- Foreign exchange market. Asian session: the dollar little changed

Noticias del mercado

Foreign exchange market. Asian session: the dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m October -0.2% 1.0%

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) November -0.4% -0.2% -0.2%

07:00 Germany Producer Price Index (YoY) November -2.3% -2.5% -2.5%

The U.S. dollar traded range-bound against major currencies ahead of Christmas at the end of the current working week. Trading is not expected to be dynamic. At the same time many traders have already closed their positions ahead of the end of the year, which increases market volatility. On Thursday, December 24, markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

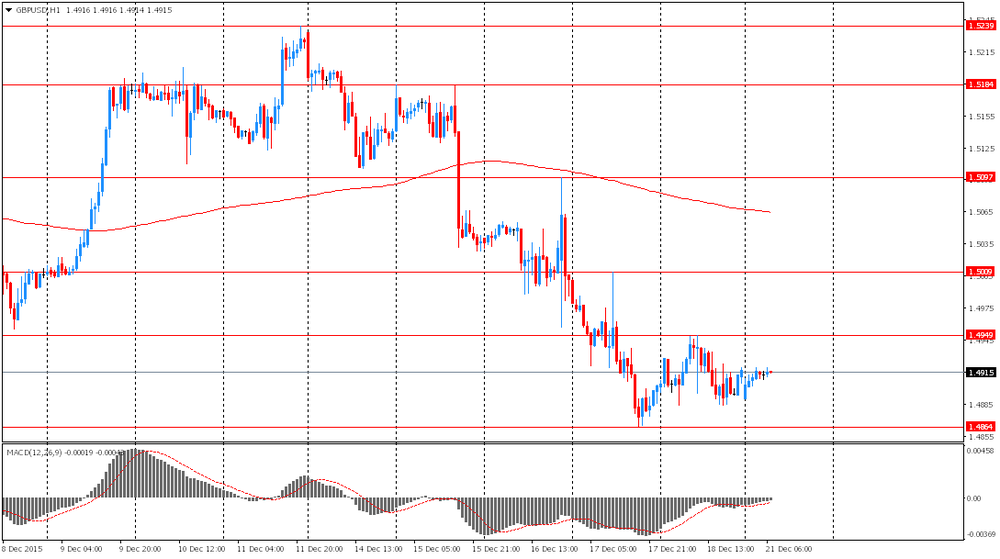

The pound also traded range-bound. Market participants are waiting for data on U.K. budged deficit. The report is expected to show that the deficit rose to £11.7 billion ($17.4 billion) in November. This would suggest that Osborne will face difficulties fulfilling his pledge to balance the budget by 2020.

The New Zealand dollar climbed on positive data. Visitor arrivals rose by 11.1% in November. Meanwhile Westpac consumer sentiment rose to 110.7 in the fourth quarter from 106 reported previously (the best quarterly increase in two years).

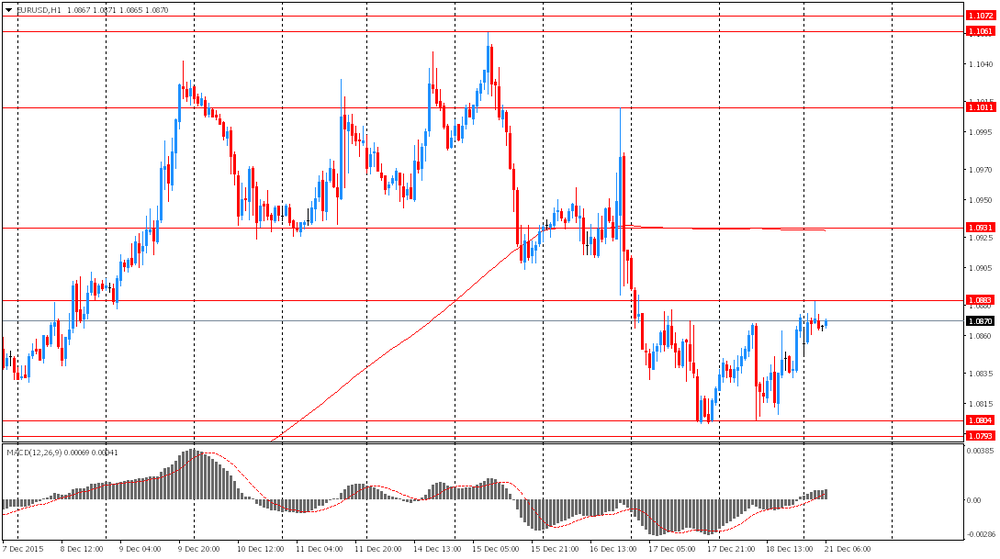

EUR/USD: the pair fluctuated within $1.0855-85 in Asian trade

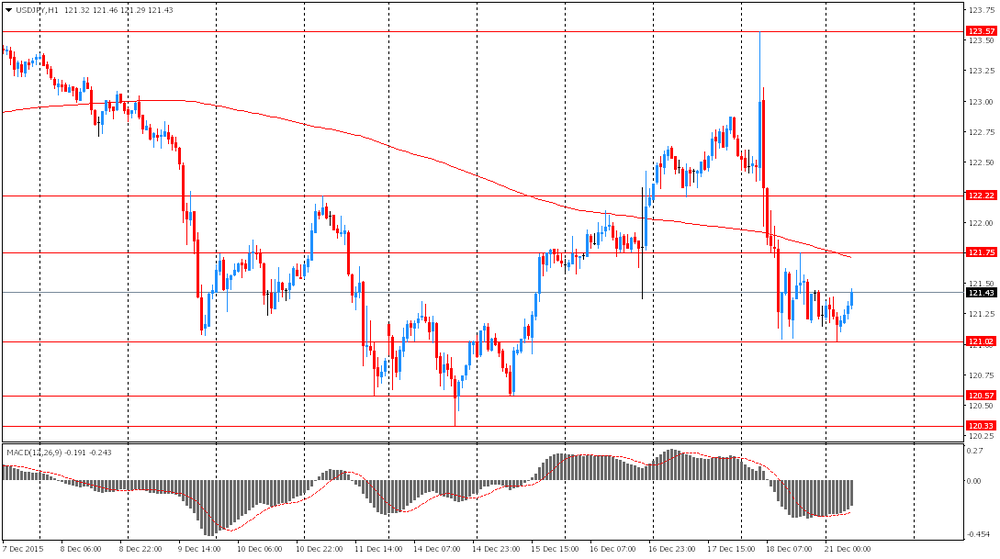

USD/JPY: the pair traded within Y121.00-50

GBP/USD: the pair traded within $1.4885-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

11:00 United Kingdom CBI retail sales volume balance December 7 21

11:00 Germany Bundesbank Monthly Report

15:00 Eurozone Consumer Confidence (Preliminary) December -5.9 -5.85