- Foreign exchange market. Asian session: the U.S. dollar retreated slightly

Noticias del mercado

Foreign exchange market. Asian session: the U.S. dollar retreated slightly

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia New Motor Vehicle Sales (YoY) November 4.2% 6.0%

00:30 Australia New Motor Vehicle Sales (MoM) November -3.6% 1.0%

00:30 Australia House Price Index (QoQ) Quarter III 4.7% 2% 2.0%

00:30 Australia RBA Meeting's Minutes

The U.S. dollar declined slightly against most major currencies ahead of Fed's interest rate decision this week. Investors expect the central bank of the U.S. to raise its interest rates for the first time since 2006. Several times Fed Chair Janet Yellen pointed to a possibility of a liftoff in interest rates at December meeting in case of sustained economic growth and lower unemployment rate. Last week data showed that the unemployment rate remained at record-low 5% in November, while the number of employed outside the farming sector rose by 211,000.

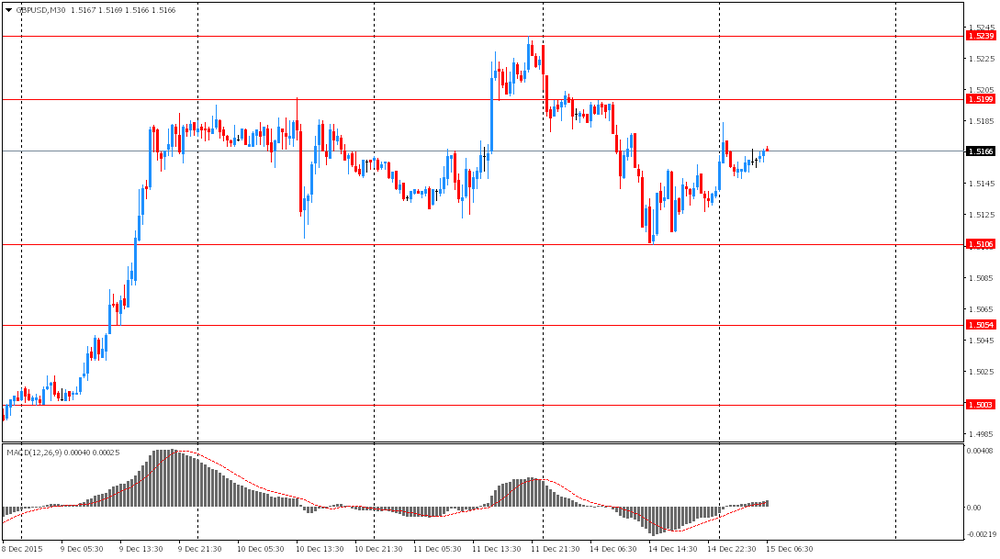

The pound climbed ahead of inflation data. Economists believe that prices rose on an annualized basis in November after staying flat for two previous months. This raises a probability of BOE rate increase in 2016. BOE officials signaled they are ready to raise rates in the first half of 2016 in case of sustained inflation growth.

The Australian dollar rose on economic data and RBA meeting minutes. The Australian Bureau of Statistics released new motor vehicle sales statistics. The corresponding index came in at 1.0% m/m in November compared to -3.6% reported previously. Sales rose by 6.0% on an annualized basis. Earlier this month the Reserve Bank of Australia left its benchmark interest rate unchanged at 2.0% amid signs of improvement in non-mining sectors.

EUR/USD: the pair rose to $1.1030 in Asian trade

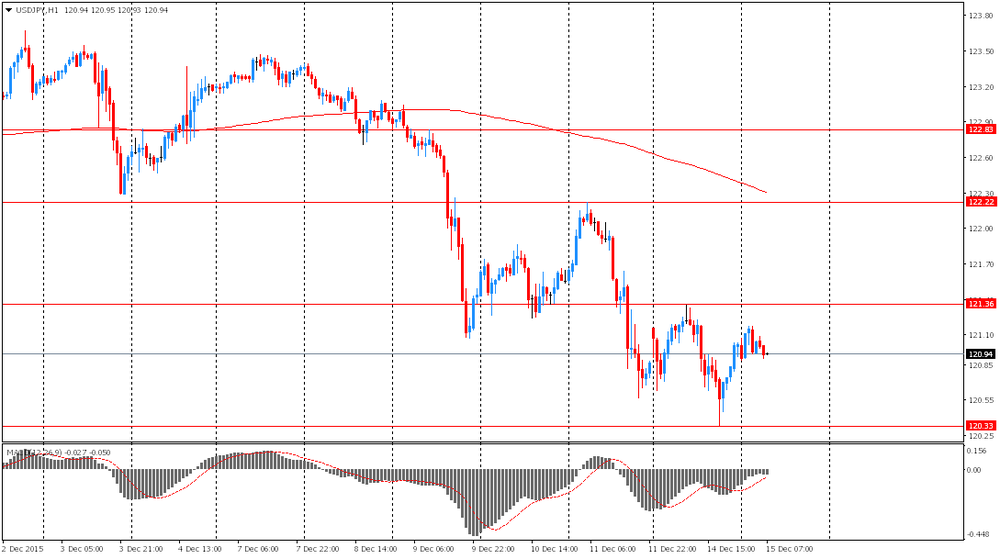

USD/JPY: the pair traded within Y120.75-20

GBP/USD: the pair rose to $1.5185

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m November 0.2% 0.1%

08:15 Switzerland Producer & Import Prices, y/y November -6.6%

09:30 United Kingdom Retail Price Index, m/m November 0% -0.1%

09:30 United Kingdom Retail prices, Y/Y November 0.7% 0.9%

09:30 United Kingdom Producer Price Index - Input (MoM) November 0.2% -1.1%

09:30 United Kingdom Producer Price Index - Input (YoY) November -12.1% -12.5%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0% -0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) November -1.3% -1.3%

09:30 United Kingdom HICP, m/m November 0.1% -0.1%

09:30 United Kingdom HICP, Y/Y November -0.1% 0.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.1% 1.2%

10:00 Eurozone ZEW Economic Sentiment December 28.3 34.4

10:00 Eurozone Employment Change Quarter III 0.3% 0.2%

10:00 Germany ZEW Survey - Economic Sentiment December 10.4 15

13:30 Canada Manufacturing Shipments (MoM) October -1.5% -0.5%

13:30 U.S. NY Fed Empire State manufacturing index December -10.74 -6

13:30 U.S. CPI, m/m November 0.2% 0%

13:30 U.S. CPI, Y/Y November 0.2% 0.4%

13:30 U.S. CPI excluding food and energy, m/m November 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y November 1.9% 2.0%

15:00 U.S. NAHB Housing Market Index December 62 63

16:45 Canada BOC Gov Stephen Poloz Speaks

21:00 U.S. Net Long-term TIC Flows October 33.6

21:00 U.S. Total Net TIC Flows October -175.1

21:45 New Zealand Current Account Quarter III -1.22 -4.901

23:30 Australia Leading Index November 0.1%