- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans November -0.3% Revised From 2.0% -0.5% 1.8%

02:00 China New Loans December 708.9 700 597.8

09:30 United Kingdom BOE Credit Conditions Survey

10:00 Eurozone Trade balance unadjusted November 24.1 23.6

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to be flat in December, after a 0.2% gain in November.

The U.S. PPI is expected to decline 0.2% in December, after a 0.3% rise in November.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in December, after a 0.3 gain in November.

The U.S. industrial production is expected to decrease 0.2% in December, after a 0.6% fall in November.

The NY Fed Empire State manufacturing index is expected to rise to -4.0 in January from -4.59 in December.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to rise to 93.0 in January from a final reading of 92.6 in December.

The euro traded higher against the U.S. dollar after the release of the positive trade data from the Eurozone. Eurostat released its trade data for the Eurozone on Friday. Eurozone's adjusted trade surplus rose to €22.7 billion in November from €19.8 billion in October.

Exports rose at an adjusted 1.6% in November, while imports decreased 0.1%.

Eurozone's unadjusted trade surplus fell to €23.6 billion in November from €24.1 billion in October.

Exports rose at an unadjusted annual rate of 6.0% in November, while imports increased 5.0%.

The British pound traded lower against the U.S. dollar despite the negative construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.5% in November, after a 0.2% rise in October.

The decline was driven by a drop in infrastructure, which plunged 4.3% in November.

On a yearly basis, construction output decreased 1.1% in November, after a 1.0% rise in October. It was the biggest decline since May 2013.

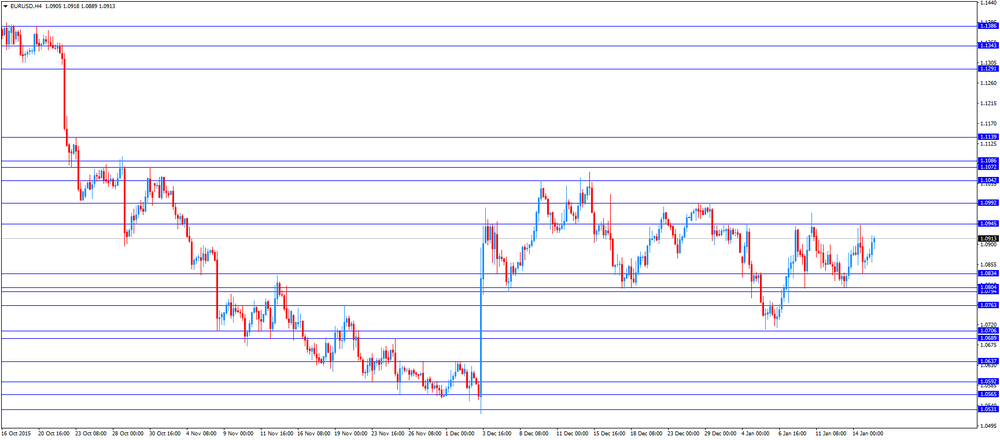

EUR/USD: the currency pair rose to $1.0919

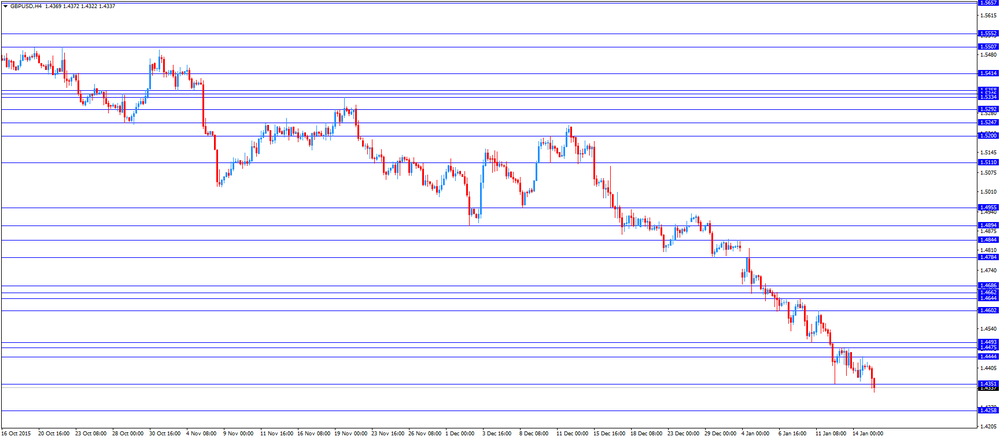

GBP/USD: the currency pair declined to $1.4322

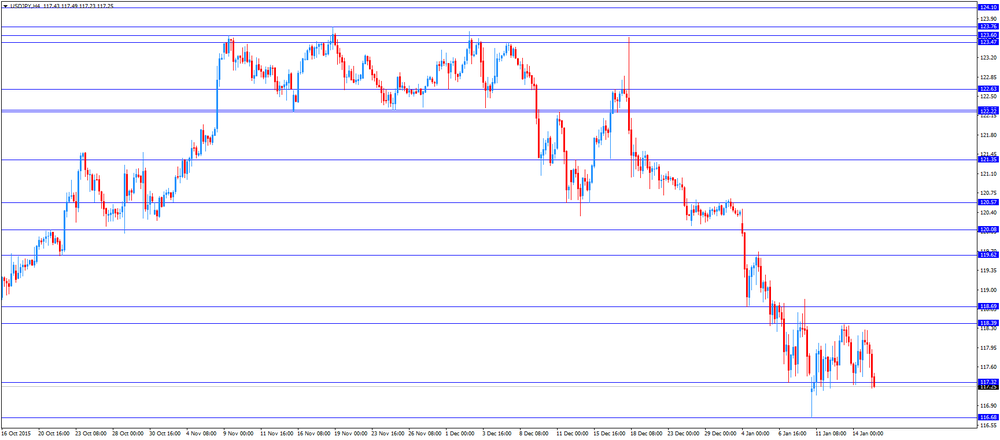

USD/JPY: the currency pair decreased to Y117.22

The most important news that are expected (GMT0):

13:30 U.S. Retail sales December 0.2% 0%

13:30 U.S. Retail Sales YoY December 1.4%

13:30 U.S. NY Fed Empire State manufacturing index January -4.59 -4

13:30 U.S. PPI, m/m December 0.3% -0.2%

13:30 U.S. PPI, y/y December -1.1% -1%

13:30 U.S. PPI excluding food and energy, m/m December 0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 0.5% 0.3%

14:00 U.S. FOMC Member Dudley Speak

14:15 U.S. Industrial Production (MoM) December -0.6% -0.2%

14:15 U.S. Industrial Production YoY December -1.2%

14:15 U.S. Capacity Utilization December 77% 76.8%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 92.6 93

15:00 U.S. Business inventories November 0% -0.1%