- Foreign exchange market. European session: the euro higher against the U.S. dollar after the European Central Bank’s interest rate decision

Noticias del mercado

Foreign exchange market. European session: the euro higher against the U.S. dollar after the European Central Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m October -4.0% -3.0%

00:30 Australia Trade Balance October -2.40 Revised From -2.32 -2.665 -3.30

01:45 China Markit/Caixin Services PMI November 52.0 53.1 51.2

08:50 France Services PMI (Finally) November 52.7 51.3 51.0

08:55 Germany Services PMI (Finally) November 54.5 55.6 55.6

09:00 Eurozone Services PMI (Finally) November 54.1 54.6 54.2

09:30 United Kingdom Purchasing Manager Index Services November 54.9 55 55.9

10:00 Eurozone Retail Sales (MoM) October -0.1% 0.2% -0.1%

10:00 Eurozone Retail Sales (YoY) October 2.9% 2.7% 2.5%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to lower against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 8,000 to 268,000 last week.

The ISM non-manufacturing purchasing managers' index is expected to decline to 58.0 in November from 59.1 in October.

The U.S. factory orders are expected to climb 1.4% in October, after a 1.0 decline in September.

The Fed Chairwoman Janet Yellen will speak at 15:00 GMT.

The euro higher against the U.S. dollar after the European Central Bank's (ECB) interest rate decision. The ECB kept its interest rate unchanged at 0.05%, but lowered its deposit rate to -0.3% from -0.2%.

The ECB President Mario Draghi will speak at 13:30 GMT.

Meanwhile, the economic data from the Eurozone was weaker than expected. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

The British pound traded higher against the U.S. dollar after the better-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

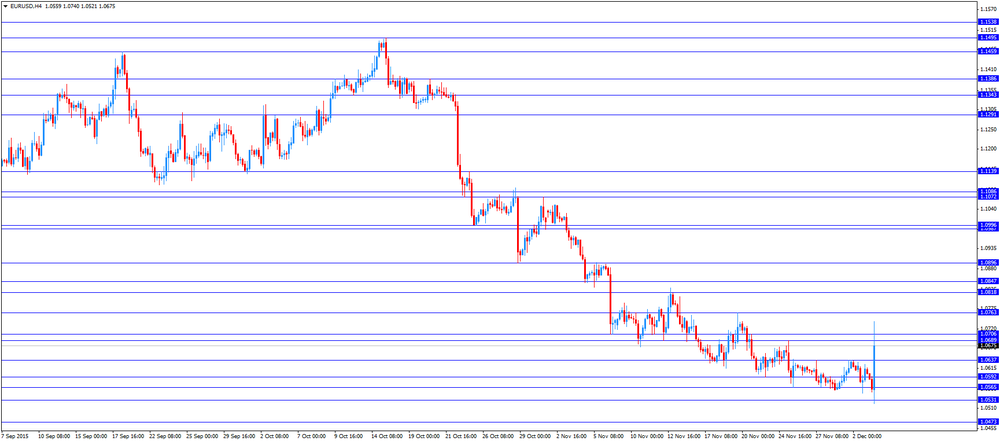

EUR/USD: the currency pair rose to $1.0740

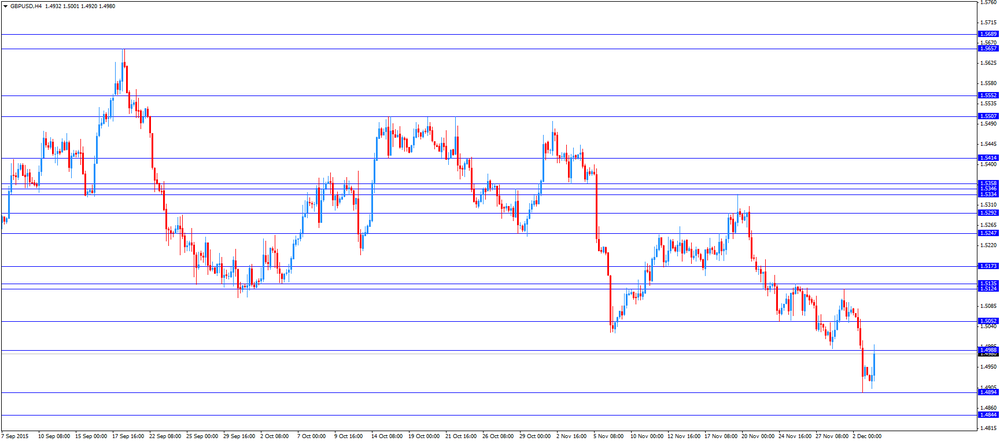

GBP/USD: the currency pair climbed to $1.5001

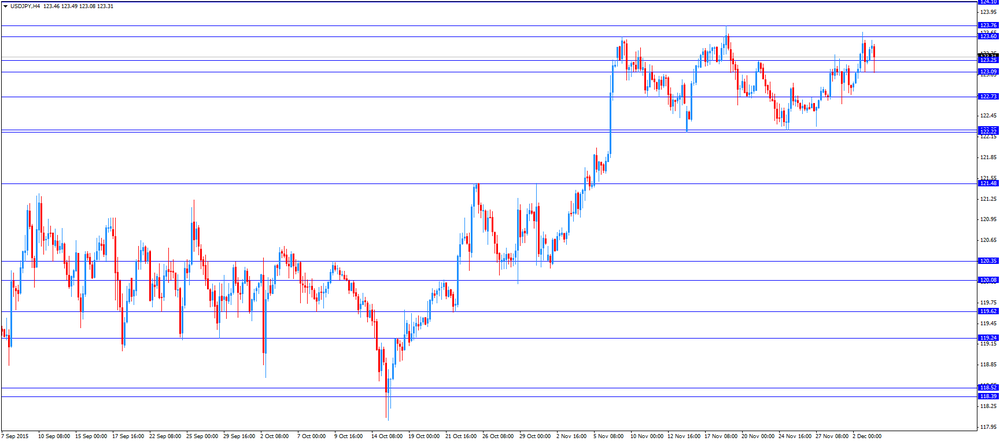

USD/JPY: the currency pair decreased to Y123.08

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims November 2207 2187

13:30 U.S. Initial Jobless Claims November 260 268

14:45 U.S. Services PMI (Finally) November 54.8 56.5

15:00 U.S. ISM Non-Manufacturing November 59.1 58

15:00 U.S. Factory Orders October -1.0% 1.4%

15:00 U.S. Fed Chairman Janet Yellen Speaks

18:10 U.S. FED Vice Chairman Stanley Fischer Speaks