- Oil prices continue to decline

Noticias del mercado

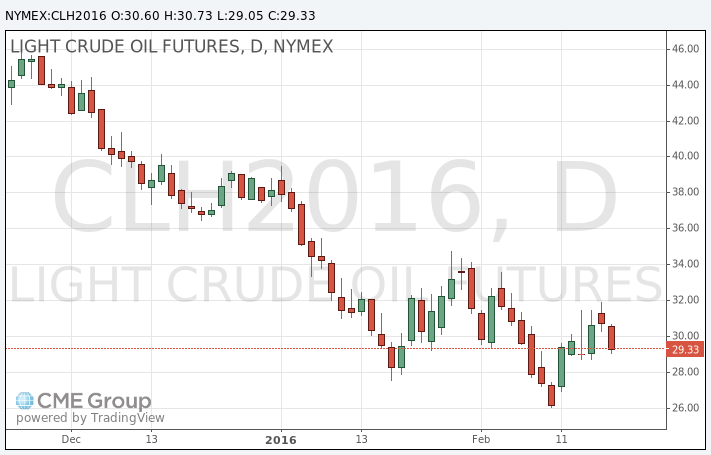

Oil prices continue to decline

Oil prices continued to decline on concerns over the global oil oversupply. Earlier this week, oil prices rose on news that Russia and Saudi Arabia agreed to freeze the oil production at the level of January if other oil producers join. But it is unclear if other oil producers will join. Especially, Iran plans to boost its exports.

Yesterday's U.S. crude oil inventories data also added to concerns over the global oil oversupply. According to the U.S. Energy Information Administration (EIA), U.S. crude inventories rose by 2.15 million barrels to 504.1 million in the week to February 12. Analysts had expected U.S. crude oil inventories to rise by 4.0 million barrels.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 28 rigs to 439 last week. It was the lowest level since January 2010.

WTI crude oil for April delivery declined to $29.05 a barrel on the New York Mercantile Exchange.

Brent crude oil for April fell to $33.48 a barrel on ICE Futures Europe.