- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Westpac Consumer Sentiment Quarter IV 106

04:00 Japan BoJ Interest Rate Decision 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:00 Eurozone Current account, unadjusted, bln October 33.8 Revised From 33.1 25.9

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. services PMI data. The preliminary U.S. services PMI is expected to fall to 56.0 in December from 56.1 in November.

The euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.5% year-on-year in November from 1.0% in October.

The core consumer price index in Canada is expected to rise to 2.3% year-on-year in November from 2.1% in October.

Wholesales sales in Canada are expected to rise 0.1% in October, after a 0.1% decline in September.

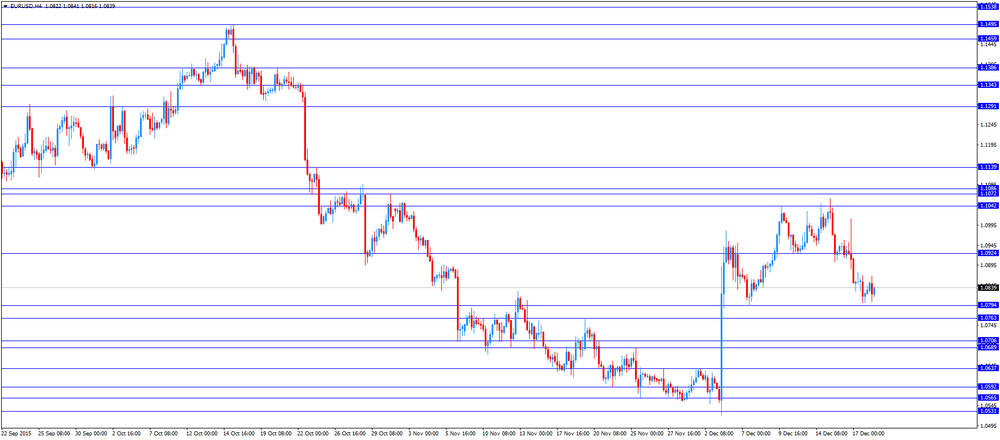

EUR/USD: the currency pair declined to $1.0804

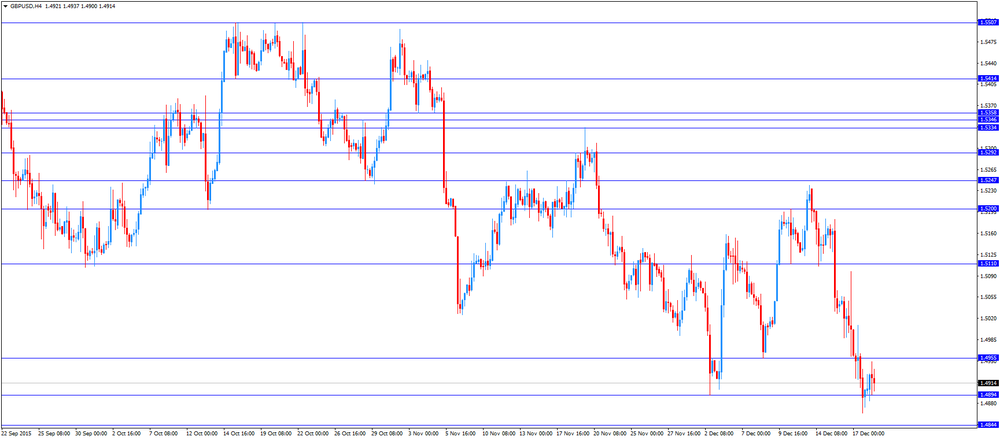

GBP/USD: the currency pair fell to $1.4895

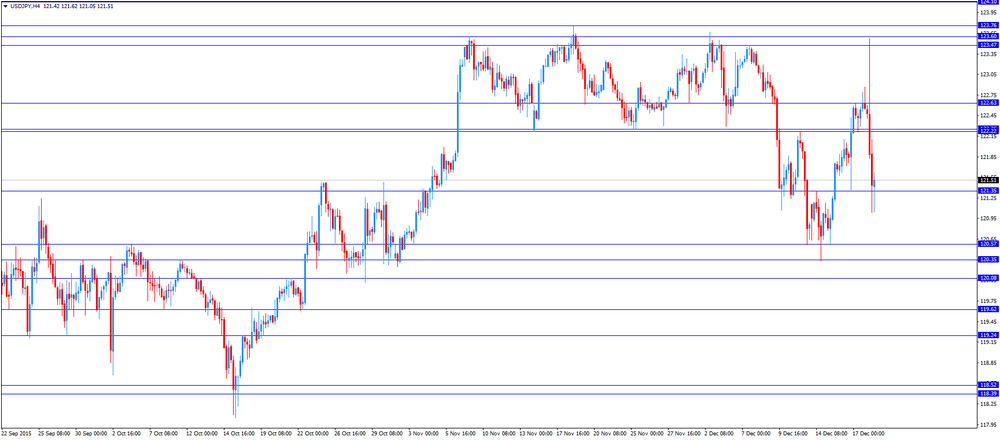

USD/JPY: the currency pair decreased to Y121.04

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m October -0.1% 0.1%

13:30 Canada Consumer Price Index m / m November 0.1% 0.1%

13:30 Canada Consumer price index, y/y November 1.0% 1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 2.1% 2.3%

14:45 U.S. Services PMI (Preliminary) December 56.1 56

18:00 U.S. FOMC Member Laсker Speaks