- Foreign exchange market. European session: the Swiss franc traded higher against the U.S. dollar after the release of the Swiss National Bank’s interest rate decision

Noticias del mercado

Foreign exchange market. European session: the Swiss franc traded higher against the U.S. dollar after the release of the Swiss National Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

07:30 Switzerland SNB Monetary Policy Assessment

08:30 United Kingdom Retail Sales (MoM) August 0.1% 0.2% 0.2%

08:30 United Kingdom Retail Sales (YoY) August 4.1% Revised From 4.2% 3.8% 3.7%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Housing starts in the U.S. are expected to decline to 1.170 million units in August from 1.206 million units in July.

The number of building permits is expected to rise to 1.160 million units in August from 1.130 million units in July.

The number of initial jobless claims in the U.S. is expected to remain unchanged at 275,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to decrease to 6.0 in September from 8.3 in August.

The Fed will release its interest rate decision at 18:00 GMT.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar after the mixed U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in August, in line with expectations, after a 0.1% rise in July.

The higher growth was partly driven by higher sales of clothing and footwear, which climbed 2.3% in August.

Food sales fell 0.9% in August.

On a yearly basis, retail sales in the U.K. climbed 3.7% in August, missing forecasts of 3.8% increase, after a 4.1% rise in July. July's figure was revised down from a 4.2% gain.

The Swiss franc traded higher against the U.S. dollar after the release of the Swiss National Bank's (SNB) interest rate decision. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market as the Swiss franc is significantly overvalued and effects inflation and economic growth.

Inflation was downgraded to -1.2% in 2015 from the previous forecast of -1.0% and to be -0.5% in 2016, down from the previous forecast -0.4%. The SNB upgraded to 0.4% in 2017, up from the previous forecast of 0.3%.

The central bank noted that the Swiss economy rose slightly in the second quarter, while employment declined further.

The SNB expects the Swiss economy to return to positive growth in the second half of 2015. Real GDP for 2015 is expected to be about 1%.

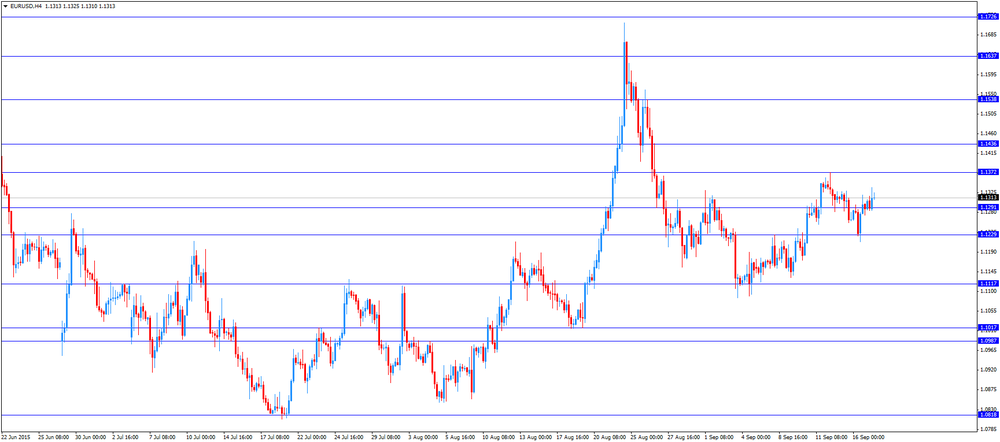

EUR/USD: the currency pair increased to $1.1337

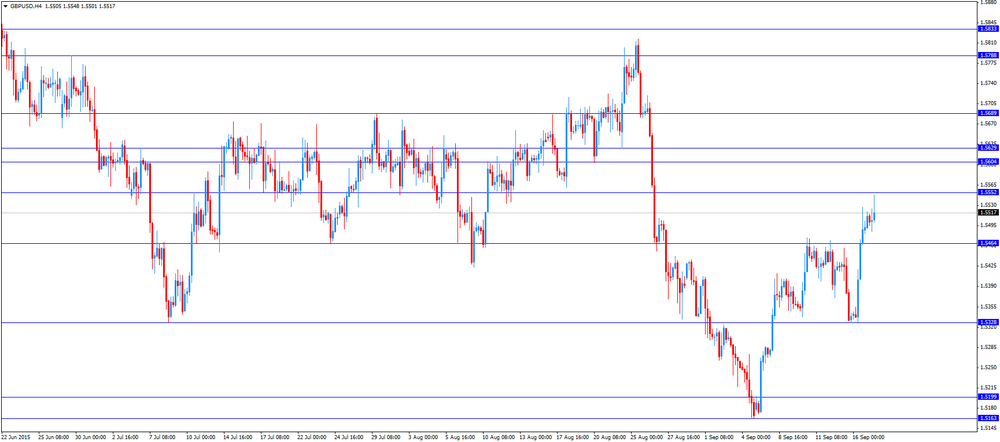

GBP/USD: the currency pair rose to $1.5548

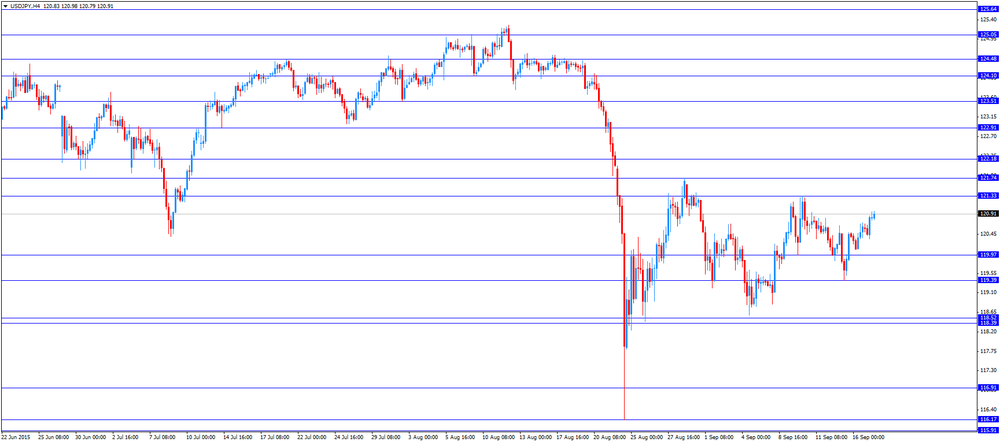

USD/JPY: the currency pair climbed to Y120.98

The most important news that are expected (GMT0):

12:30 U.S. Continuing Jobless Claims September 2260 2260

12:30 U.S. Current account, bln Quarter II -113.3 -111.3

12:30 U.S. Housing Starts August 1206 1170

12:30 U.S. Building Permits August 1130 1160

12:30 U.S. Initial Jobless Claims September 275 275

14:00 U.S. Philadelphia Fed Manufacturing Survey September 8.3 6.0

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Monetary Policy Meeting Minutes