- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Consumer confidence September 94 Revised From 93 94 97

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1% 1.0%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3% 4.8%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The final U.S. GDP is expected to rise 3.7% in the second quarter, after a 0.2% decline in the first quarter.

The preliminary U.S. services purchasing managers' index (PMI) is expected to decline to 55.6 in September from 56.1 in August.

The final Reuters/Michigan Consumer Sentiment Index is expected to drop to 86.7 in September from 91.9 in August.

The greenback was supported by yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.8% in August from last year, missing expectations for a 5.3% gain, after a 5.3 % increase in July.

Loans to the private sector in the Eurozone climbed 1.0% in August from the last year, missing expectations for a 1.1% rise, after a 0.9% gain in July.

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 97 in September from 94 in August. It was the highest level since October 2007.

August's figure was revised up from 93.

Analysts had expected the index to remain unchanged at 94.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

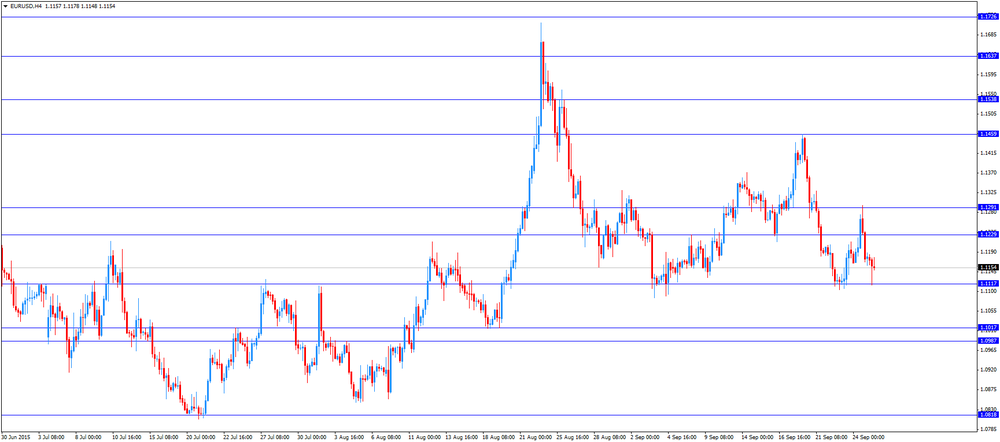

EUR/USD: the currency pair traded mixed

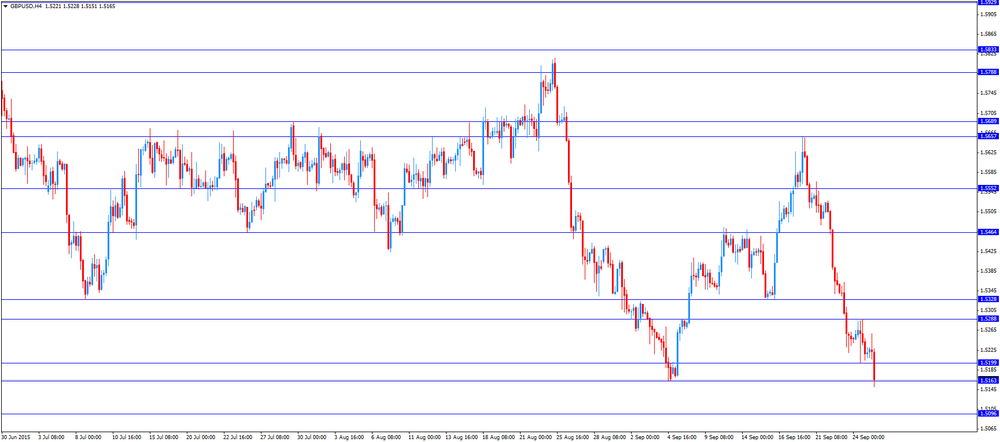

GBP/USD: the currency pair fell to $1.5151

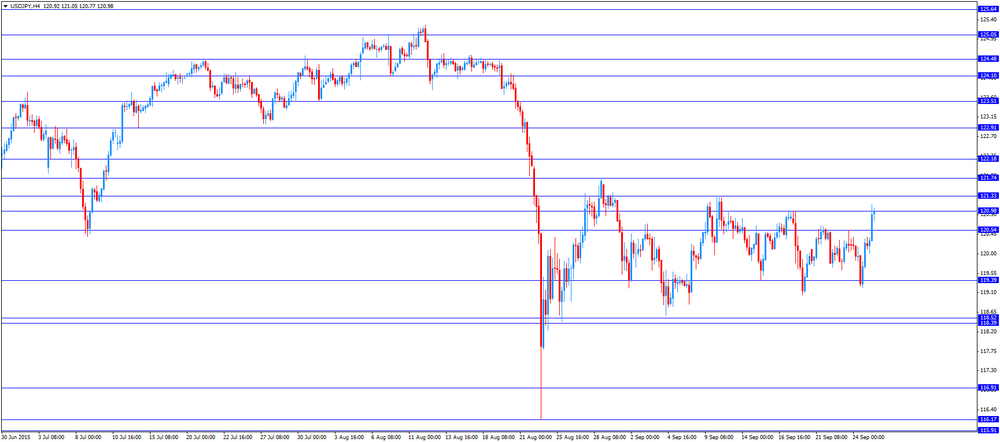

USD/JPY: the currency pair rose to Y121.13

The most important news that are expected (GMT0):

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks