- Oil prices decrease after yesterday’s significant rise

Noticias del mercado

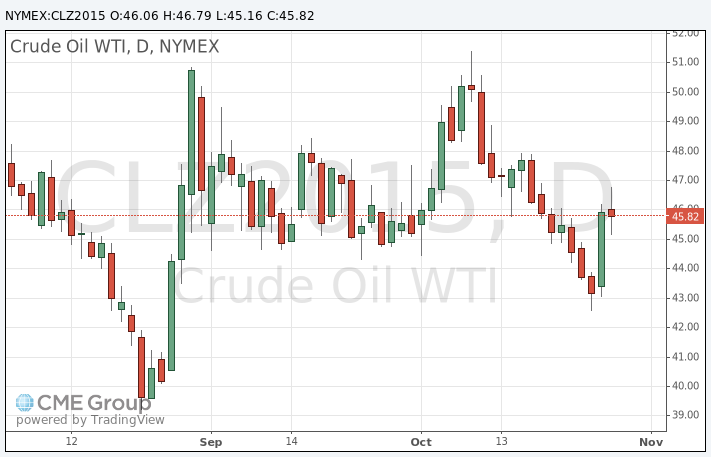

Oil prices decrease after yesterday’s significant rise

Oil prices declined after yesterday's significant rise. WTI crude yesterday rose more than 6%, while Brent crude increased more than 4%. U.S. crude oil inventories data supported yesterday's increase. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 3.38 million barrels to 480.0 million in the week to October 23. It was the fifth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories decreased by 1.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 785,000 barrels.

The U.S. GDP data weighed on oil prices. The U.S. Commerce Department released gross domestic product data on Thursday. The U.S. preliminary gross domestic product increased by 1.9% in the third quarter, missing expectations for a 1.6% gain, after a 3.9% rise in the second quarter.

The slower rise was mainly driven by a drop in private inventory investment.

Consumer spending grew 3.2% in the third quarter, after a 3.6% increase in the second quarter.

WTI crude oil for December delivery declined to $45.16 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $49.01 a barrel on ICE Futures Europe.