- Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the positive economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) October 3.8% Revised From 3.9% 0.4%

01:30 Japan Labor Cash Earnings, YoY September 0.4% Revised From 0.5% 0.6%

07:00 Germany Current Account September 13.3 Revised From 12.3 25.1

07:00 Germany Trade Balance September 15.3 Revised From 15.4 22.9

09:30 Eurozone Sentix Investor Confidence November 11.7 15.1

13:15 Canada Housing Starts October 230.7 200

The U.S. dollar traded mixed against the most major currencies in the absence of any U.S. major economic reports.

The greenback declined on profit taking after the Friday's significant rise on the U.S. labour market.

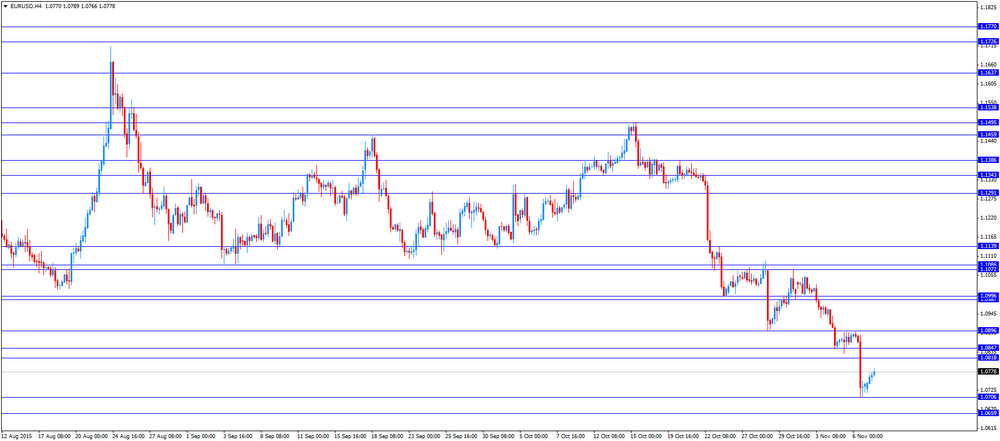

The euro traded higher against the U.S. dollar on the positive economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.1 in November from 11.7 in October. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Reason for rising economic expectations is gaining confidence in Asian markets," Sentix said in its statement.

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus declined to €19.4 billion in September from 19.4 in August.

Exports rose 4.4% year-on-year in September, while imports climbed 3.9% year-on-year.

On a yearly basis, German exports increased at a seasonally and calendar-adjusted 2.6% in September, while imports rose by 3.6%.

Germany's current account surplus was at €25.1 billion in September, up from €13.3 billion in August. August's figure was revised up from €12.3 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian housing starts data. Housing starts in Canada are expected to drop 200,000 in October from 230,700 in September.

EUR/USD: the currency pair rose to $1.0789

GBP/USD: the currency pair was up to $1.5114

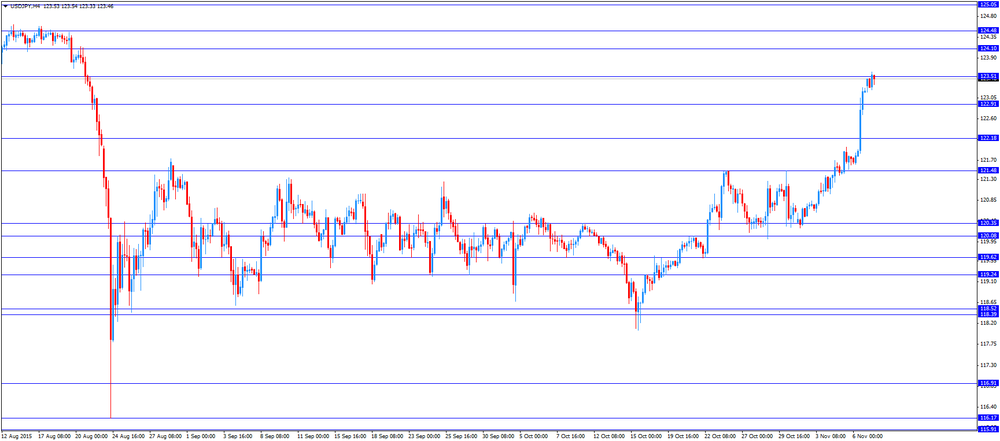

USD/JPY: the currency pair increased to Y123.60

The most important news that are expected (GMT0):

13:15 Canada Housing Starts October 230.7 200

15:00 U.S. Labor Market Conditions Index October 0

23:50 Japan Current Account, bln September 1653 2235.2