- Foreign exchange market. European session: the euro slightly fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Noticias del mercado

Foreign exchange market. European session: the euro slightly fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:00 Japan BoJ Interest Rate Decision 0% 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.2% 0.2% -0.2%

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance October 3.25 Revised From 3.05 3.4 4.16

08:00 Eurozone ECB's Jens Weidmann Speaks

09:00 Eurozone Current account, unadjusted, bln September 14.6 Revised From 18.7 33.1

09:30 United Kingdom Retail Sales (MoM) October 1.7% Revised From 1.9% -0.5% -0.6%

09:30 United Kingdom Retail Sales (YoY) October 6.2% Revised From 6.5% 4.2% 3.8%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decrease by 5,000 to 271,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -1.0 in November from -4.5 in October.

The U.S. leading economic index is expected to climb 0.5% in October, after a 0.2% decrease in September.

Yesterday's minutes of the Fed's latest monetary policy meeting minutes weighed on the greenback. The minutes showed that an interest rate hike in December is possible, but it will depend on the incoming data.

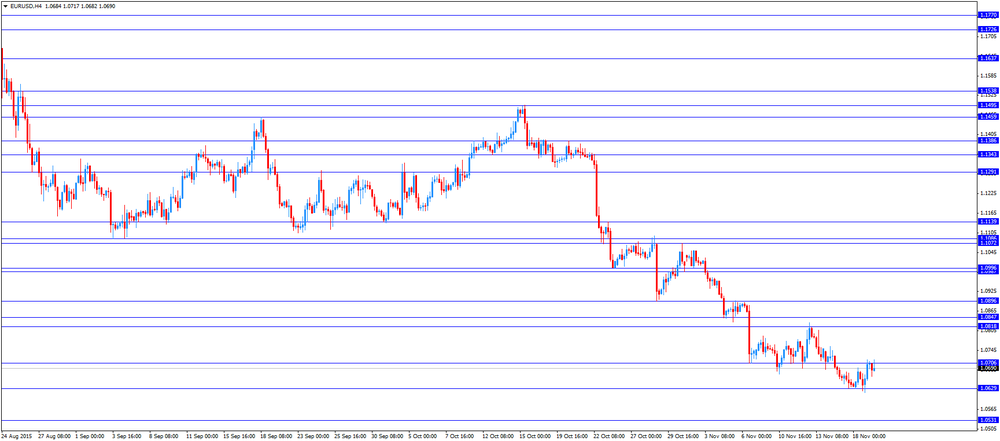

The euro slightly fell against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The central bank said that current measures may not be sufficient to reach the inflation target. The ECB noted that it will review its stimulus measures at its monetary policy meeting in December.

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved, adding that downside risks increased, while tail risks receded.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected retail sales data from the U.K. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -11% in November to -18% in October.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the wholesale sales data from Canada. Wholesales sales in Canada are expected to rise 0.3% in September, after a 0.1% decline in August.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus rose to CHF4.16 billion in October from CHF3.25 billion in the previous month. September's figure was revised up from a surplus of CHF3.05 billion.

Exports climbed 5.1% in October, while imports rose 3.5%.

Exports dropped 1.5% year-on-year in October, while imports were down 5.3% year-on-year.

EUR/USD: the currency pair increased to $1.0717

GBP/USD: the currency pair fell to $1.5236

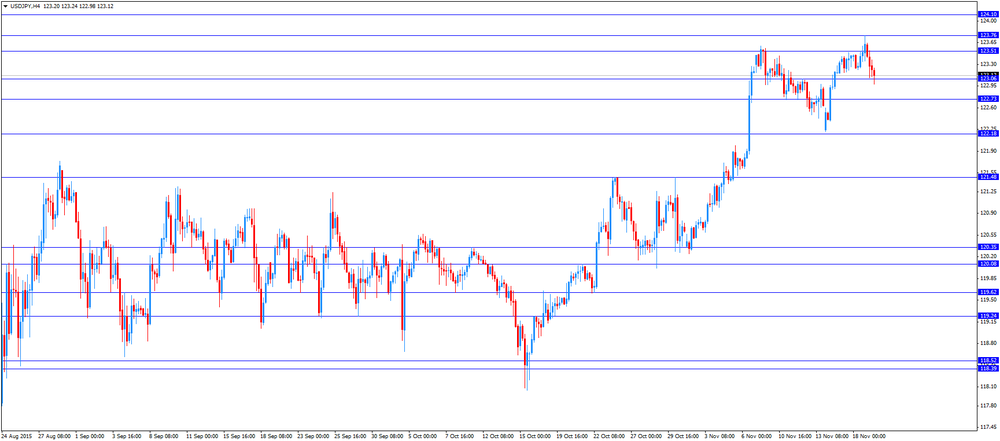

USD/JPY: the currency pair declined to Y122.98

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m September -0.1% 0.3%

13:30 U.S. Initial Jobless Claims November 276 271

15:00 U.S. Leading Indicators October -0.2% 0.5%

15:00 U.S. Philadelphia Fed Manufacturing Survey November -4.5 -1

17:30 U.S. FOMC Member Dennis Lockhart Speaks

21:45 U.S. FED Vice Chairman Stanley Fischer Speaks