland Retail Sales (MoM) June -1.4%

09:00 Eurozone Trade balance unadjusted June 18.8

12:30 Canada Foreign Securities Purchases June -5.45

12:30 U.S. NY Fed Empire State manufacturing index August 3.86 5

14:00 U.S. NAHB Housing Market Index August 60 61

20:00 U.S. Net Long-term TIC Flows June 93.0

20:00 U.S. Total Net TIC Flows