- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the U.K. trade data

Noticias del mercado

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the U.K. trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M November 0.6% Revised From 0.5% 0.4% 0.4%

01:30 Japan Labor Cash Earnings, YoY December 0.7% 0.7% 0.0%

05:00 Japan Coincident Index (Preliminary) November 113.6 Revised From 113.3 116.6

05:00 Japan Leading Economic Index (Preliminary) November 104.2 103.9 103.9

06:45 Switzerland Unemployment Rate (non s.a.) December 3.4% 3.7% 3.7%

07:00 Germany Current Account November 22.9 Revised From 23.0 24.7

07:00 Germany Industrial Production s.a. (MoM) November 0.5% Revised From 0.2% 0.5% -0.3%

07:00 Germany Industrial Production (YoY) November 0.5% Revised From 0.0% 0.1%

07:00 Germany Trade Balance (non s.a.), bln November 22.3 Revised From 22.5 20.6

07:45 France Industrial Production, y/y November 2.3% 2.8%

07:45 France Industrial Production, m/m November 0.7% Revised From 0.5% -0.4% -0.9%

07:45 France Trade Balance, bln November -4.87 Revised From -4.58 -3.95 -4.63

08:15 Switzerland Consumer Price Index (MoM) December -0.1% -0.3% -0.4%

08:15 Switzerland Consumer Price Index (YoY) December -1.4% -1.2% -1.3%

09:30 United Kingdom Total Trade Balance November -3.51 Revised From -4.14 -3.17

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. labour market data today. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in December. The U.S. economy is expected to add 200,000 jobs in December, after adding 211,000 jobs in November.

Wholesale inventories in the U.S. are expected to decline 0.1% in November, after a 0.1% decrease in October.

The euro traded lower against the U.S. dollar after the release of the mostly weaker-than-expected economic data from the Eurozone. Destatis released its industrial production data for Germany on Friday. German industrial production fell 0.3% in November, missing expectations for a 0.5% gain, after a 0.5% rise in October. October's figure was revised up from a 0.2% increase.

The output of capital goods decreased 3.3% in November, energy output rose 2.5%, and the production in the construction sector was up 1.6%, while the production of intermediate goods climbed 1.1%. The output of consumer goods jumped 1.9%.

German industrial production excluding energy and construction declined by 0.8% in November.

Germany's seasonally adjusted trade surplus decreased to €19.7 billion in November from 20.5 in October.

Exports rose at a seasonally and calendar-adjusted 0.4% in November, while imports climbed 1.6%.

On a yearly basis, German exports increased 7.7% in November, while imports rose by 5.3%.

Germany's current account surplus was at €24.7 billion in November, up from €22.9 billion in October. October's figure was revised down from a surplus of €23.0 billion.

According to the French Customs, France's trade deficit narrowed to €4.63 billion in November from €4.87 billion in October, missing expectations for a decline to a deficit of €3.95 billion. Exports climbed 3.0% in November, while imports rose 2.0%.

The French statistical office Insee its industrial production figures on Friday. Industrial production in France declined 0.9% in November, missing expectations for a 0.4% decline, after a 0.7% rise in October.

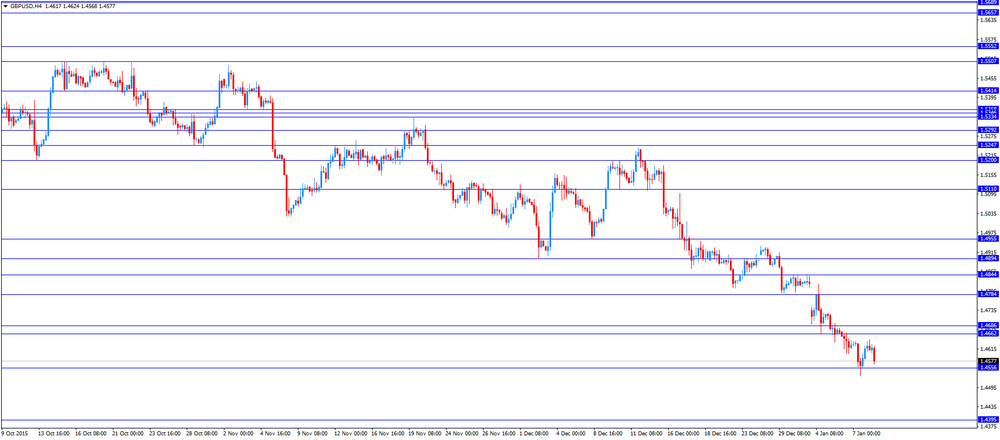

The British pound traded lower against the U.S. dollar after the release of the U.K. trade data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.64 billion in November from £11.20 billion in October. October's figure was revised down from a deficit of £11.83 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 1.3% in November, while imports slid 2.5%.

The total trade deficit, including services, narrowed to £3.17 billion in November from £3.51 billion in October. October's figure was revised down from a deficit of £4.14 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian economic data. The unemployment rate in Canada is expected to remain unchanged at 7.1% in December.

Canada's economy is expected to add 10,000 jobs in December.

The Canadian building permits are expected to fall 3.0% in November, after a 9.1% rise in October.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index fell 0.4% in December, missing expectations for a 0.3% fall, after a 0.1% decrease in November.

The decline was partly driven by lower prices for petroleum and food products.

On a yearly basis, Switzerland's consumer price index rose to -1.3% in December from -1.4% in November, missing forecasts for a 1.2% drop.

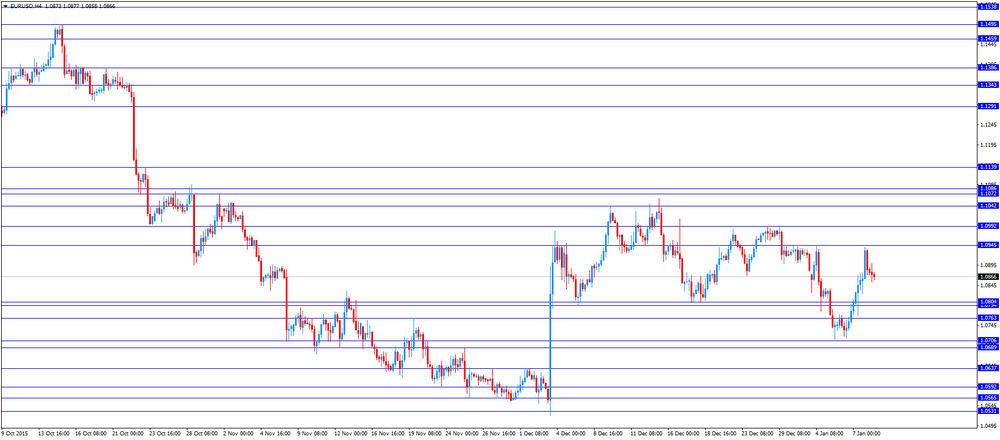

EUR/USD: the currency pair declined to $1.0858

GBP/USD: the currency pair fell to $1.4568

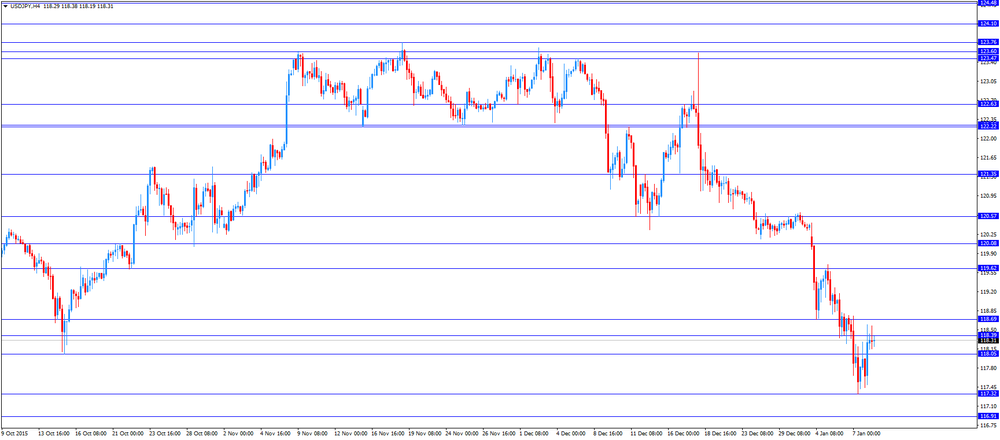

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Building Permits (MoM) November 9.1% -3%

13:30 Canada Unemployment rate December 7.1% 7.1%

13:30 Canada Employment December -35.7 10

13:30 U.S. Average workweek December 34.5 34.5

13:30 U.S. Average hourly earnings December 0.2% 0.2%

13:30 U.S. Nonfarm Payrolls December 211 200

13:30 U.S. Unemployment Rate December 5% 5%

15:00 U.S. Wholesale Inventories November -0.1% -0.1%

20:00 U.S. Consumer Credit November 15.98 18.25