- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data

Noticias del mercado

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Bulletin

09:00 Germany IFO - Business Climate December 109 109 108.7

09:00 Germany IFO - Current Assessment December 113.4 113.4 112.8

09:00 Germany IFO - Expectations December 104.7 105 104.7

09:30 United Kingdom Retail Sales (MoM) November -0.5% Revised From -0.6% 0.5% 1.7%

09:30 United Kingdom Retail Sales (YoY) November 4.2% Revised From 3.8% 3% 5.0%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 7,000 to 275,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to fall to 1.5 in December from 1.9 in November.

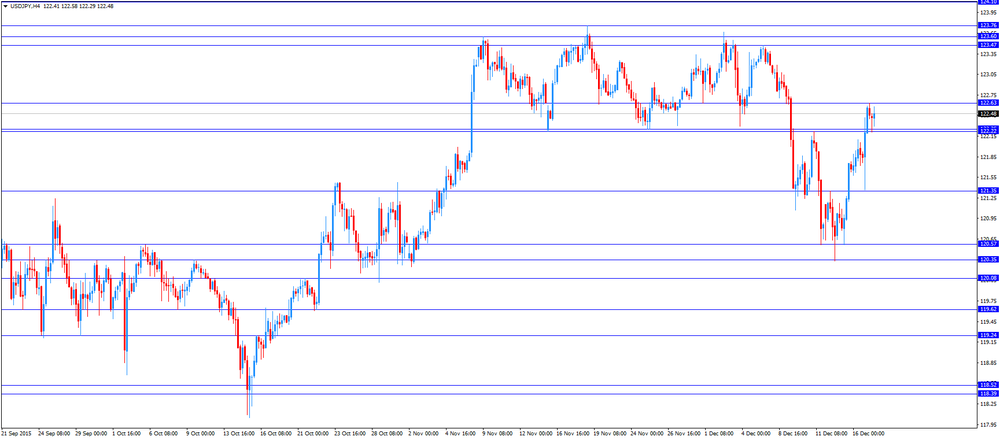

The U.S. dollar was supported by the Fed's interest rate hike. The Fed on Wednesday raised its interest rate to the range 0.25% - 0.50% from 0.00% - 0.25% as widely expected by analysts. All Federal Open Market Committee (FOMC) members voted for the interest rate hike. The Fed repeated that further interest rate hikes will be gradual.

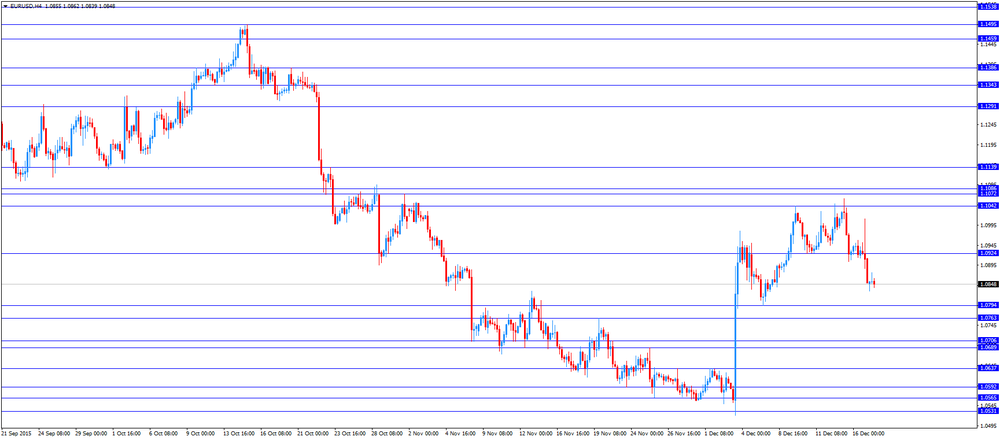

The euro traded mixed against the U.S. dollar after the release of the weaker-than-expected data from Germany. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index declines to 108.7 in December from 109.0 in November. Analysts had expected the index to remain unchanged at 109.0.

"The economic situation could hardly be better in the run-up to Christmas," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.8 from 113.4. Analysts had expected the index to remain unchanged at 113.4.

The Ifo expectations index remained unchanged at 104.7, missing expectations for a rise to 105.0.

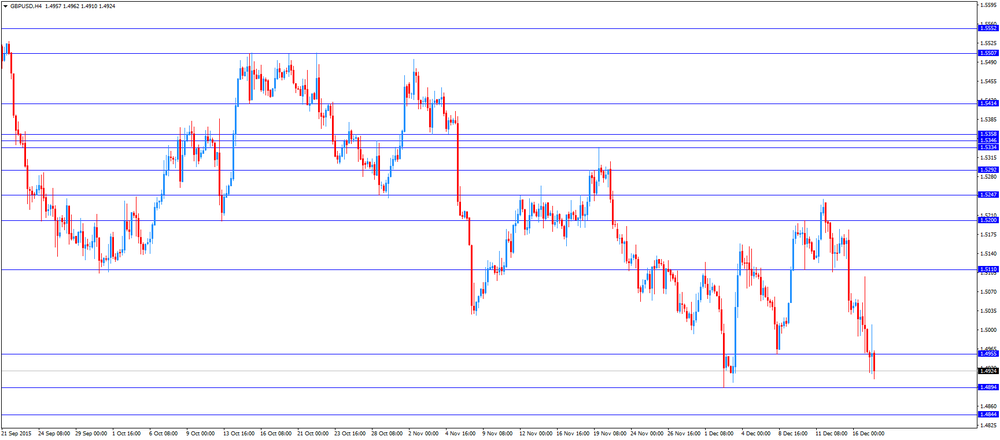

The British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.7% in November, exceeding expectations for a 0.5% rise, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was driven by retailers' promotions at the end of the month.

Food sales were up 0.8% in November, sales at department stores rose 4.3%, while household goods sales climbed 4.1%.

On a yearly basis, retail sales in the U.K. jumped 5.0% in November, beating forecasts of 3.0% increase, after a 4.2% rise in October. October's figure was revised up from a 3.8% gain.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economics (SECO) released its growth forecasts for Switzerland on Thursday. The Swiss economy is expected to expand 0.8% in 2015, down from the previous estimate of 0.9%, 1.5% in 2016, unchanged from the previous estimate, and 1.9% in 2017.

The KOF Swiss Economic Institute released its growth forecasts for Switzerland on Thursday. The Swiss economy is expected to expand 0.7% in 2015, down from the previous estimate of 0.9%, 1.1% in 2016, down from the previous estimate of 1.4%, and 2.0% in 2017.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.4910

USD/JPY: the currency pair rose to Y122.58

The most important news that are expected (GMT0):

13:30 U.S. Continuing Jobless Claims December 2243 2220

13:30 U.S. Current account, bln Quarter III -109.7 -118

13:30 U.S. Philadelphia Fed Manufacturing Survey December 1.9 1.5

13:30 U.S. Initial Jobless Claims December 282 275