- Foreign exchange market. European session: the British pound showed a correction against the U.S. dollar after the last week’s significant decline

Noticias del mercado

Foreign exchange market. European session: the British pound showed a correction against the U.S. dollar after the last week’s significant decline

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia ANZ Job Advertisements (MoM) August -0.4% 1.0%

05:00 Japan Coincident Index (Preliminary) July 112.3 112.2

05:00 Japan Leading Economic Index (Preliminary) July 106.5 104.9

06:00 Germany Industrial Production s.a. (MoM) July -0.9% Revised From -1.4% 1% 0.7%

06:00 Germany Industrial Production (YoY) July 0.9% Revised From 1.0% 0.5%

07:00 Switzerland Foreign Currency Reserves August 531 Revised From 532 540

08:30 Eurozone Sentix Investor Confidence September 18.4 13.6

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for a public holiday on Monday.

The situation regarding the interest rate hike by the Fed remained unclear. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 13.6 in September from 18.4 in August. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The decline was driven by a slowdown in the Chinese economy.

"Investors now see the slowdown in China as well as in other emerging markets as a significant burden for the euro zone's economy, which can no longer be compensated by good developments in the domestic euro zone economy or the United States," Sentix said.

Destatis released its industrial production data for Germany on Monday. German industrial production rose 0.7% in July, missing expectations for a 1.0% gain, after a 0.9% decline in June. June's figure was revised up from a 1.4% drop.

The output of capital goods increased 2.8% in July, energy output climbed 1.9%, and the production in the construction sector was up 3.2%, while the production of intermediate goods fell 0.8%.

The output of consumer goods decreased 3.7%.

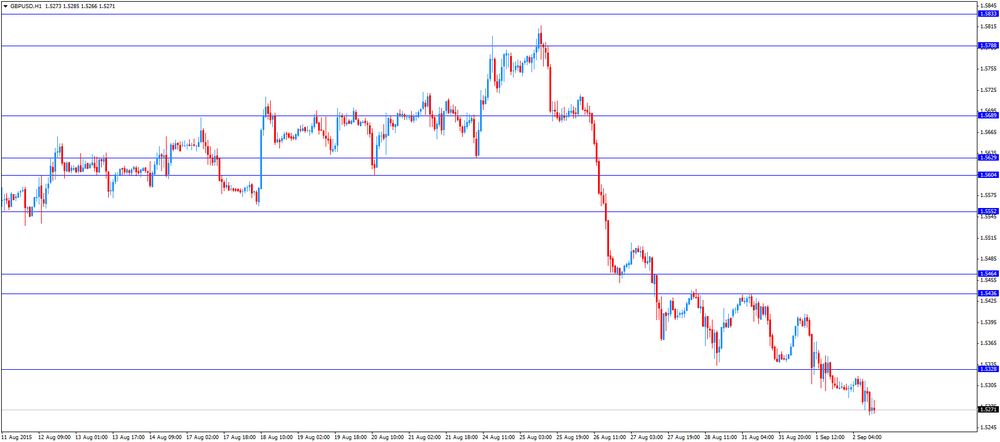

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

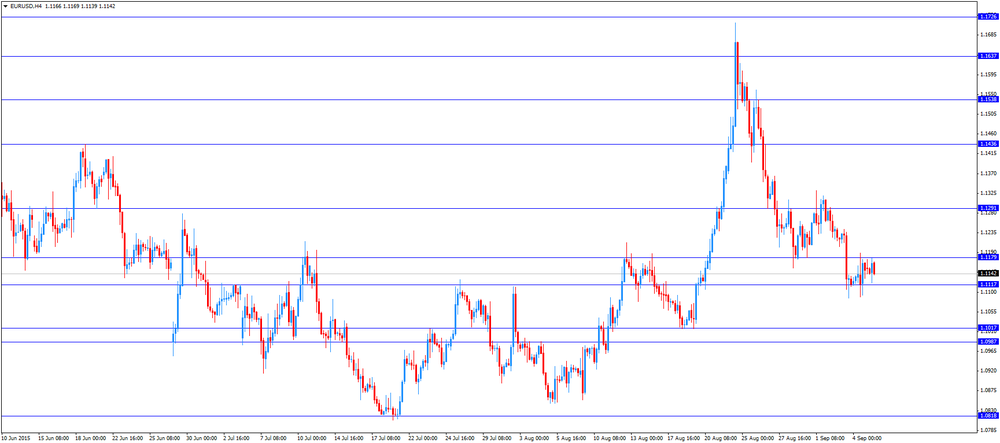

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5278

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

23:50 Japan GDP, q/q (Finally) Quarter II 1% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter II 3.9% -1.8%