- Gold price declines as market participants eye speeches by Fed officials

Noticias del mercado

Gold price declines as market participants eye speeches by Fed officials

Gold price declined as market participants eyed speeches by Fed officials. St. Louis Fed President James Bullard said in a speech on Thursday that the Fed should start raising its interest rate as the Fed's targets are reached.

"During 2015, I have been an advocate of beginning to normalize the policy rate in the U.S. My arguments have focused on the idea that the U.S. economy is quite close to normal today based on an unemployment rate of 5 percent, which is essentially at the Committee's estimate of the long‐run rate, and inflation net of the 2014 oil price shock only slightly below the Committee's target," he said.

"My current policy views have not changed," Bullard added.

Chicago Fed President Charles Evans said in a speech on Thursday that he wants to be confident that inflation begins to pick up toward the Fed's target before to start raising interest rates.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment," he said.

"I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation," Evans added.

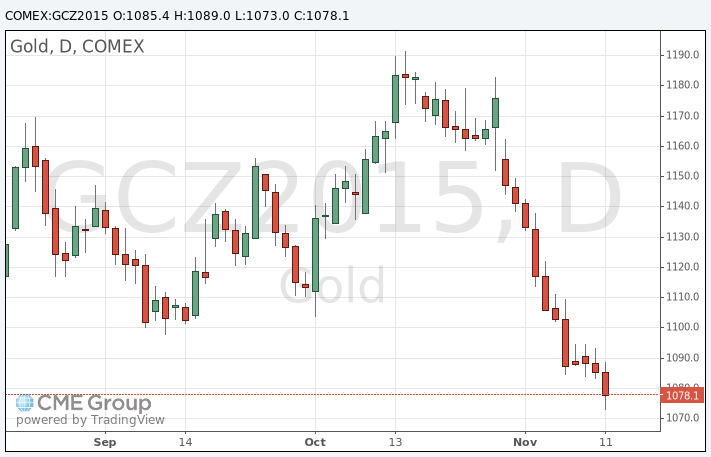

December futures for gold on the COMEX today fell to 1073.00 dollars per ounce.