- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak inflation data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:55 Germany Unemployment Change December -14 Revised From -13 -7 -14

08:55 Germany Unemployment Rate s.a. December 6.3% 6.3% 6.3%

09:30 United Kingdom PMI Construction December 55.3 56 57.8

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.2% 0.4% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.9% 0.9% 0.9%

The U.S. dollar traded higher against the most major currencies in the absence of any major U.S. economic reports today.

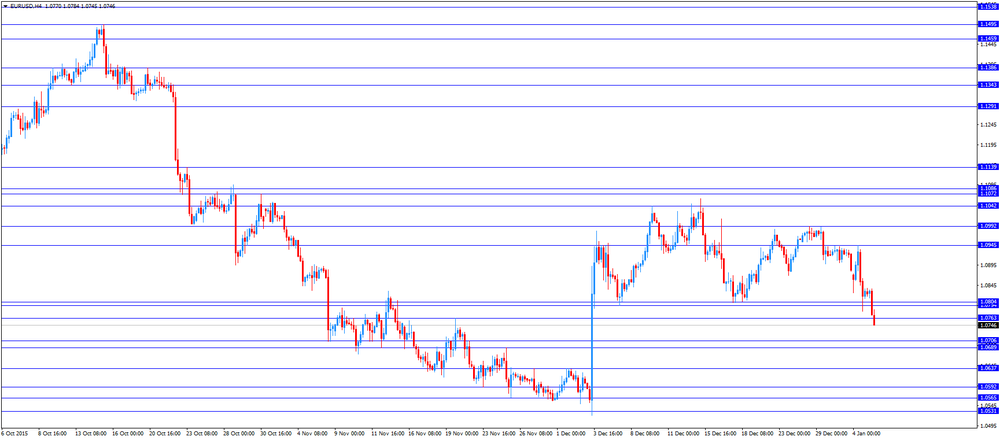

The euro traded lower against the U.S. dollar after the release of the weak inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in December, missing expectations for a rise to 0.4%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in December, in line with expectations.

Food, alcohol and tobacco prices were up 1.2% in December, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 5.9%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 14,000 in December, exceeding expectations for a 7,000 decline, after a 14,000 decrease in November. November's figure was revised up from a 13,000 decline.

The unemployment rate remained unchanged at 6.3% in December, in line with expectations.

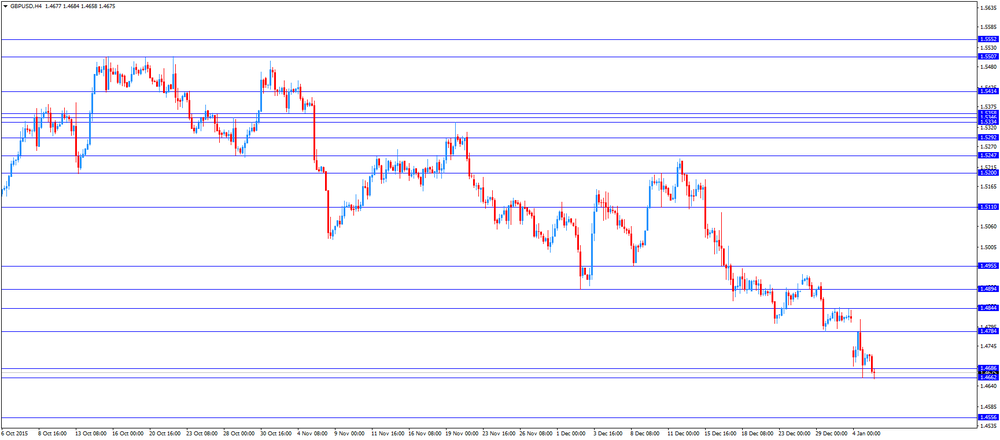

The British pound traded lower against the U.S. dollar despite the better-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 57.8 in December from 55.3 in November, exceeding expectations for an increase to 56.0.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a rise in commercial construction.

"UK construction companies finished 2015 in a positive fashion, as overall output growth recovered from November's seven-month low. Commercial building was the main engine of growth, with this area of activity expanding at the strongest pace since autumn 2014. There was also a rebound in house building activity in December, but momentum was still much softer than the post-crisis highs achieved during 2014," Senior Economist at Markit, Tim Moore, said.

The Canadian dollar traded lower against the U.S. dollar head of the release of Canadian Industrial Product Price Index.

EUR/USD: the currency pair fell to $1.0745

GBP/USD: the currency pair declined to $1.4658

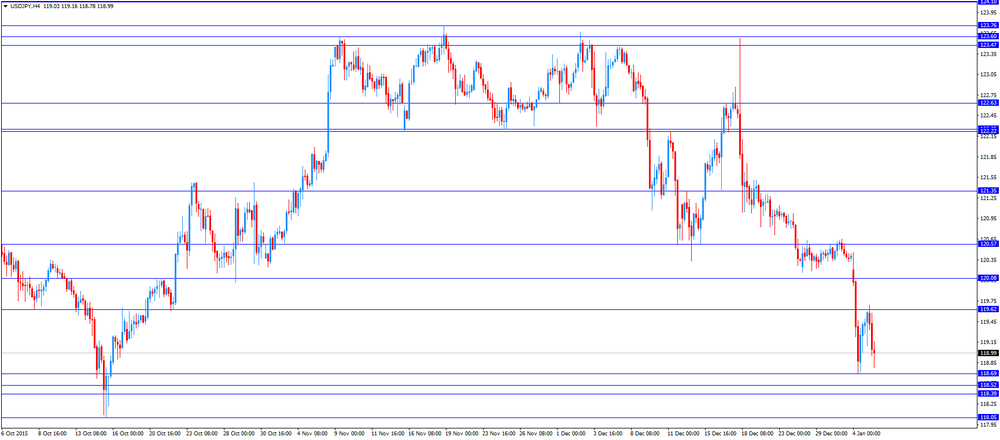

USD/JPY: the currency pair decreased to Y118.78

The most important news that are expected (GMT0):

13:30 Canada Industrial Product Price Index, m/m November -0.5%

13:30 Canada Industrial Product Price Index, y/y November -0.4%

20:45 U.S. Total Vehicle Sales, mln December 18.19 18.1

22:30 Australia AIG Services Index December 48.2