- Foreign exchange market. Asian session: the Australian dollar weakened

Noticias del mercado

Foreign exchange market. Asian session: the Australian dollar weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia MI Inflation Gauge, m/m August 0.2% 0.1%

01:00 Australia HIA New Home Sales, m/m July 0.5% -0.4%

01:00 New Zealand ANZ Business Confidence August -15.3 -29.1%

01:30 Australia Private Sector Credit, m/m July 0.4% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y July 5.9% 6.1%

01:30 Australia Company Gross Profits QoQ Quarter II -0.3% Revised From 0.2% -2% -1.9%

05:00 Japan Construction Orders, y/y July 15.4% -4.0%

05:00 Japan Housing Starts, y/y July 16.3% 11% 7.4%

06:00 Germany Retail sales, real unadjusted, y/y July 5.1% 1.9% 3.3%

06:00 Germany Retail sales, real adjusted July -2.3% 1% 1.4%

The U.S. dollar advanced against major currencies. The greenback is supported by Fed officials' comments made at the Jackson Hole symposium at the end of the week. Fed Vice Chairman Stanley Fischer said that the case for a rate increase in September is not clear. He said that the central bank is on track to raise rates, but he noted he wasn't sure that September is the right time to act.

The Australian dollar declined against the U.S. dollar amid TD Securities inflation data. The corresponding consumer price index fell to 0.1% in August from 0.2% reported previously. The index came in at 1.7% y/y compared to 1.6% y/y in July. Official data are published once per quarter, that's why data by TD Securities are very important.

The New Zealand dollar fell against the greenback amid weak statistics. The ANZ business confidence index fell to a six-year low of -29.1 in August. In the previous month the index stood at -15.3. ANZ also warned investors that the pace of declines in the economy picked up.

Declines in Asian stocks boosted demand for the yen, thus allowing this currency to strengthen against the dollar. Meanwhile Japanese industrial production fell 0.6% in July missing expectations for a 0.1% reading. On an annualized basis it dropped to 0.2% from 2.3%.

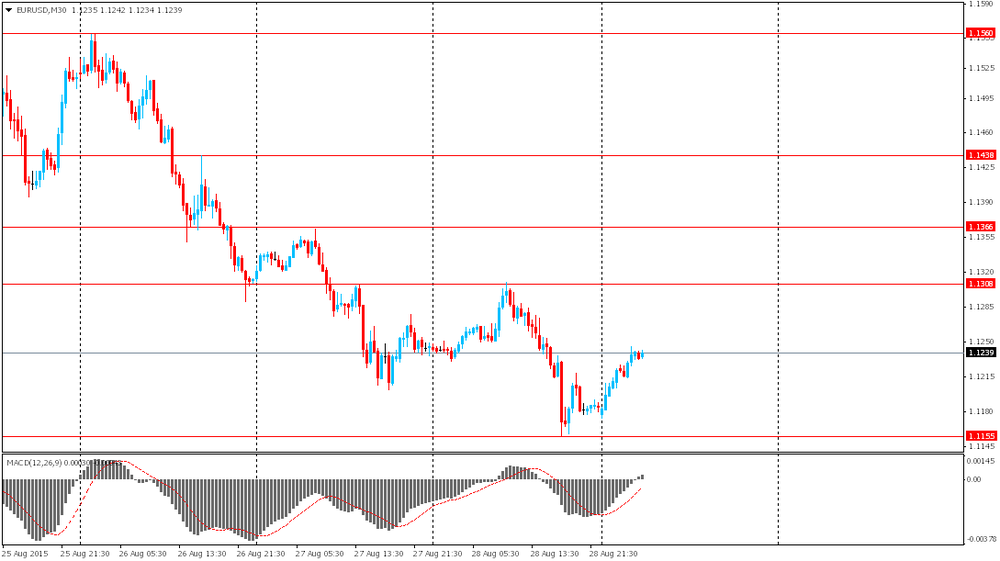

EUR/USD: the pair rose above $1.1250 in Asian trade

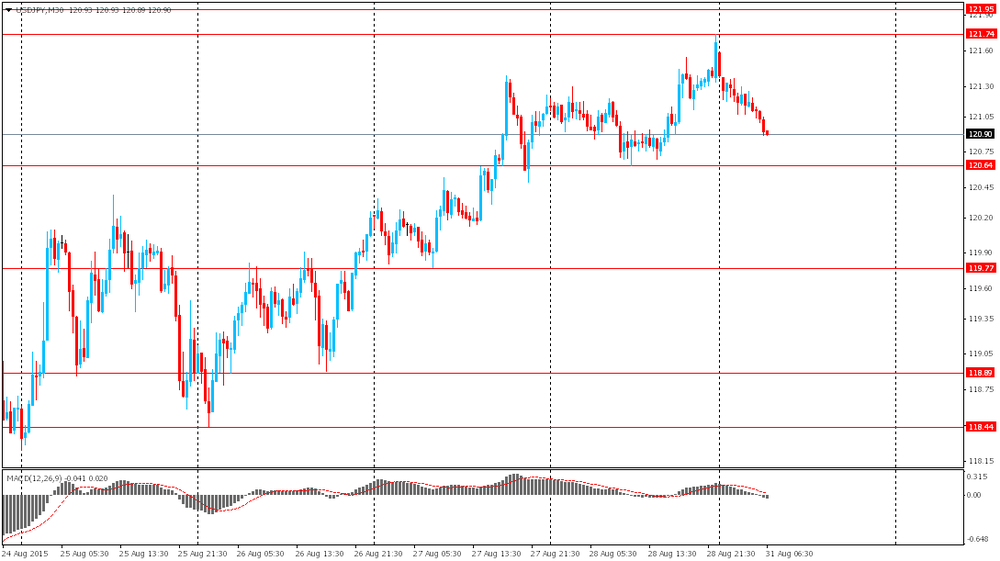

USD/JPY: the pair fell to Y120.85

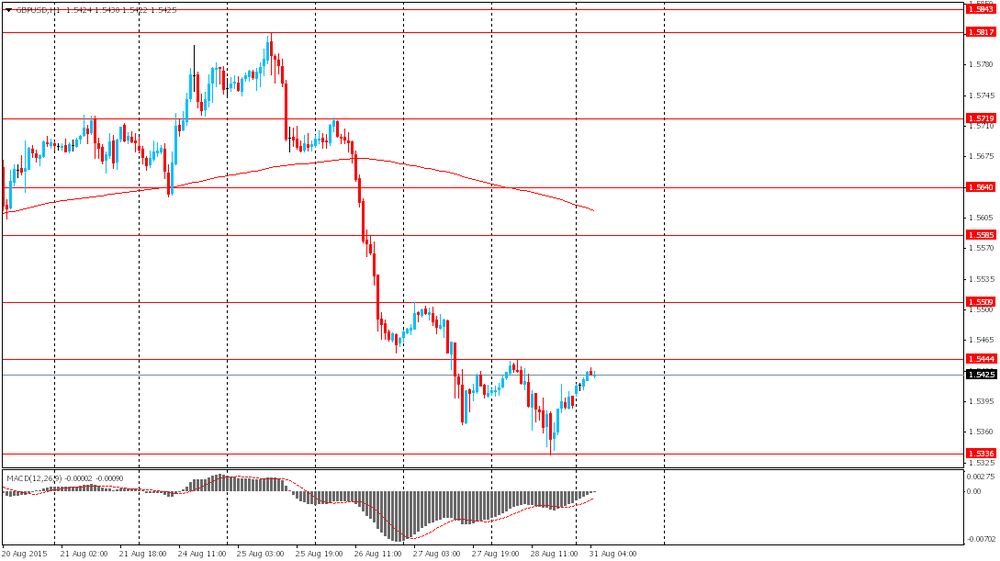

GBP/USD: the pair rose to $1.5435

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator August 99.8 99.5

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.1%

12:30 Canada Current Account, bln Quarter II -17.5

13:45 U.S. Chicago Purchasing Managers' Index August 54.7 54.9

23:30 Australia AIG Manufacturing Index August 50.4

23:50 Japan Capital Spending Quarter II 7.3% 9%