- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data

Noticias del mercado

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m August -0.1% Revised From 0.2% -0.2%

08:30 United Kingdom PSNB, bln September 10.8 Revised From 10.9 9.4 8.63

11:00 U.S. MBA Mortgage Applications October -27.6% 11.8%

The U.S. dollar traded mixed against the most major currencies in the absence of any major U.S. economic reports.

The euro traded mixedagainst the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar after the release of U.K. public sector net borrowing data. The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. fell to £8.63 billion in September from £10.80 billion in August. August's figure was revised up from £10.9 billion. Analysts had expected a decrease to £9.4 billion.

Public sector net borrowing excluding public sector banks totalled £9.4 billion in September, down £1.6 billion from last year.

The decline in debt was driven by higher revenues from income, VAT and corporation tax.

Total debt was £1,524.1 billion in September, up £70.5 billion from last year. It was equal to 80.6% of GDP.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5460

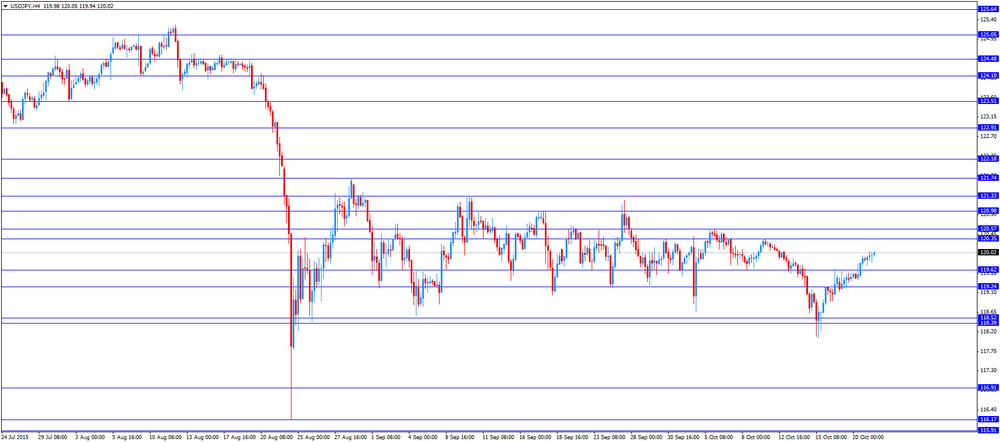

USD/JPY: the currency pair increased to Y120.05

The most important news that are expected (GMT0):

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks