- Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 4 1

02:00 China Trade Balance, bln August 43.03 48.2 60.24

05:00 Japan Eco Watchers Survey: Current August 51.6 49.3

05:00 Japan Eco Watchers Survey: Outlook August 51.9 48.2

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1% 3.2%

06:00 Germany Current Account July 24.4 23.4

06:00 Germany Trade Balance July 24.2 Revised From 24.1 25.0

06:45 France Trade Balance, bln July -2.76 Revised From -2.7 -3.3

09:00 Eurozone GDP (QoQ) (Revised) Quarter II 0.5% Revised From 0.4% 0.3% 0.4%

09:00 Eurozone GDP (YoY) (Revised) Quarter II 1.0% 1.2% 1.5%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The situation regarding the interest rate hike by the Fed remained unclear. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

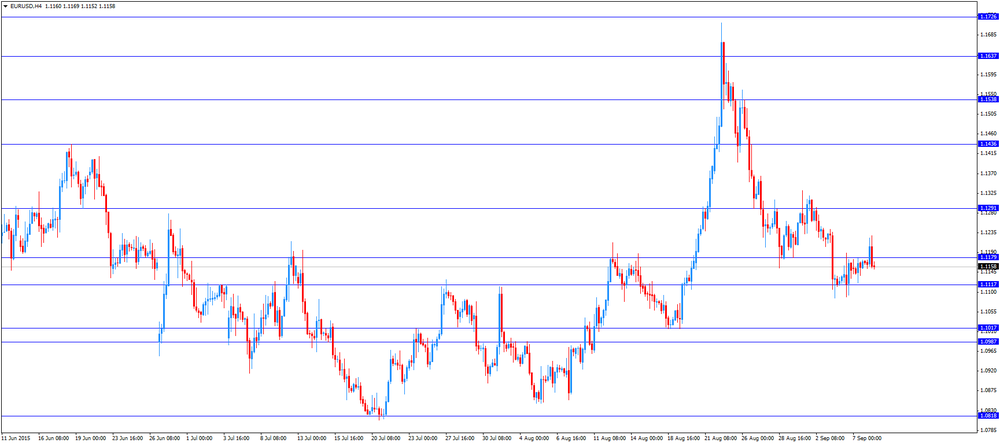

The euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone. Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

Eurostat released its revised GDP data today. Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

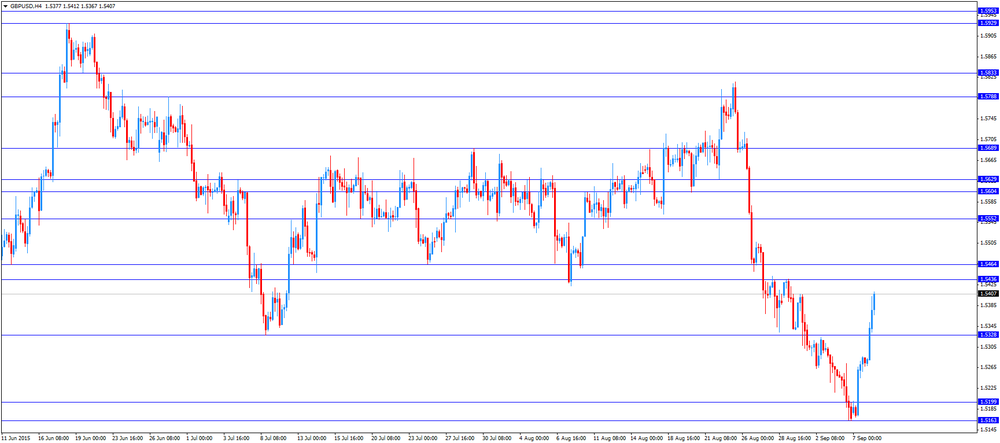

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

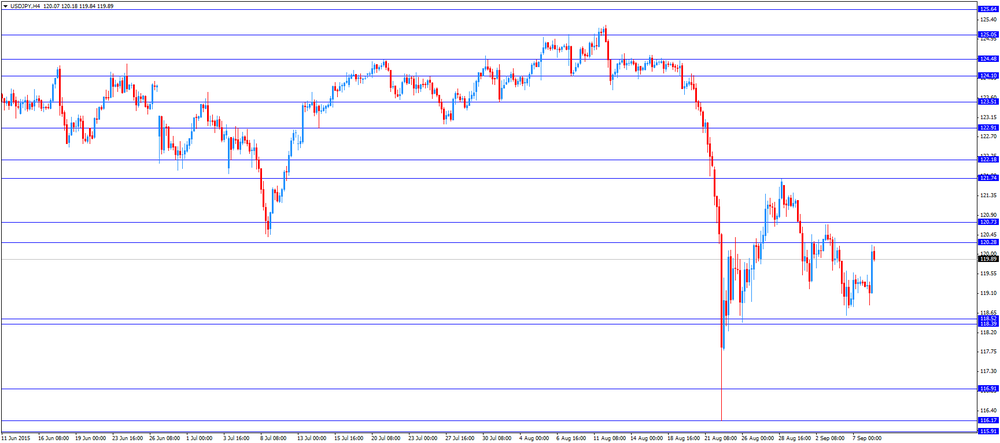

The Swiss franc traded lower against the U.S. dollar after the labour market data from Switzerland. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

EUR/USD: the currency pair fell to $1.1152

GBP/USD: the currency pair rose to $1.5412

USD/JPY: the currency pair increased to Y120.22

The most important news that are expected (GMT0):

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5