- Foreign exchange market. Asian session: the yen declined

Noticias del mercado

Foreign exchange market. Asian session: the yen declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Germany CPI, m/m (Finally) August 0.2% 0% 0.0%

06:00 Germany CPI, y/y (Finally) August 0.2% 0.2% 0.2%

The U.S. dollar traded with low volatility as declines in U.S. import prices had weighed on the greenback before the current session began. Lower import prices are likely to limit inflationary pressure further and justify more gradual tightening of Fed monetary policy. Market participants are waiting for producer price index data. A greater-than-expected decline in this index may weigh on the dollar in the short-term outlook. Economists expect a decline of 0.1% in August compared to an increase of 0.2% in the previous month.

The yen tends to decline against the greenback despite positive business sentiment data. The Business Sentiment Index, which is based on a survey of large Japanese manufacturers, rose to +11 in the third quarter from -6 reported previously. Japan economy minister Amari said that it is important for improvements in corporate sentiment to be reflected in capital expenditure.

The New Zealand dollar advanced slightly. The index of business activity in the industrial sector of the country's economy rose to 55.0 in August from 53.7 in July (revised from 53.5).

EUR/USD: the pair fluctuated within $1.1270-00 in Asian trade

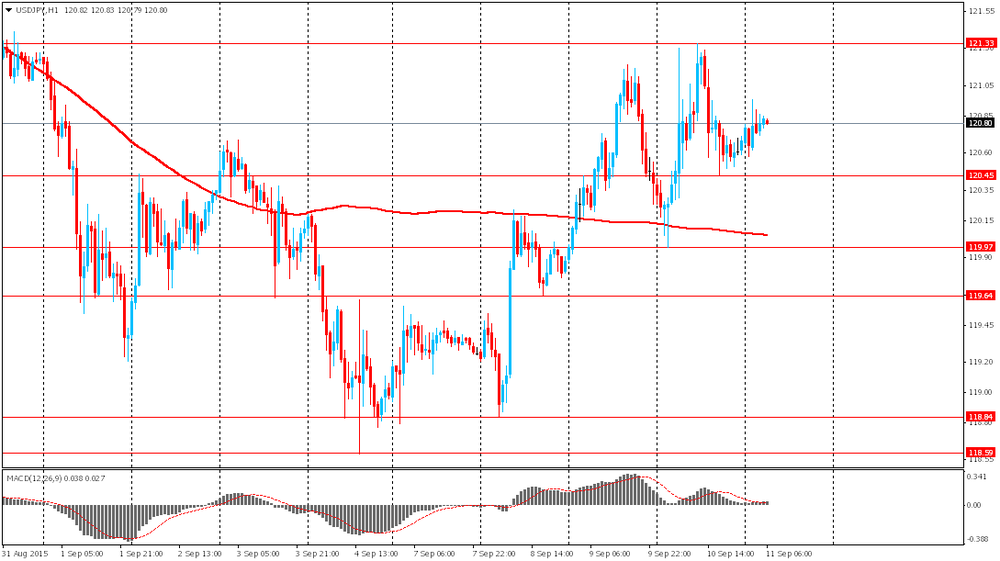

USD/JPY: the pair traded within Y120.55-95

GBP/USD: the pair rose to $1.5460

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone ECOFIN Meetings

11:30 United Kingdom MPC Member Forbes Speaks

12:30 U.S. PPI, m/m August 0.2% -0.1%

12:30 U.S. PPI, y/y August -0.8% -0.9%

12:30 U.S. PPI excluding food and energy, m/m August 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August 0.6% 0.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 91.9 91.2

18:00 U.S. Federal budget August -149.2 -81.5